Greetings,

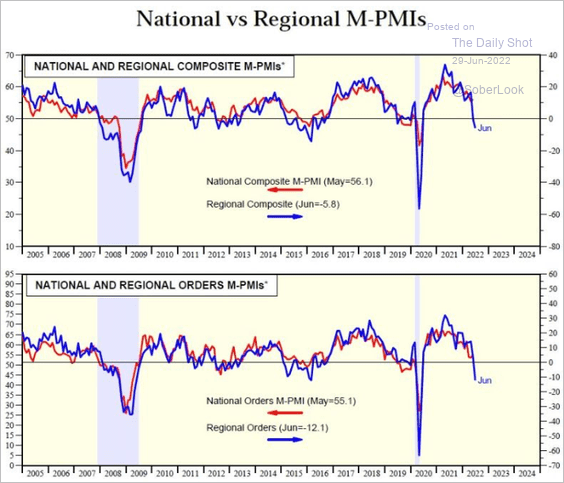

The United States: Starting off, the regional Fed indicators point to manufacturing contraction at the national level this month.

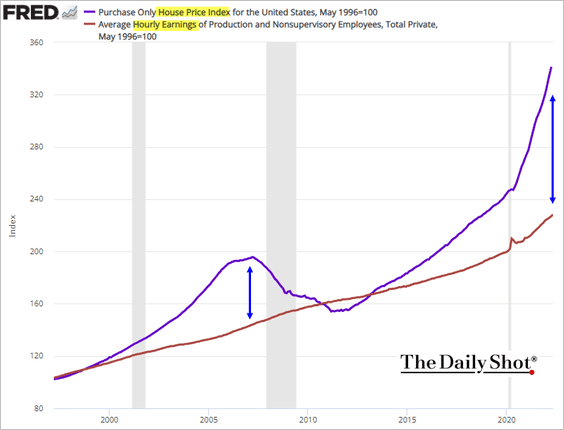

Also, the divergence between home prices and wages continues to widen.

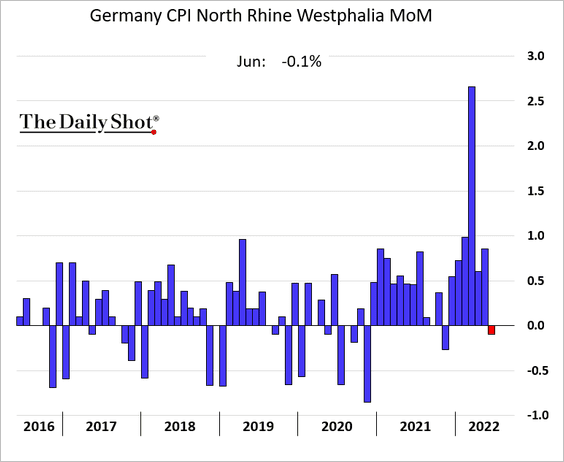

The Eurozone: There was a hint of slower inflation in Germany.

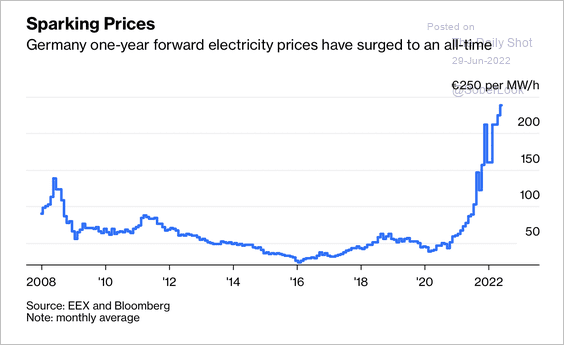

On the other hand, German electricity prices have surged to an all-time high. Forward contracts, which lock in energy costs, are getting more expensive by the day.

