Greetings,

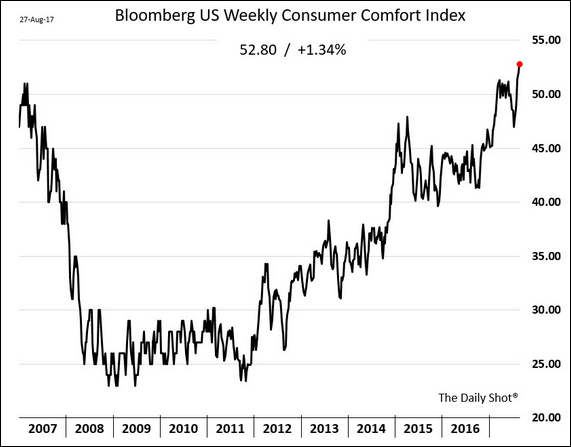

The United States: The Bloomberg Consumer Comfort Index hit another multi-year high (the highest since 2001). Will this trend translate into higher spending?

For now, big-ticket items such as houses and autos don’t seem to reflect this consumer exuberance. For example, inventories of crossover SUVs are piling up at dealers despite a significant bump in incentives.

Bitcoin: The $4,500 resistance level for Bitcoin seems to be holding

Energy Markets: Hurricane Harvey’s impact on the Gulf Coast refining operations sent jet fuel prices sharply higher.

China: China’s stock market rally accelerates.

The Eurozone: Mario Draghi said that the global recovery is “firming.” Some analysts now expect October to bring news of the ECB’s QE tapering plans. The euro rose to the highest level since 2015 against the dollar on Draghi’s comments.

Speculative investors continue to bet on the single bloc’s currency appreciating further. Some have suggested that buying the euro has become a crowded trade. Will the ECB disappoint?

Emerging Markets: Even on a risk-adjusted basis, EM stocks did very well.

EM funds had some outflows last week, which didn’t appear to hurt performance.

Asia: Singapore’s industrial production surprised to the upside (a 21% year-over-year increase).

Food for Thought: Trust in institutions (globally).

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com