Greetings,

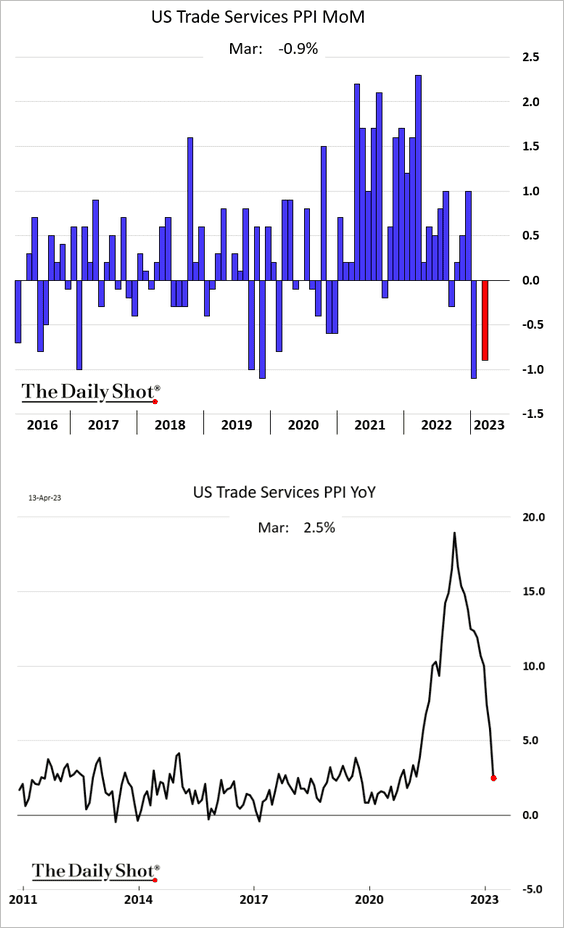

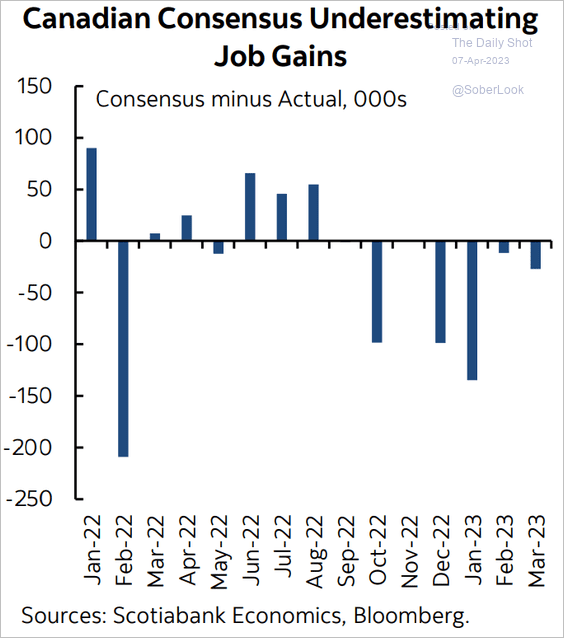

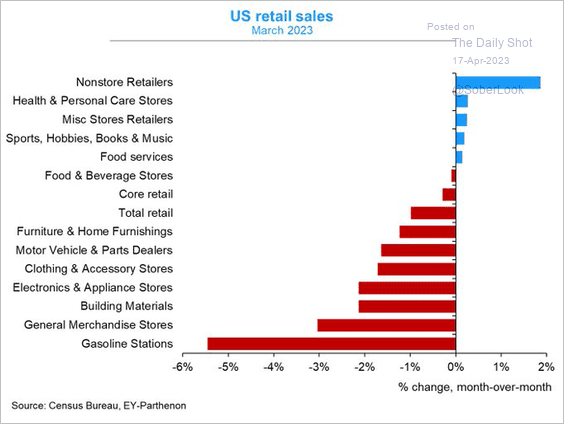

The United States: Here are the March changes by sector.

