Greetings,

Before we begin, we wanted to alert you to one of our favorite weekend reads: the Weekly S&P500 ChartStorm by Callum Thomas — it features 10 handpicked charts covering macro, technicals, valuations, and more — it’s a quick and effective way to stay on top of the market outlook.

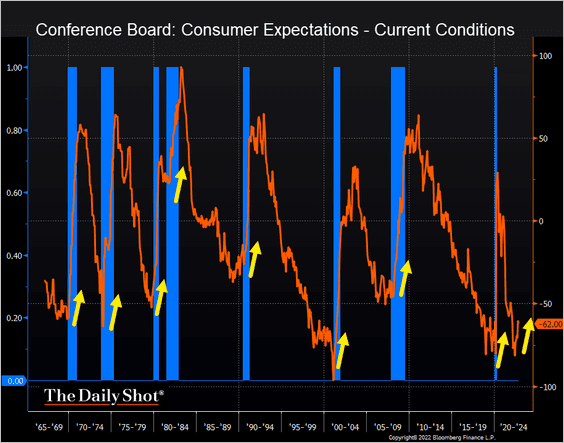

The United States: The spread between consumer expectations and current conditions indicators is starting to rise, which usually signals a recession.

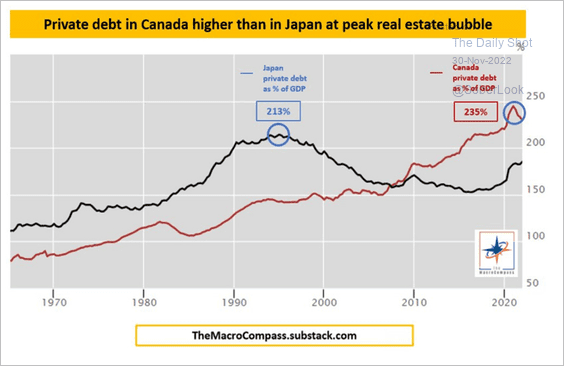

Canada: Private debt has ballooned to unprecedented levels.

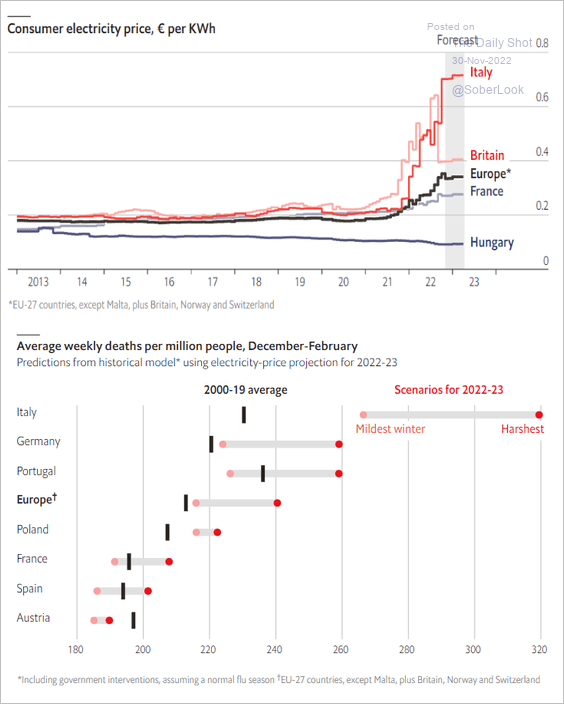

Europe: A challenging winter lies ahead with increased electricity prices.

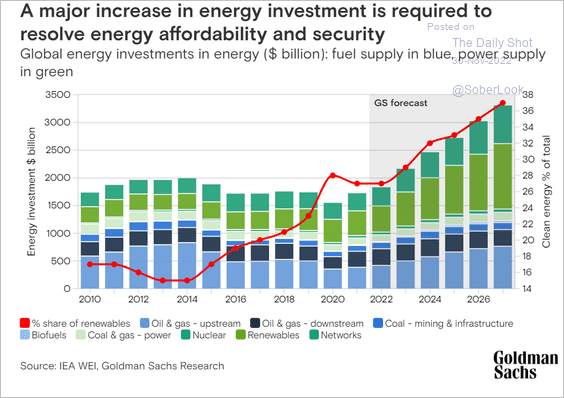

Energy: Global energy investment requirements will grow sharply over the next few years, according to Goldman Sachs.

