Greetings,

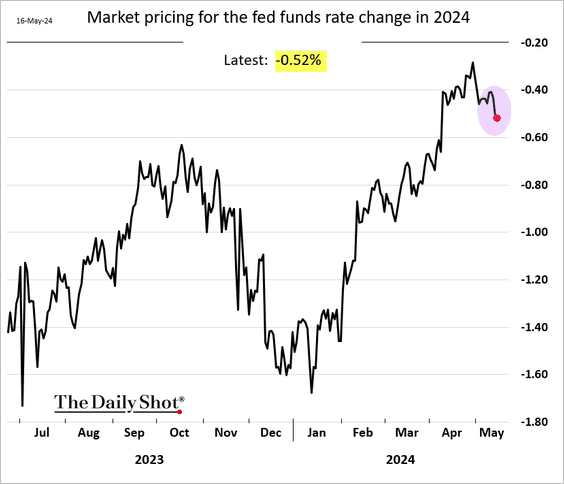

The United States: After the “benign” CPI report and weak retail sales data, the market fully priced in two Fed rate cuts this year, perhaps in September and December.

Retail sales were weaker than expected last month, with the “core” measures unexpectedly declining. Consumers are becoming more discerning, which should help slow price increases.

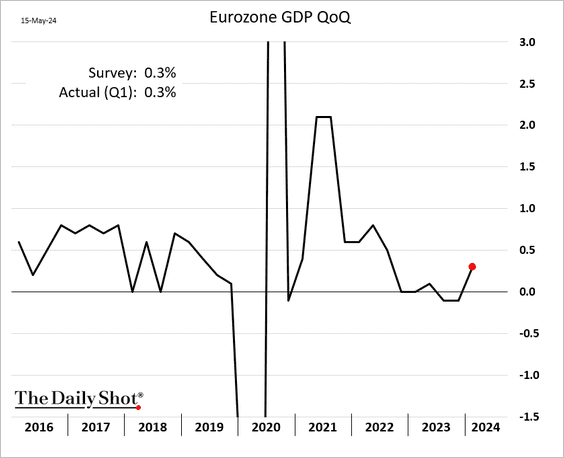

The Eurozone: Euro-area GDP bounced in Q1.

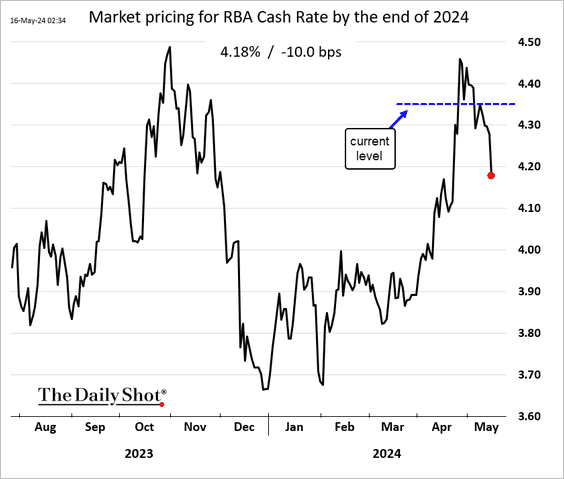

Asian-Pacific: The market is no longer concerned about an RBA rate hike this year.

Emerging Markets: Foreign net purchases of EM equities and bonds dropped to the lowest level in six months amid a strengthening dollar.

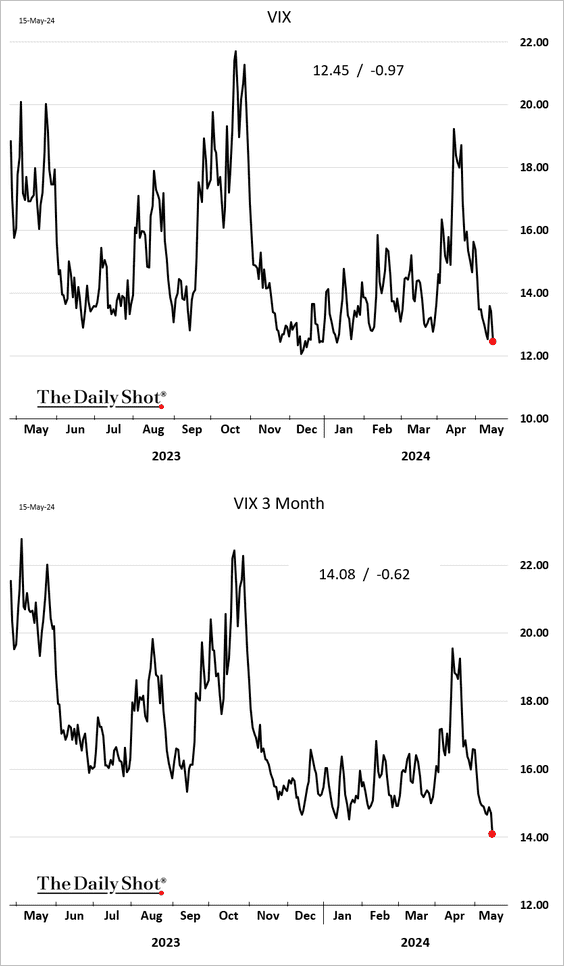

Equities: Implied volatility indicators continue to sink.

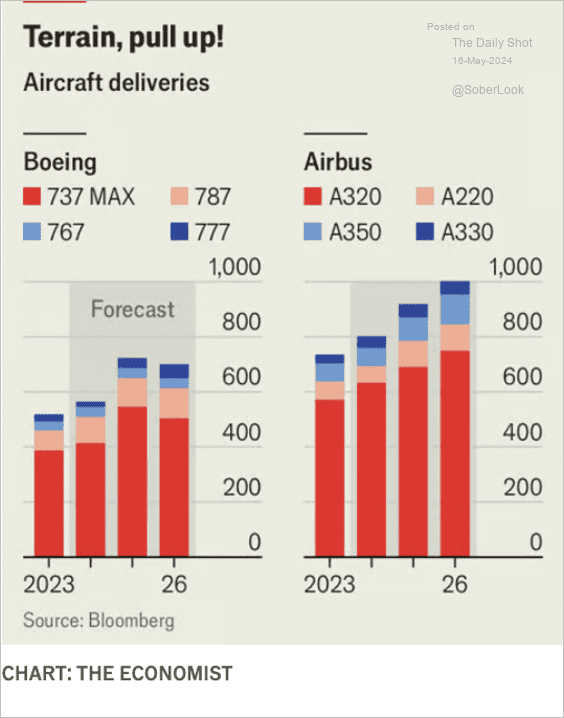

Food for Thought: Aircraft deliveries:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief