Greetings,

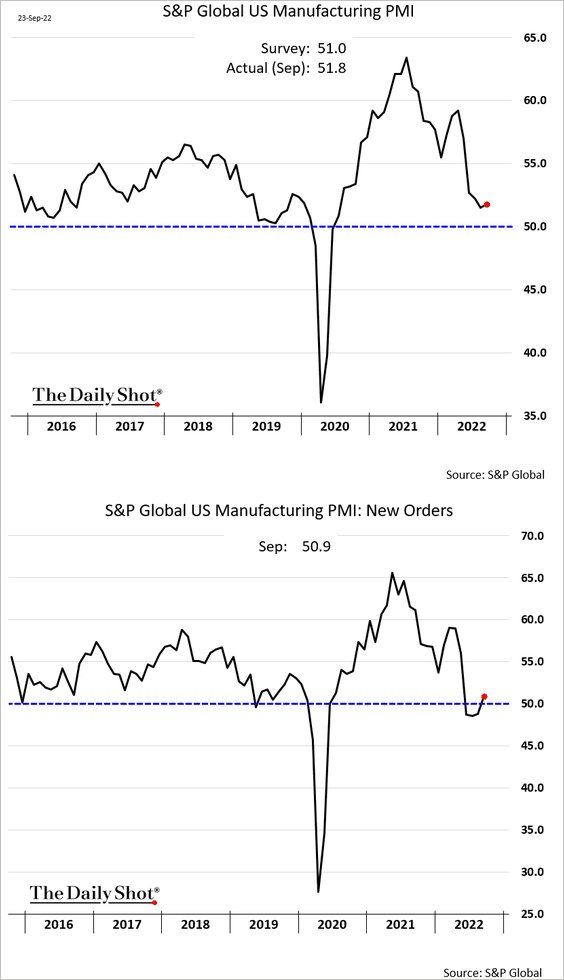

The United States: The S&P Global PMI report showed surprising resilience in the nation’s business activity. Manufacturing orders are back in growth territory.

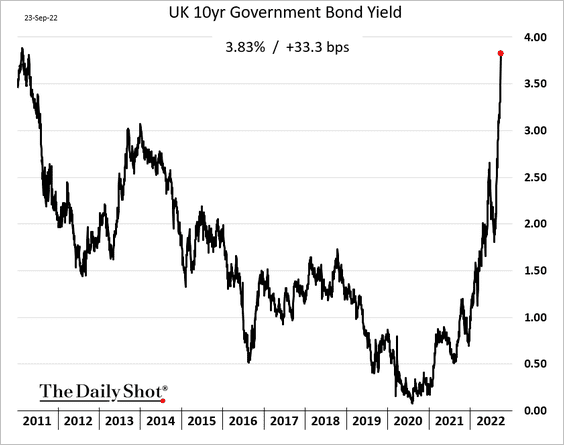

The United Kingdom: The UK government announced a massive stimulus package.

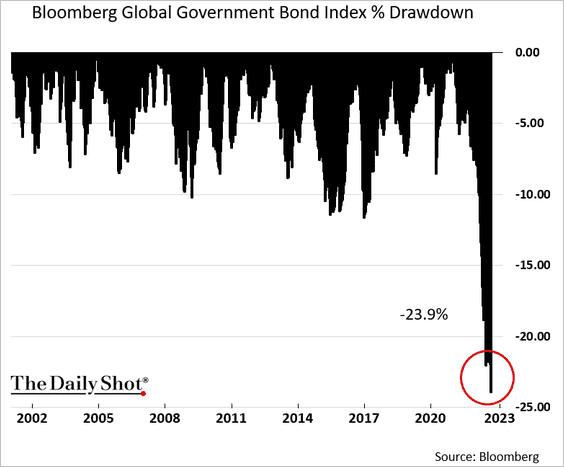

A massive amount of extra debt will be hitting the markets. The surge in yields after the budget announcement was unprecedented in recent decades.

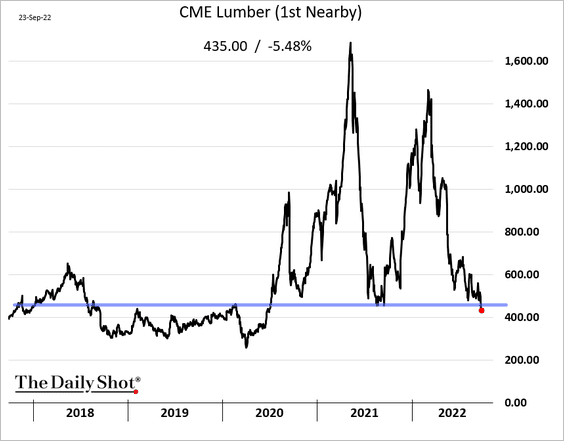

Commodities: US lumber prices are falling as the housing market comes under pressure.

