Greetings,

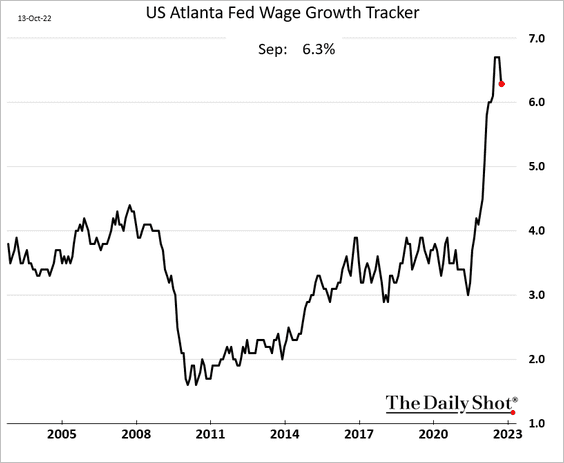

The United States: To begin, the Atlanta Fed’s wage growth tracker appears to have peaked.

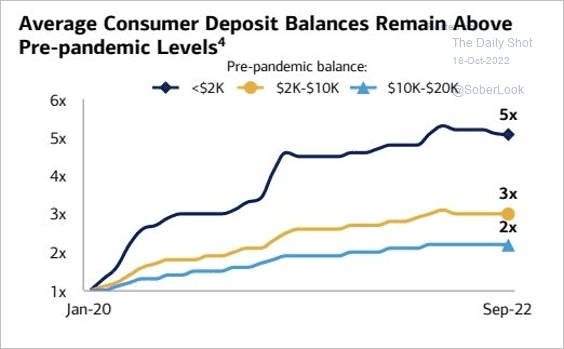

Consumer savings remain elevated, which should provide a cushion as the economy slows.

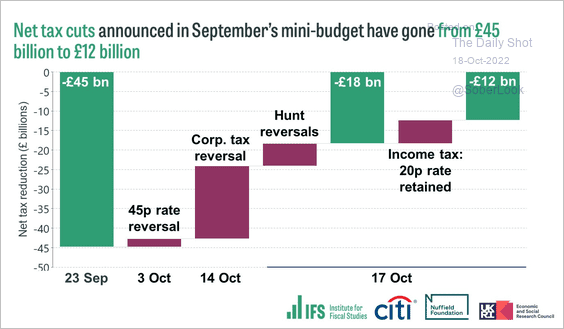

The United Kingdom: The UK government is walking back most of the tax cuts.

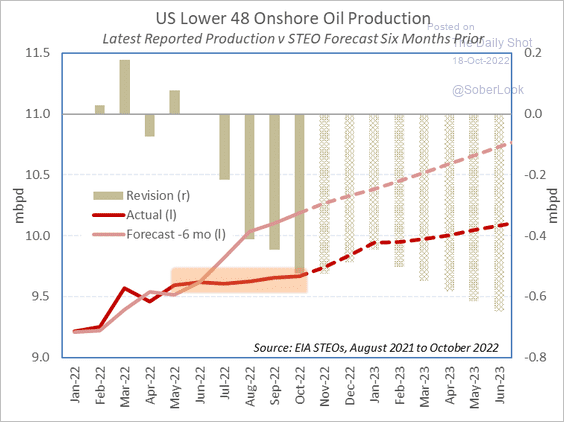

Energy: The COVID-era rebound in US oil production has been slower than expected.

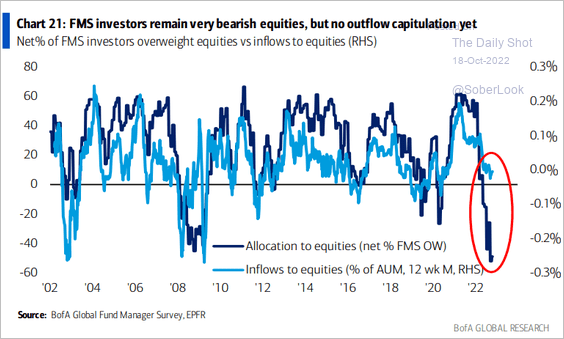

Equities: Fund managers’ extreme bearishness has not yet translated into outflow capitulation.

