Greetings,

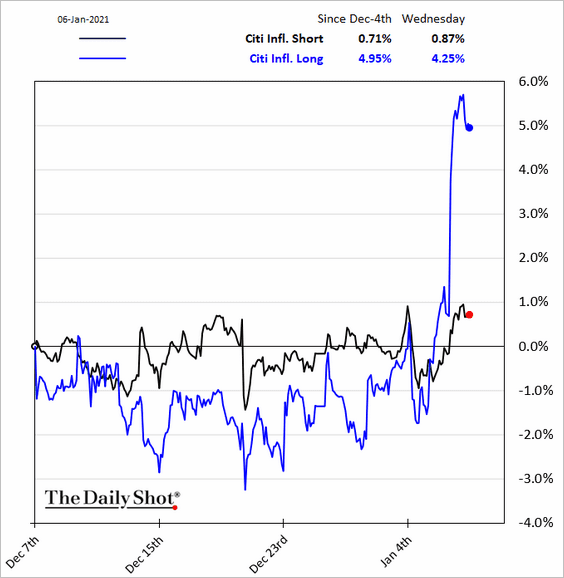

Equities: The news of Democrats taking control of the US Senate reignited the reflation trade. The market is betting on the federal government unleashing further fiscal stimulus, boosting consumption, economic growth, and inflation. Here is the relative performance of stocks that benefit from higher prices (Citi inflation long index) vs. those that do well in a deflationary environment.

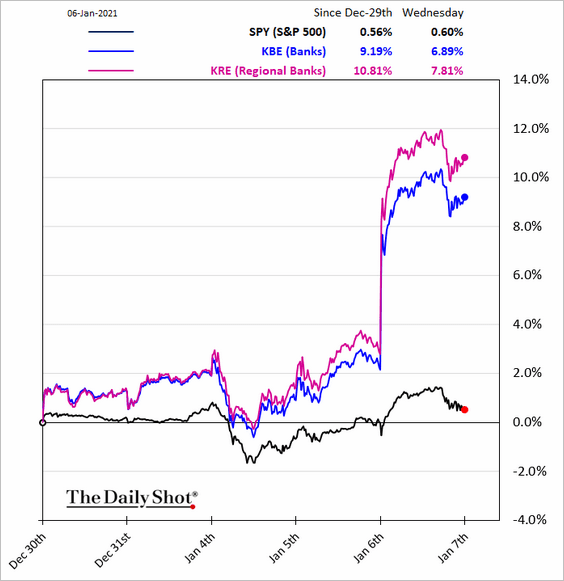

Bank shares rose sharply. Notice the spread between the regional and total banking indices. Democrats are likely to tighten the regulatory environment, which may have a greater impact on larger banks.

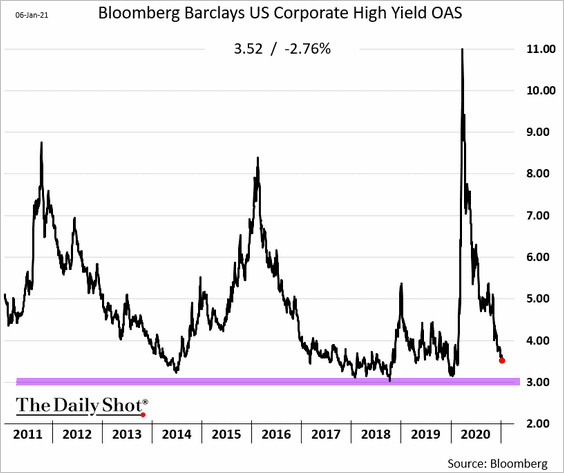

Credit: High-yield bond spreads are approaching pre-crisis lows.

