Greetings,

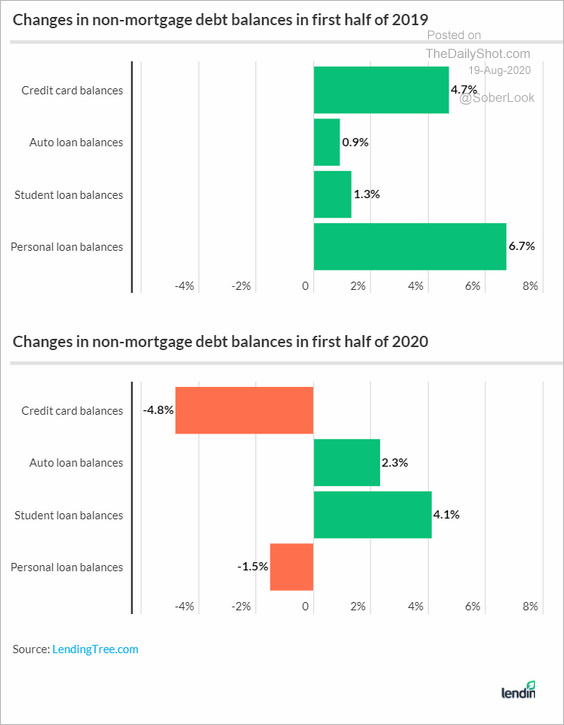

United States: This chart shows consumer debt changes in the first half of 2019 and 2020 (significant reductions in credit card debt).

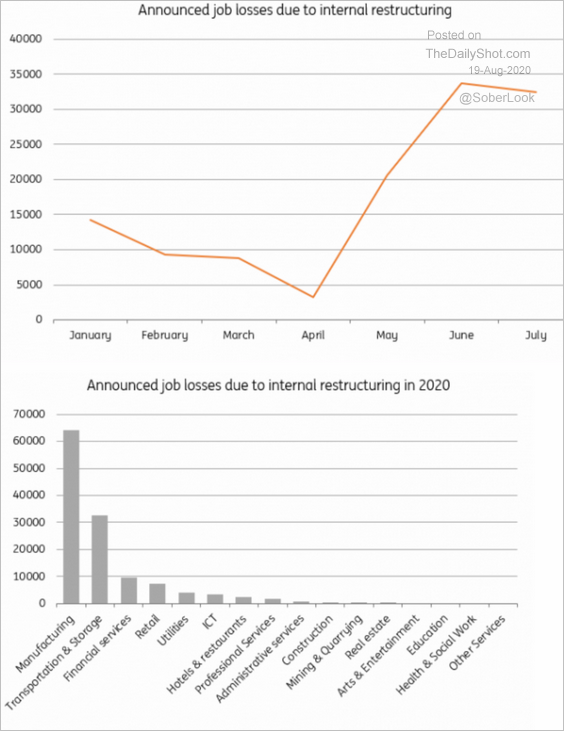

Europe: Job losses due to corporate restructuring have been substantial.

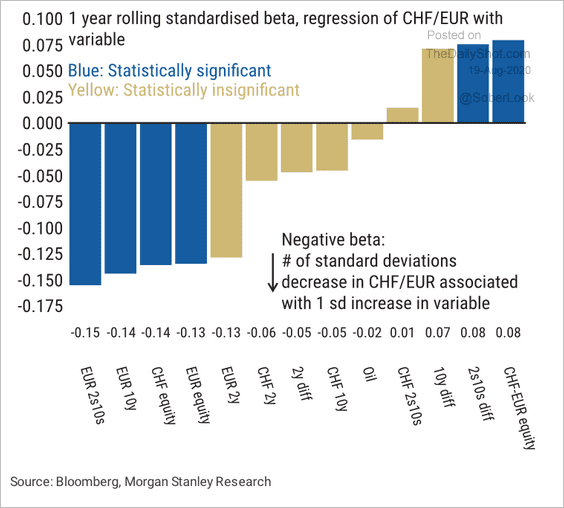

Also, the Swiss Franc remains negatively correlated with markets that signal risk-on, such as equities and yields/curve.