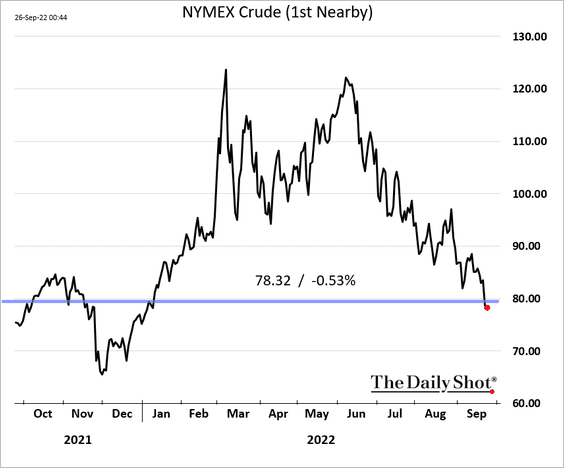

Energy: Oil prices declined further last week. Time to start refilling the US strategic oil reserves?

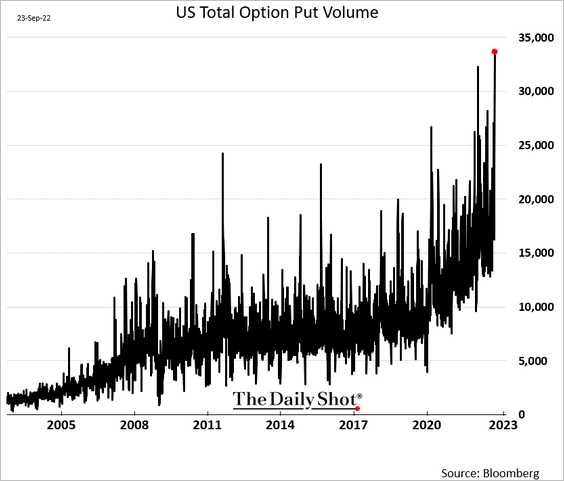

Equities: Put option volume surged last week. A market bounce could be painful for some investors.

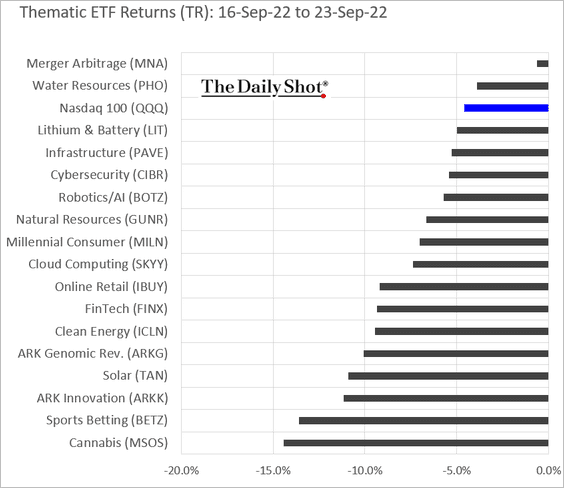

Here’s a look at last week’s performance for some thematic ETFs.

Rates: The drawdown in global government bonds has been unprecedented.

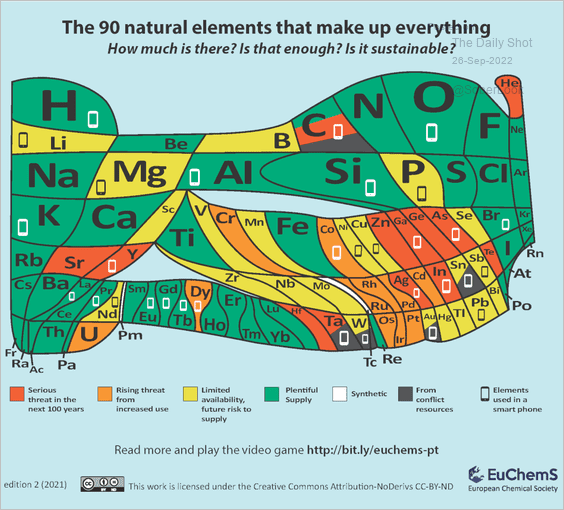

Food for Thought: The periodic table of “endangered” elements.

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com