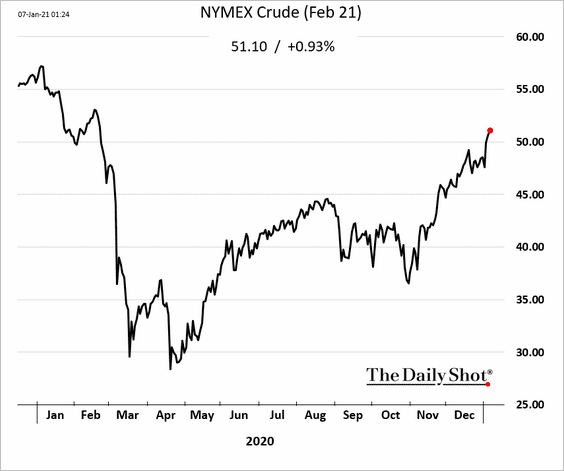

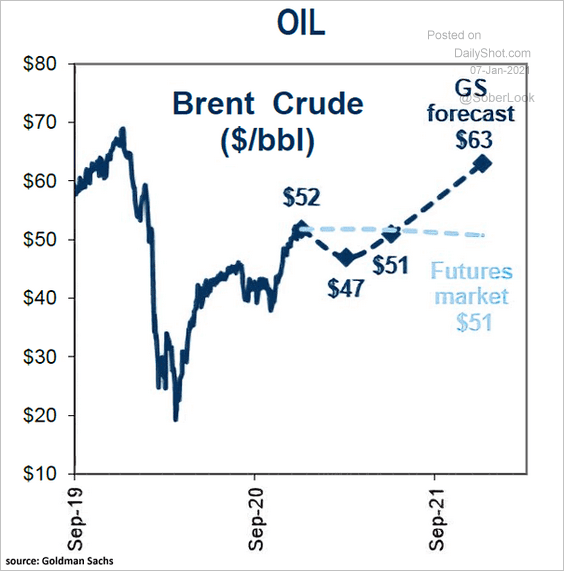

Energy: WTI crude oil climbed past $51/bbl.

Goldman expects Brent crude to reach $63/bbl by the end of the year.

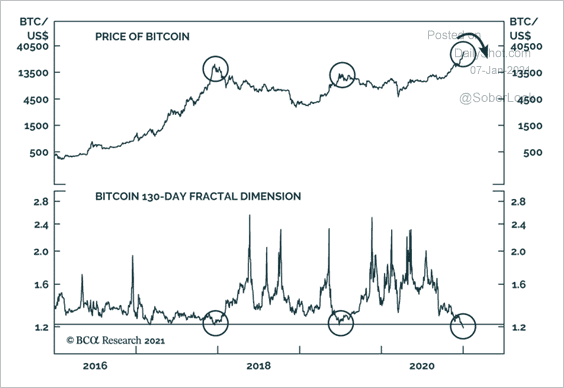

Cryptocurrency: Technicals suggest Bitcoin is due for a pull-back.

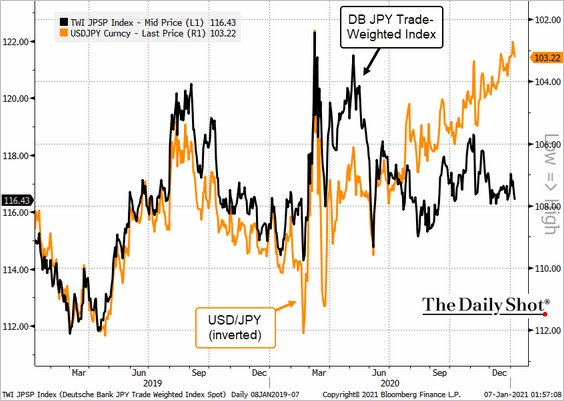

Japan: The yen has been rallying against the US dollar. However, the yen trade-weighted index has been flat over the past year.

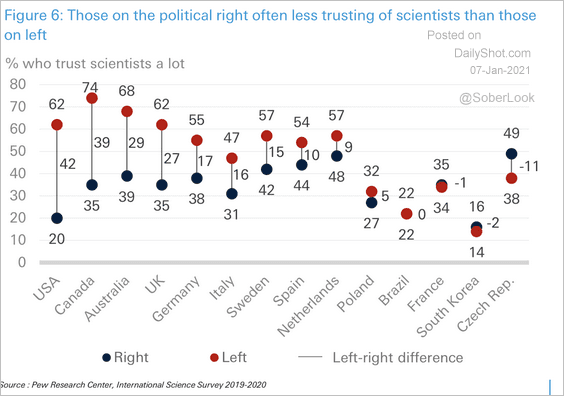

Food For Thought: Trust in scientists:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com