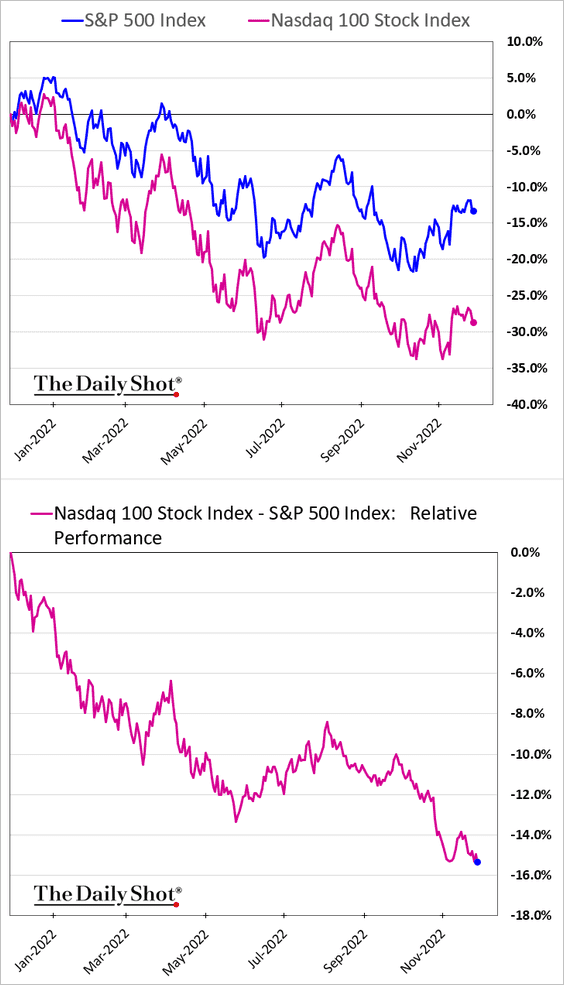

Equities: The Nasdaq 100 continues to widen its underperformance, now lagging the S&P 500 by more than 15% over the past 12 months.

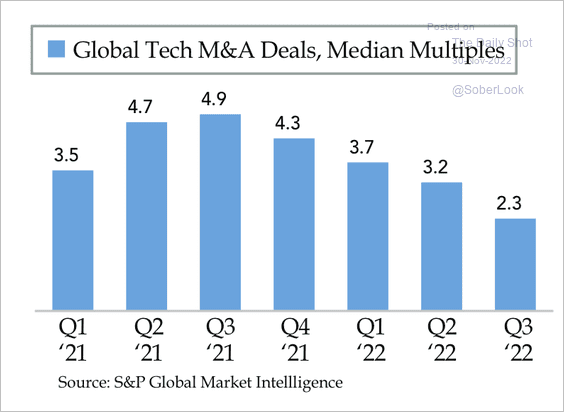

Alternatives: Tech M&A valuations have declined massively from the 2021 peak.

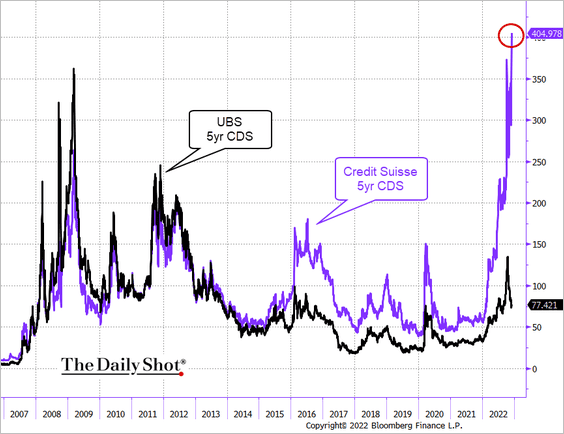

Credit: The market is doubting whether Credit Suisse will survive.

Here’s a look a their credit default swap spread.

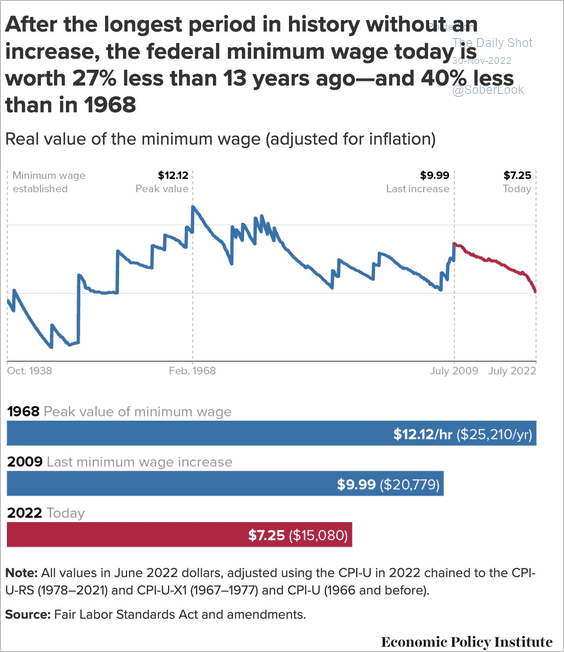

Food for Thought: Lastly, let’s take a look at the real value of the minimum wage.

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com