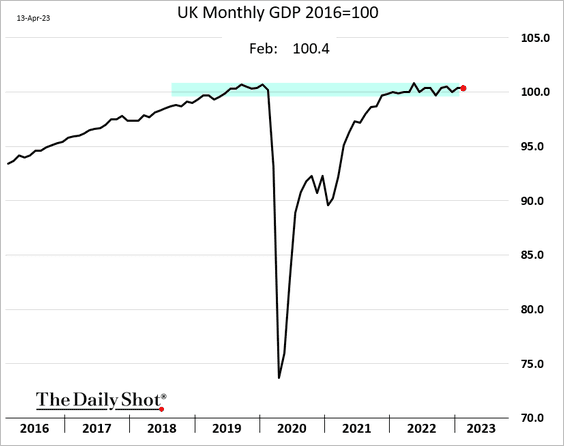

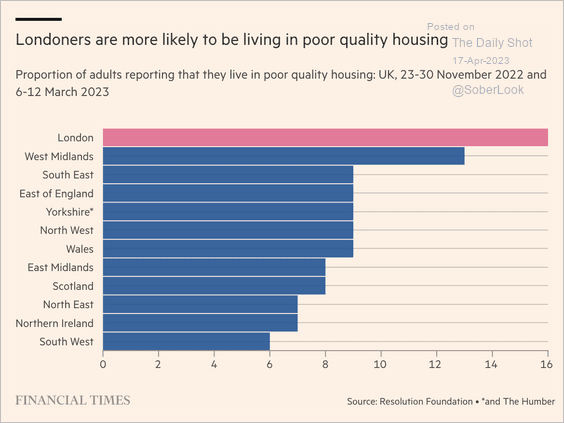

The United Kingdom: What percentage of the population lives in poor-quality housing?