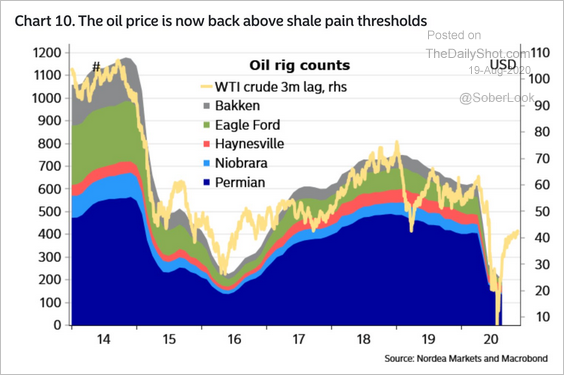

Energy: The US rig count is set to recover.

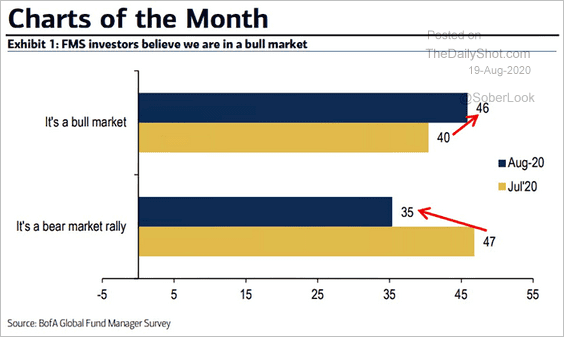

Equities: Fund managers are increasingly convinced that we are in a bull market.

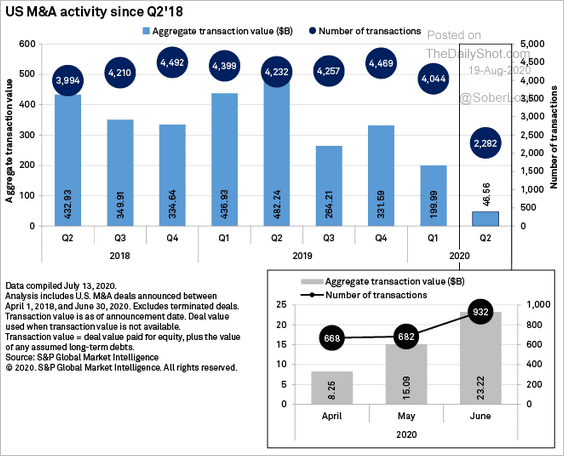

Is M&A activity rebounding?

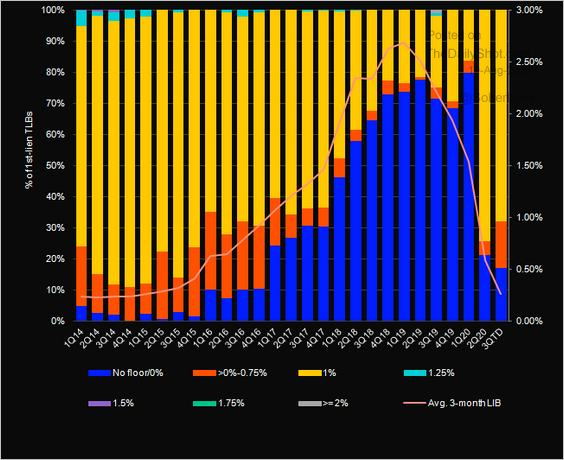

Credit: Investors continue to demand LIBOR floors on new leveraged loans.

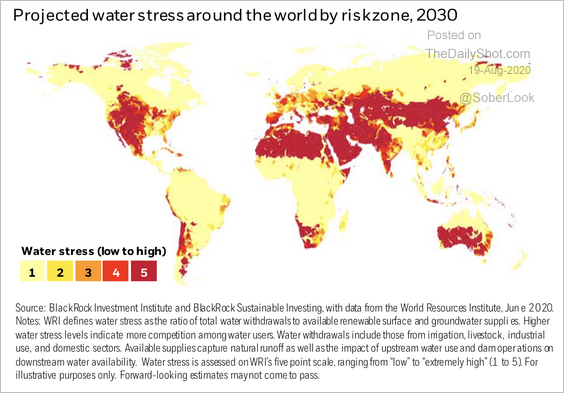

Food For Thought: Water stress globally:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Subscribe to the Daily Shot Brief