Greetings,

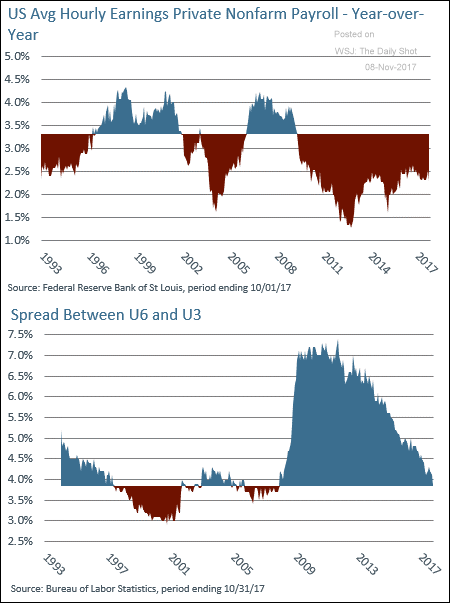

The United States: Some analysts see wage growth accelerating soon, as the spread between the underemployment rate (U-6) and the unemployment rate (U-3) declines further. This spread could be viewed as a measure of labor slack.

Wages as a share of the GDP have been trending lower, boosting corporate margins.

The Eurozone: Greek banks have been having some issues with auctions of foreclosed properties. Investors are getting nervous. Here is the Greek bank index.

China: China’s corporate debt as a percentage of the GDP remains near record levels.

Equity Markets: Funds with the most buy recommendations have consistently underperformed.

Credit: This chart shows the yields, spreads, and durations for the various fixed-income asset classes.

Global Developments: Demand for fuel from cars on the road will continue to rise over the long-term. While fuel efficiency will improve, it won’t offset the demand for more vehicles in emerging markets.

Food for Thought: This forecast shows electric vehicle usage in 2040 vs. last year.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com