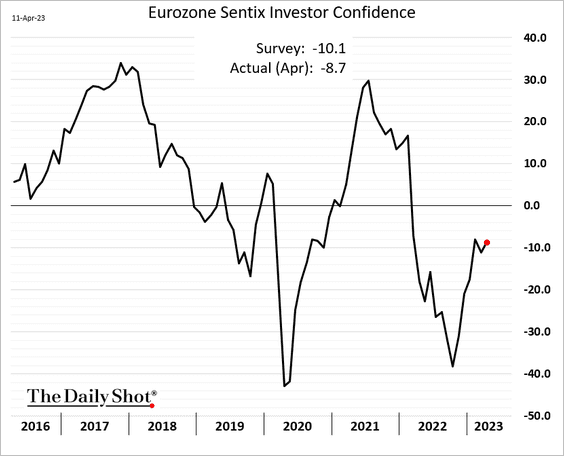

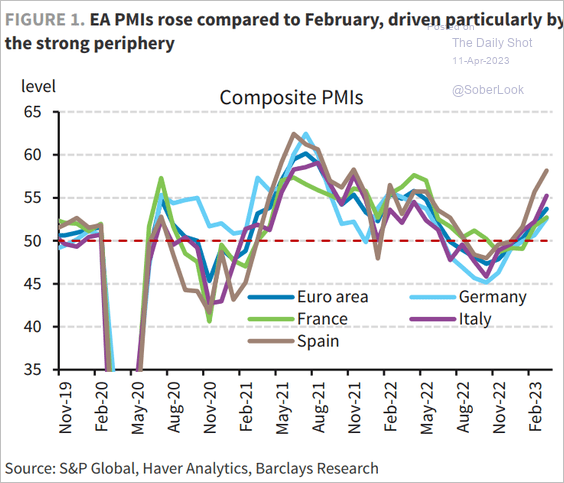

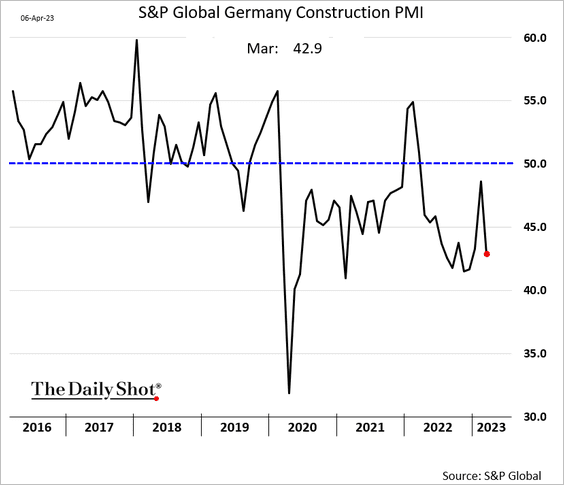

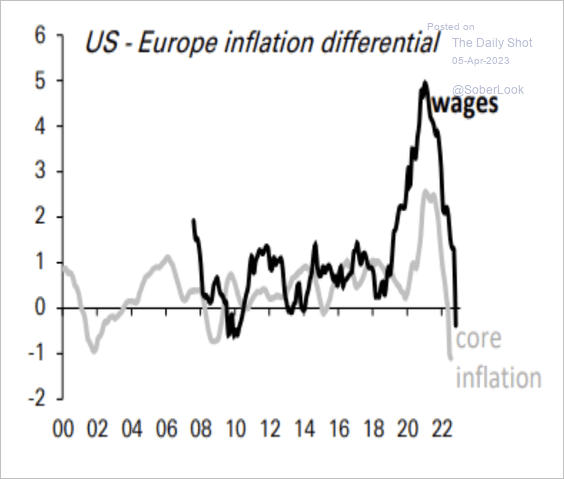

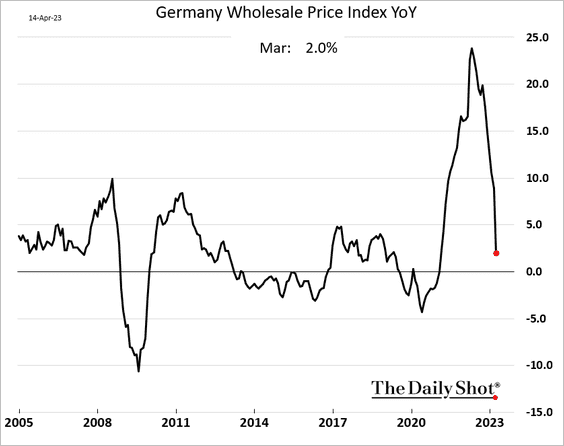

The Eurozone: Germany’s wholesale price inflation is crashing.

