Greetings,

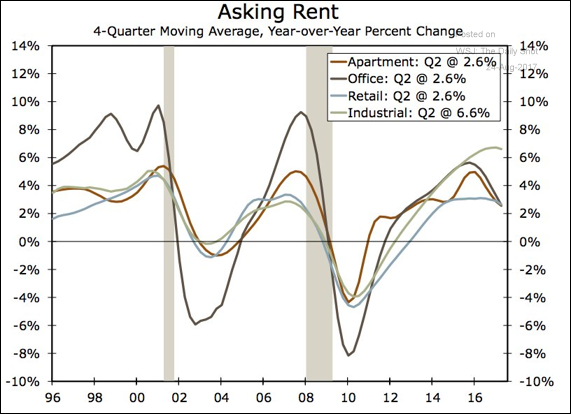

The United States: US commercial property rent increases seem to have peaked.

Foreign capital inflows into US commercial real estate have peaked as well. Here is the breakdown by origin.

Credit: Leveraged loan issuance hits the highest monthly volume in two years.

Equity Markets: Fund outflows from US equities accelerated while inflows into global stock funds have stalled (“ETP” = exchange traded product, “MF” = mutual fund).

Here are the fund flows for large and small-cap US funds.

And this chart shows fund flows into (non-US) developed and emerging markets.

China: What are the implications of the latest Communist Party congress?

The Eurozone: Here is a forecast for the ECB’s QE tapering. This, combined with improving economic growth (#2 above) should support the euro.

Emerging Markets: Debt issuance in the Middle East surged since the decline in oil prices.

Global Developments: For the first time in a decade, all OECD economies are expanding.

Food for Thought: What is the “carbon intensity” of different foods?

How does this intensity translate into the carbon footprint for different diets?

The next Daily Shot Brief will be out on Monday, August 28th.

Have a great weekend!

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com