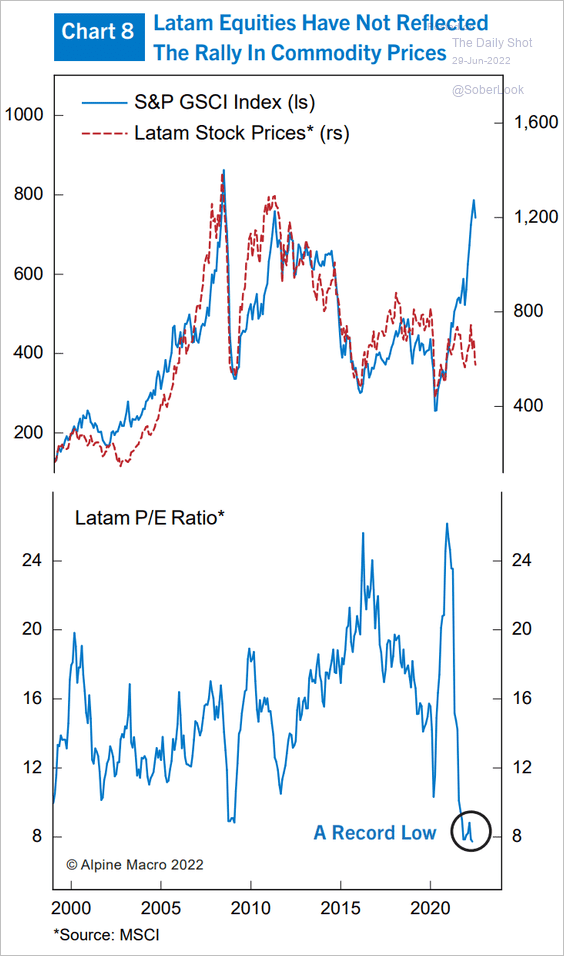

Emerging Markets: LatAm equities have been lagging commodities.

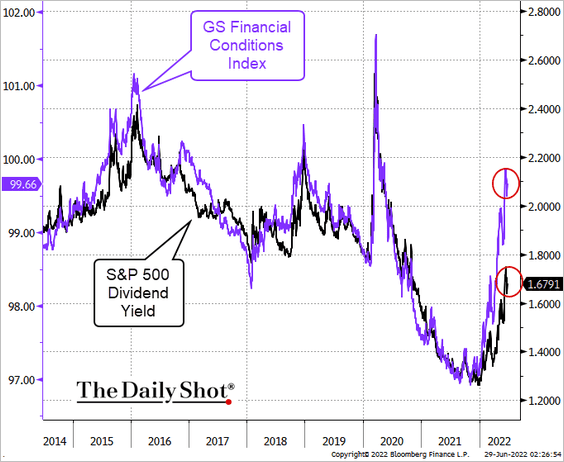

Equities: Tighter financial conditions require higher compensation for investors to take on risk. The S&P 500 dividend yield is about 40 bps too low. Since companies are not about to boost dividends in this environment, stock prices need to be substantially lower.

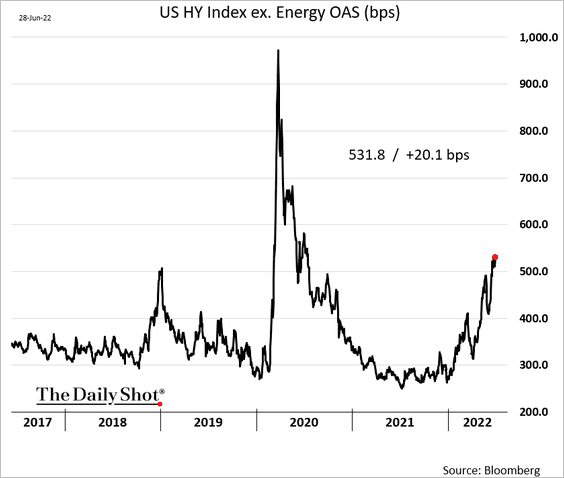

Credit: High-yield spreads continue to grind higher.

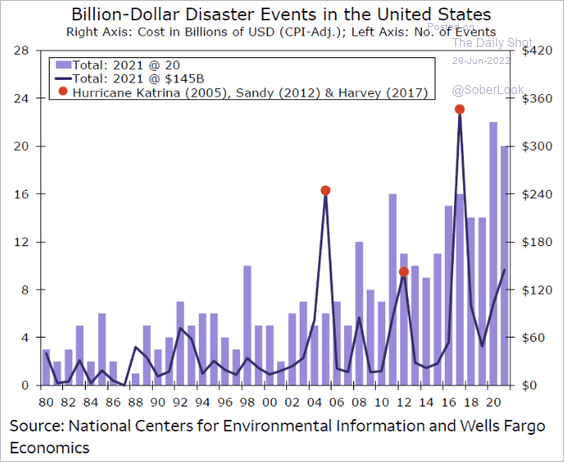

Food for Thought: Lastly, let’s take a look at the increasingly devastating effects of weather disasters in the US over the past 40 years.

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com