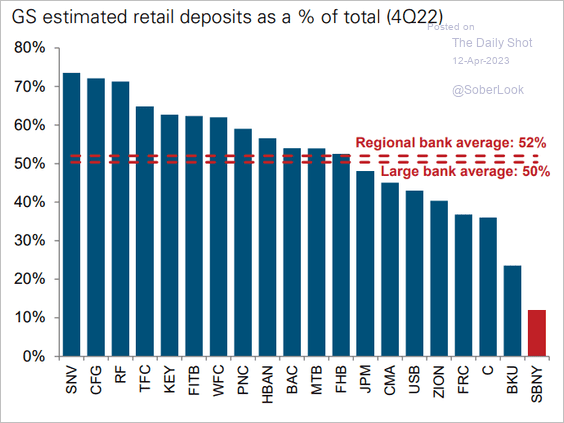

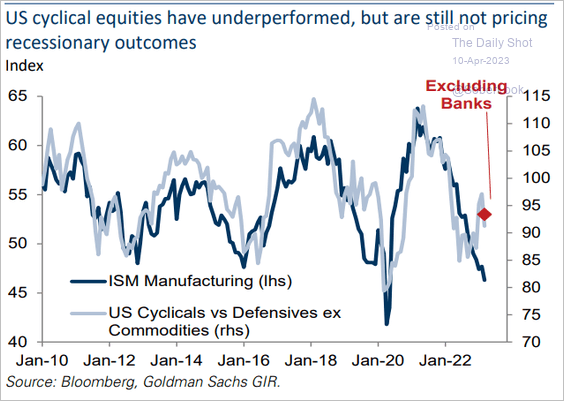

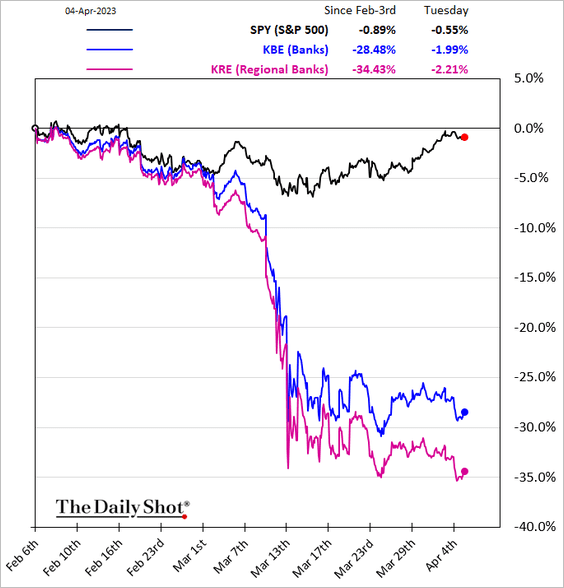

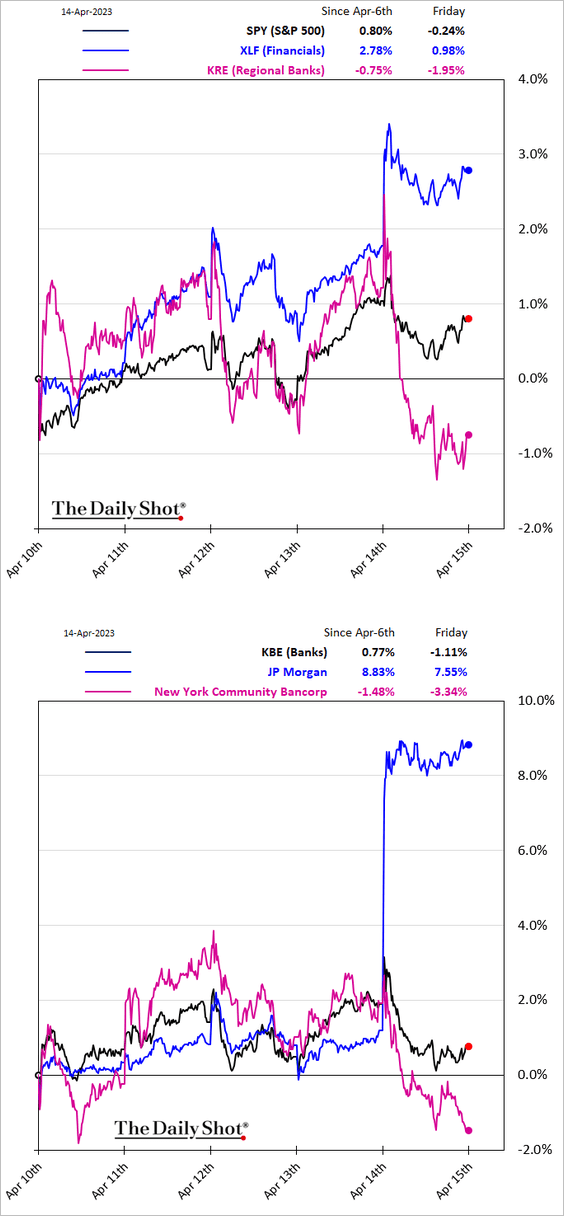

Equities: Traders jumped into shares of large banks on Friday while dumping regional/small banks.

