Greetings,

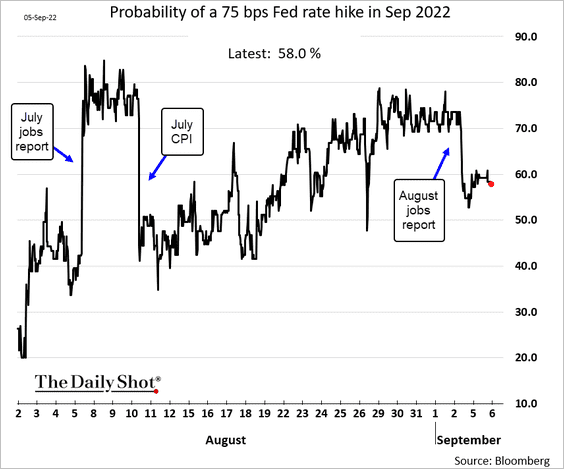

The United States: The probability of a 75 bps Fed rate hike this month dropped in response to the employment report as labor force participation improved and wage growth edged lower. The labor market is showing signs of loosening.

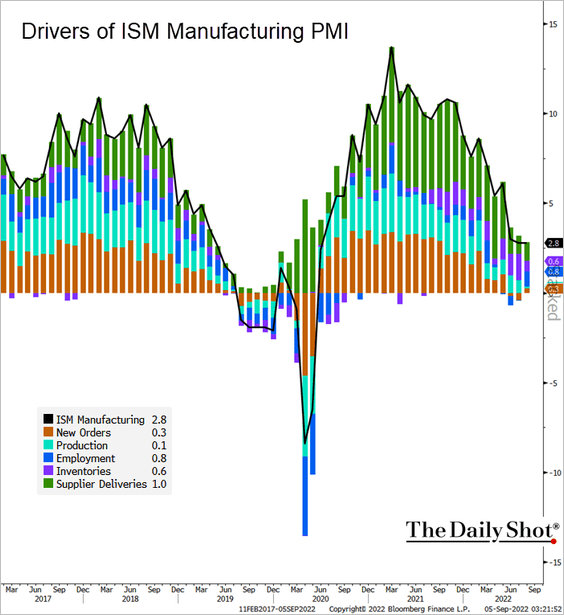

The ISM Manufacturing PMI held up well in August, suggesting that factory activity remains in growth mode. Here are the contributions:

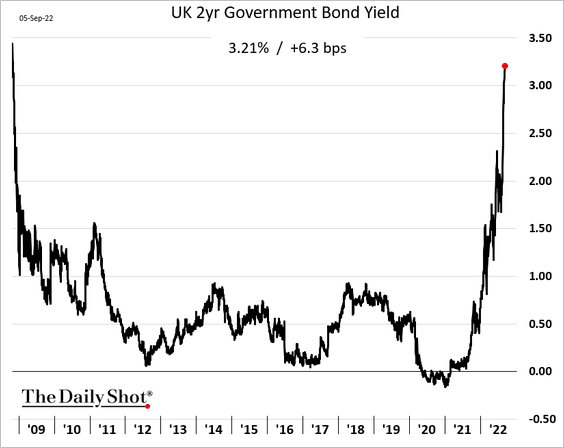

The United Kingdom: The 2-year gilt yield continues to surge as the market prices in more BoE rate hikes.

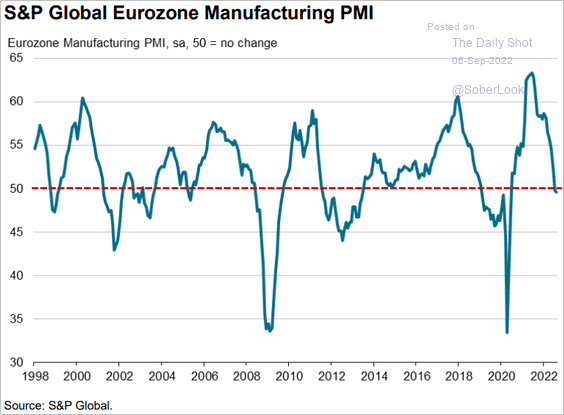

The Eurozone: Manufacturing growth has stalled at the Eurozone level.

