Greetings,

The United States: The S&P Global Composite PMI moved into contraction territory this month (PMI < 50), signaling a pullback in business activity.

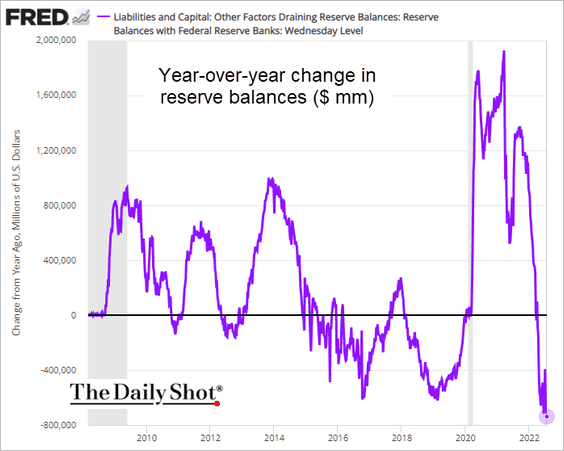

Liquidity has been decreasing as the Fed reverses quantitative easing. It’s a headwind for economic growth.

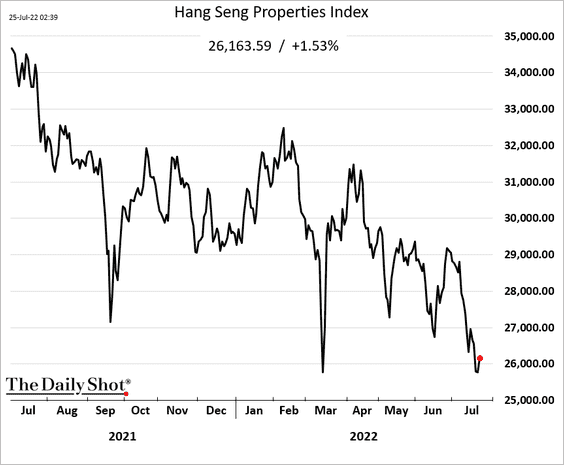

China: Property shares have stabilized as Beijing plans a massive bailout.

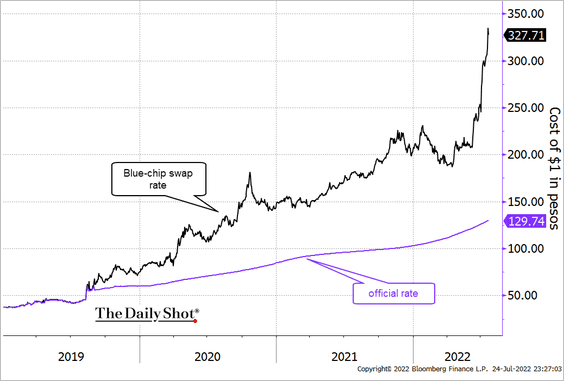

Emerging Markets: The gap between the official and unofficial peso exchange rate has blown out (higher value = weaker peso).

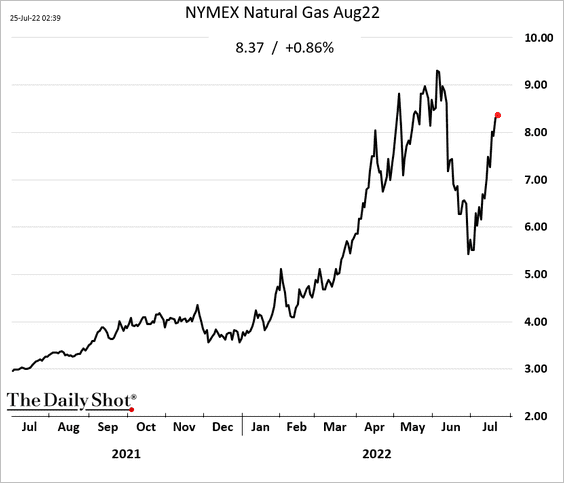

Energy: US natural gas futures continue to climb.

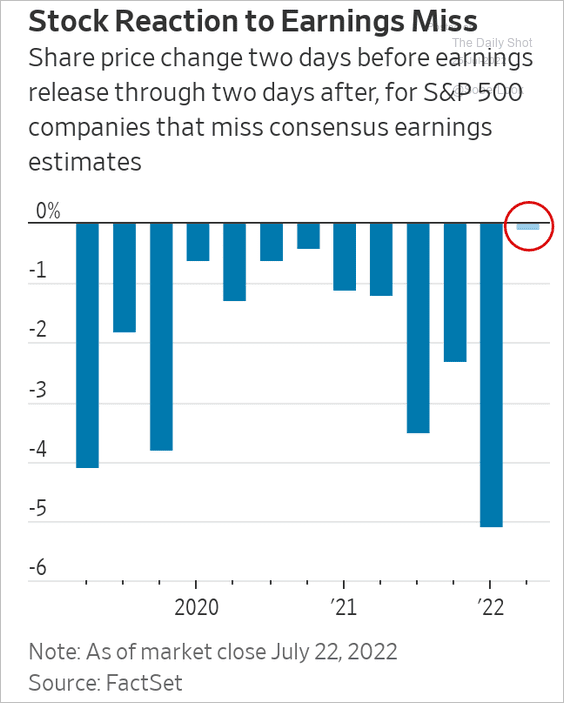

Equities: The market has been very forgiving with the Q2 earnings misses.

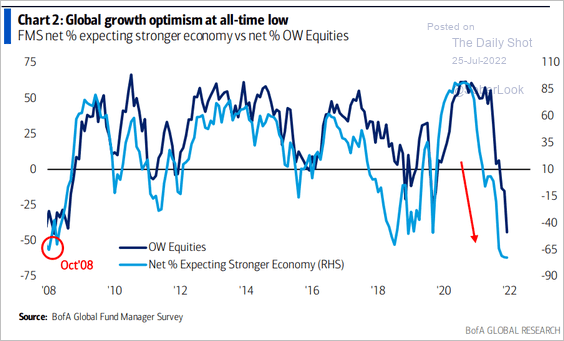

Global Developments: Fund managers’ economic growth optimism is below 2008 lows.

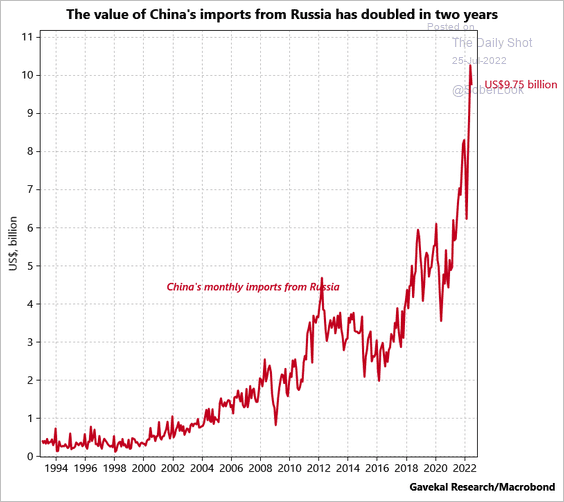

Food for Thought: Lastly, let’s take a look at the value of China’s imports from Russia.

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com