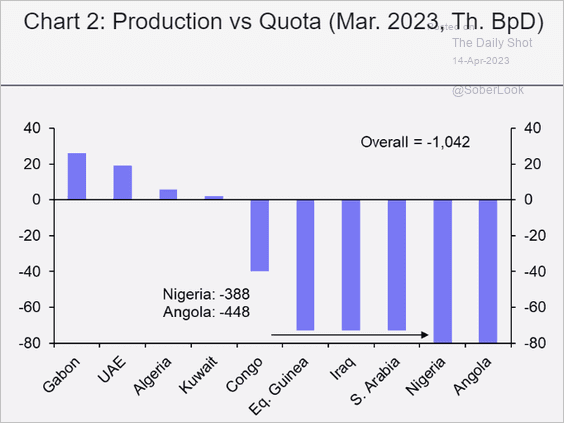

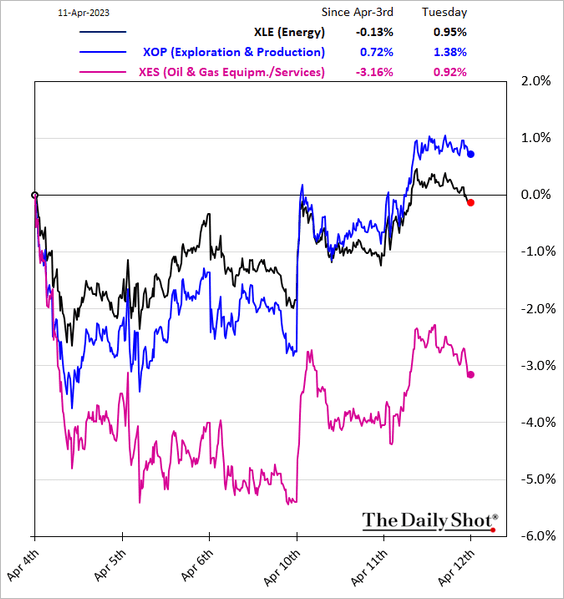

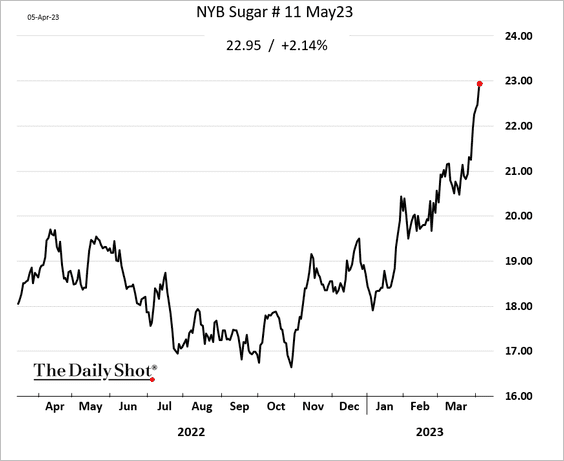

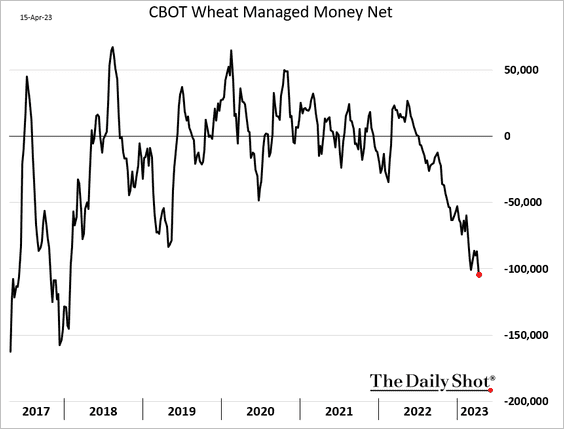

Commodities: Funds have been boosting their bets against US wheat futures amid ample global supplies.