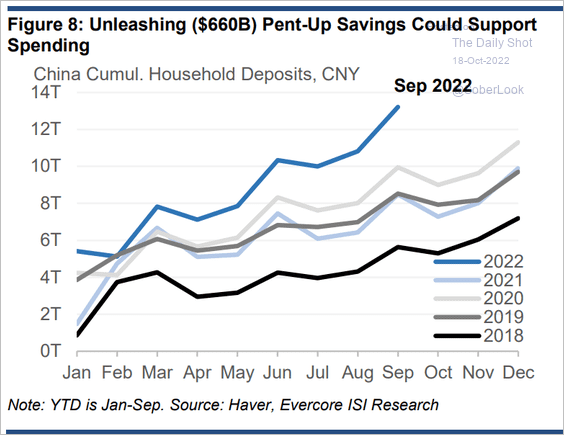

China: The 2022 deposit surge in China should support consumption next year, which thus far has lagged amidst lockdown uncertainty.

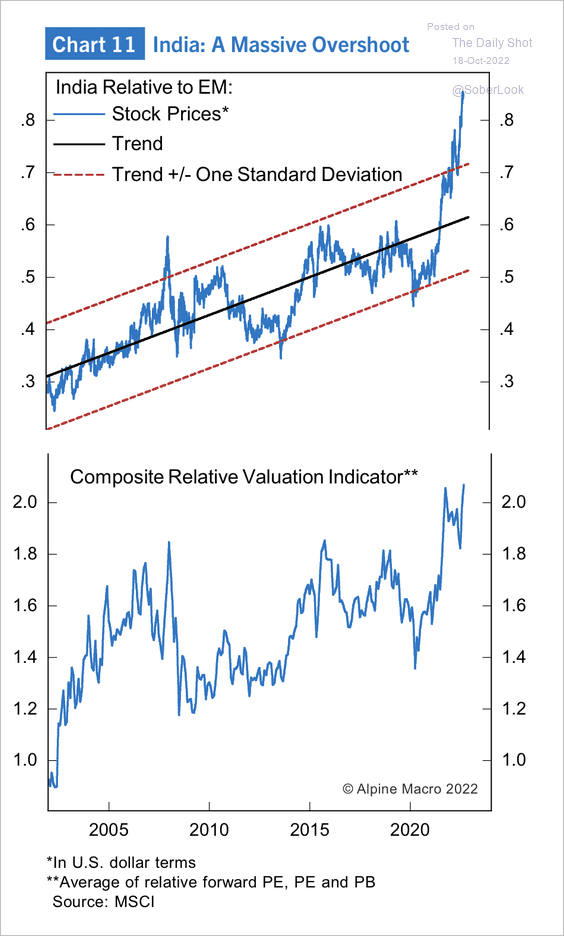

Emerging Markets: Indian equities appear overbought relative to broader EM, in dollar terms.

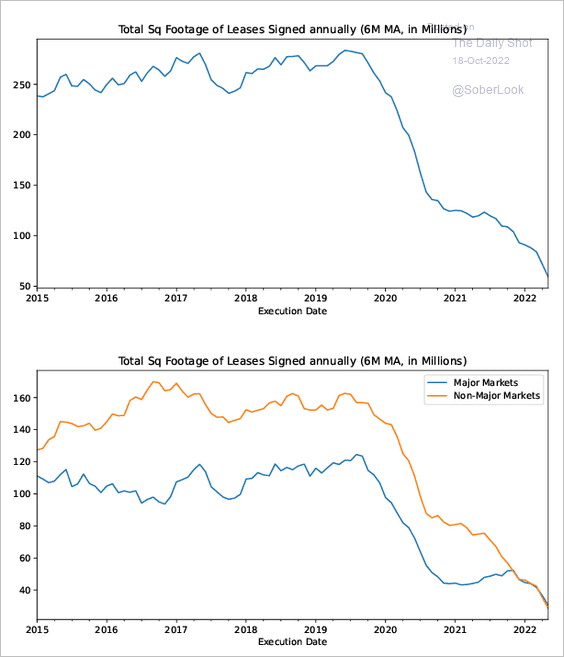

Food for Thought: To conclude, here is the amount of new leases signed for office space in the US:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com