Greetings,

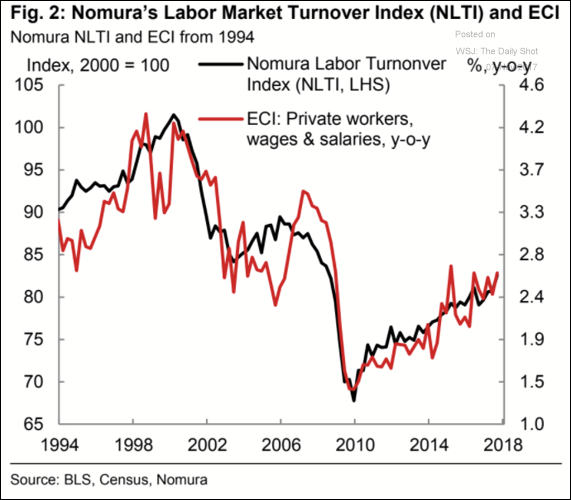

The United States: The US is struggling with low labor turnover, which is a significant contributor to the sluggish wage growth.

And the reason for declining labor turnover is the aging corporate sector. Old US firms, many of which are heavily entrenched in their industry, increasingly dominate the economy.

Nomura: – “The decline in dynamism reflects many disconcerting trends in the US economy, including reduced worker mobility, low entry rates of new firms and increased concentration across many industries. These trends are structural and are unlikely to reverse course soon. Moreover, these trends have played out over a number of decades.”

The Eurozone: German manufacturing orders have accelerated, exceeding expectations.

Asia: People across Asia are uneasy about the US withdrawing from the international agreements.

Equity Markets: The market is encouraging companies to increase CapEx, as Goldman’s CapEx/R&D index outperforms.

Some analysts point to higher sales growth as a leading indicator for CapEx.

Credit: CLOs have cut their liability costs significantly this year by refinancing.

Food for Thought: Largest electric car manufacturers.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com