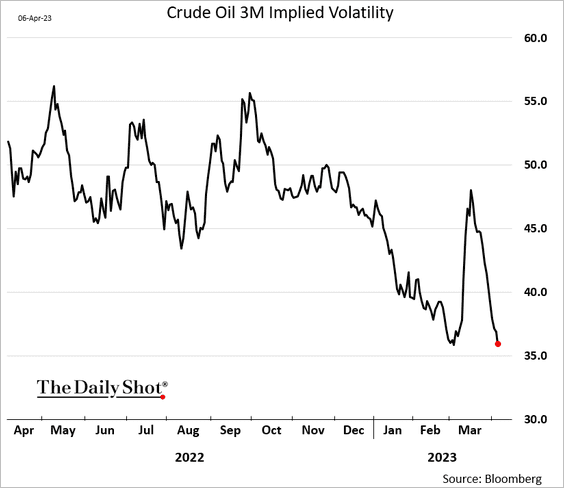

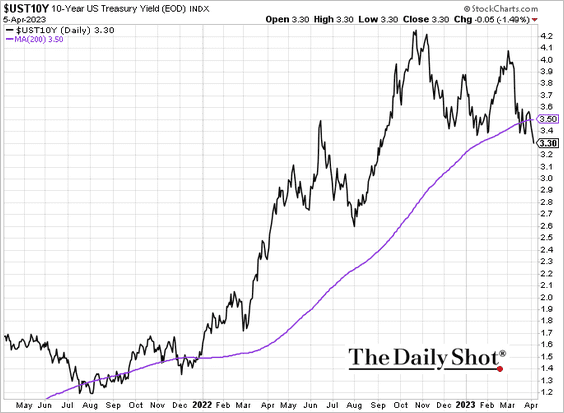

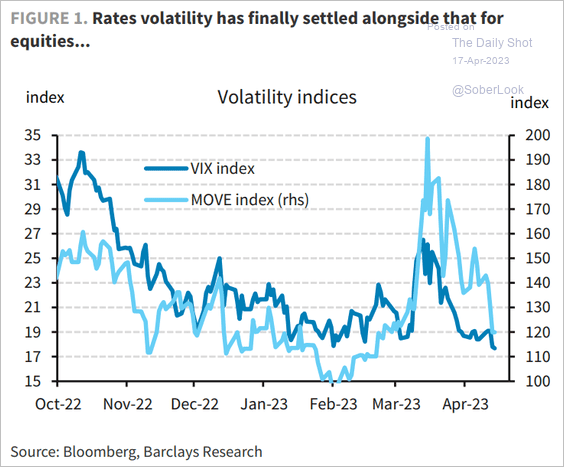

Rates: Rates market implied vol has closed most of the gap with equities.

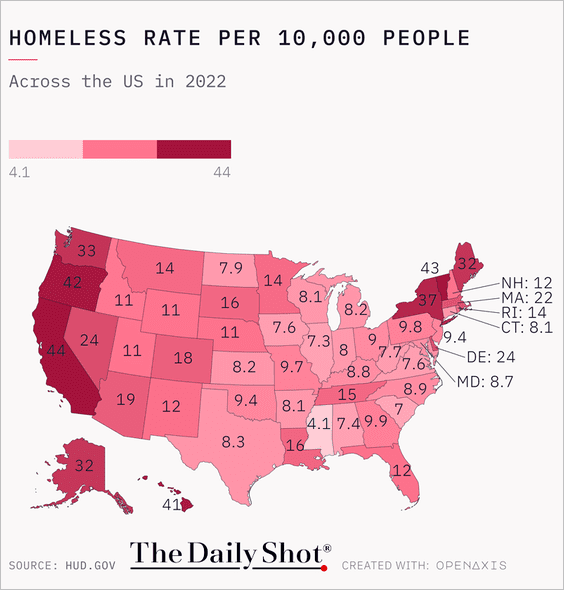

Food for Thought: Homeless rates across the US:

Edited by Josh Oldmixon

Contact the Daily Shot Editor: Brief@DailyShotResearch.com