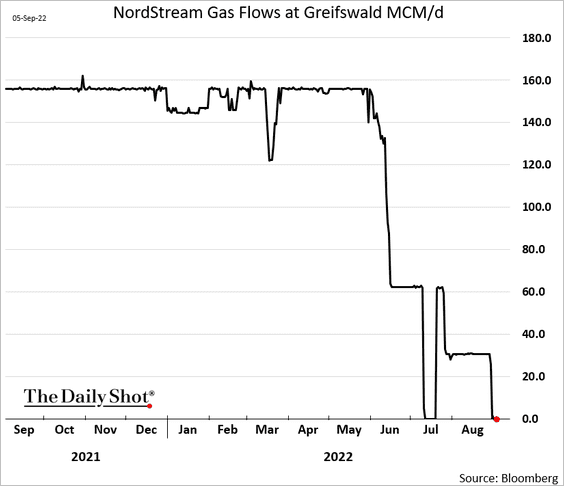

Energy: Moscow says Nord Stream will remain shut:

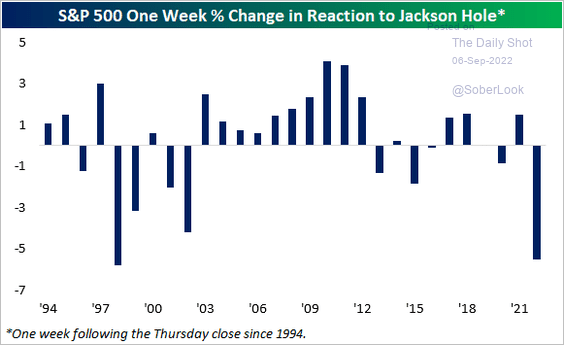

Equities: The post-Jackson-Hole one-week selloff has been severe.

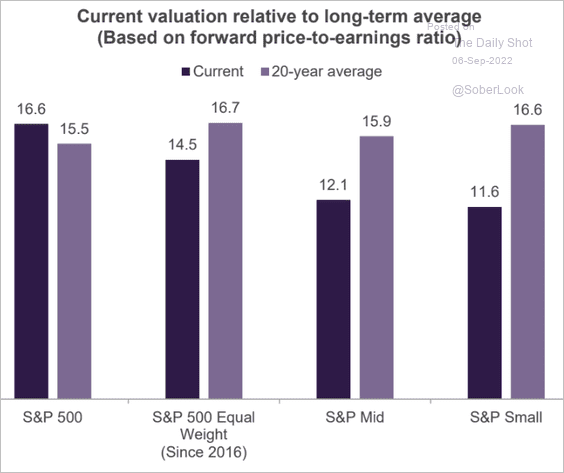

This chart shows current US index valuations relative to the 20-year averages.

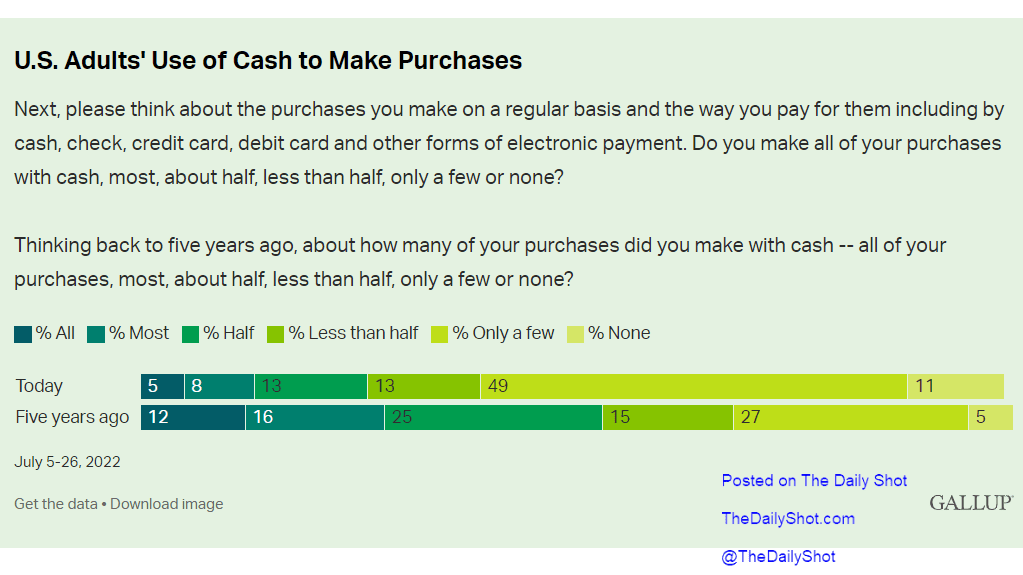

Food for Thought: To conclude, here is US cash usage today vs. five years ago:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com