Greetings,

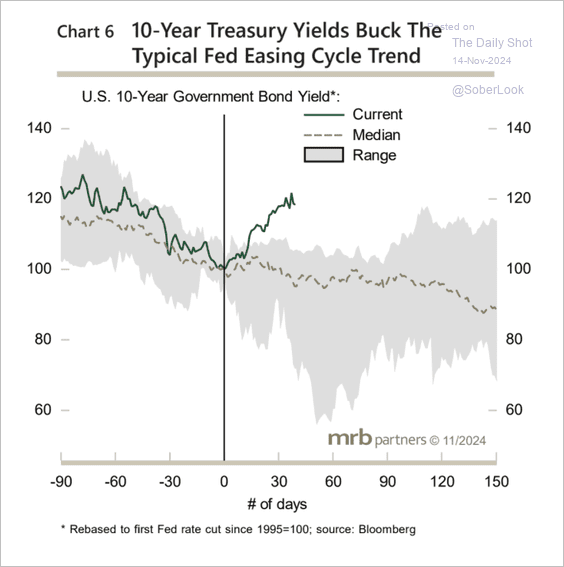

Rates: The 10-year Treasury yield has already deviated from its typical post-Fed cut path. A major factor this year has been resilient economic growth and overly aggressive rate-cut expectations.

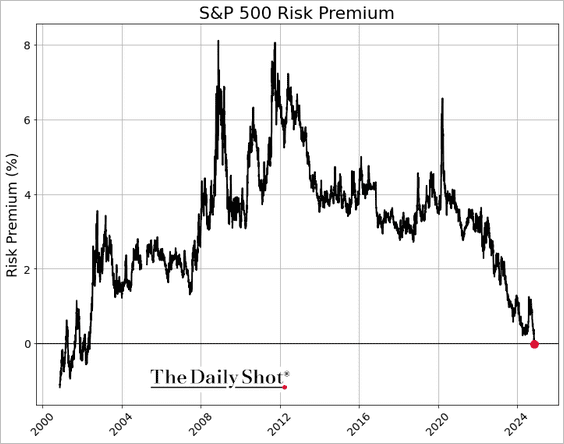

Equities: The S&P 500 risk premium (forward earnings yield minus the 10-year Treasury yield) has turned negative for the first time since 2002, indicating frothy valuations in the US stock market.

The United States: This chart illustrates the changes in CPI components for October.

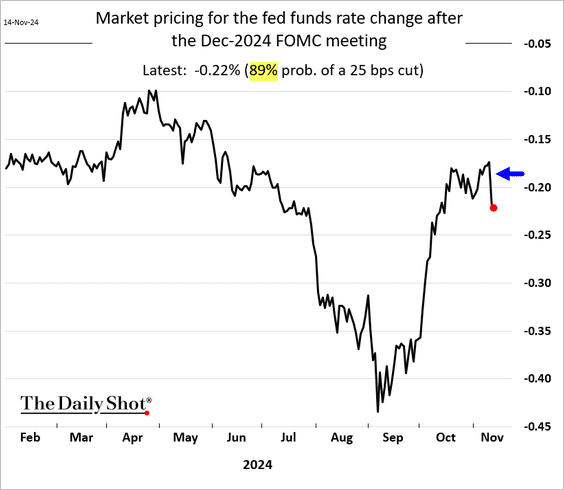

Market expectations for a December Fed rate cut have risen, with the probability approaching 90%.

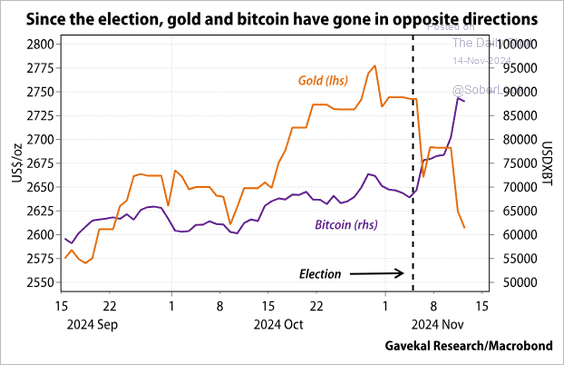

Cryptocurrency: Bitcoin and gold have diverged after the US election.

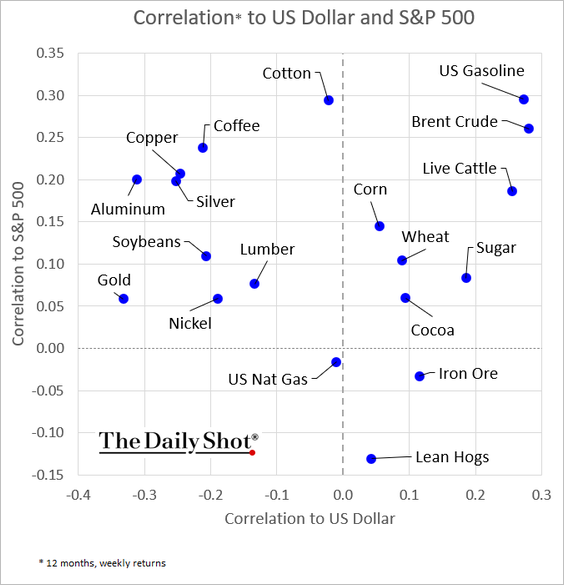

Commodities: This scatterplot illustrates the correlations of commodity markets with the S&P 500 and the US dollar.

Alternatives: The chart below shows the current allocation of institutional investors across major alternative asset strategies.

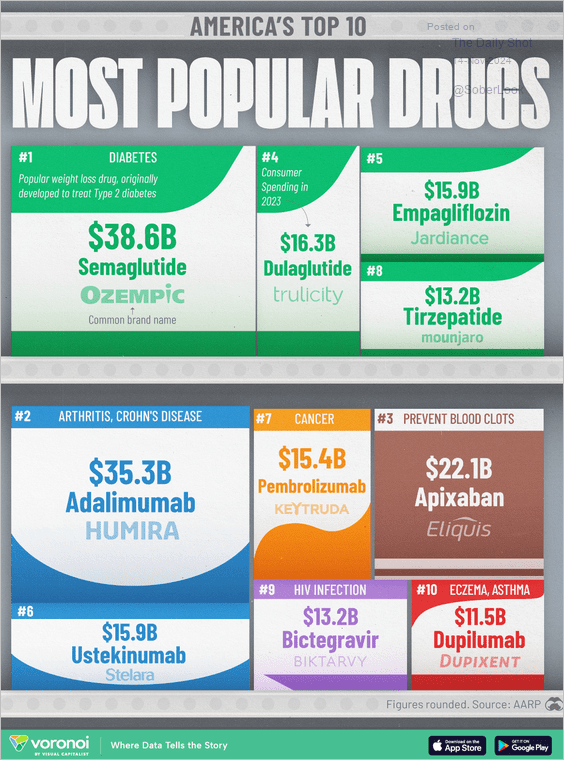

Food for Thought: Top 10 prescription drugs in the US:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief