Greetings,

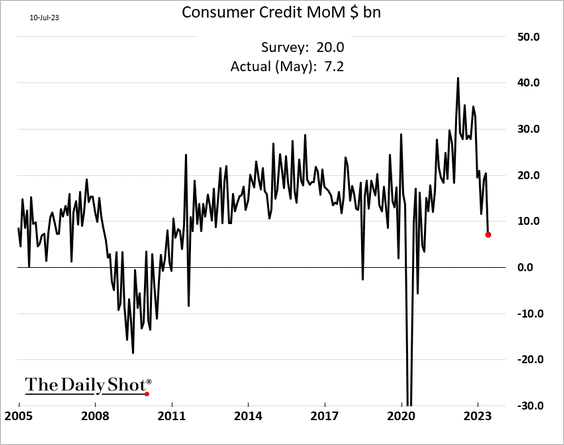

The United States: Consumer credit growth slowed sharply in May.

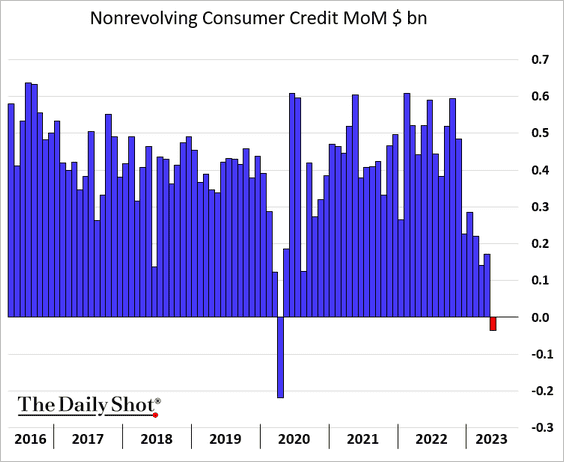

Non-revolving consumer credit (mostly auto loans and student debt) declined for the first time since the pandemic shock.

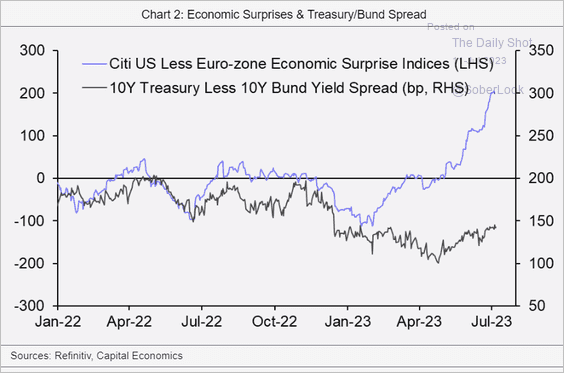

The Eurozone: The Treasury-Bund spread has diverged from the US-Eurozone economic surprise differential.

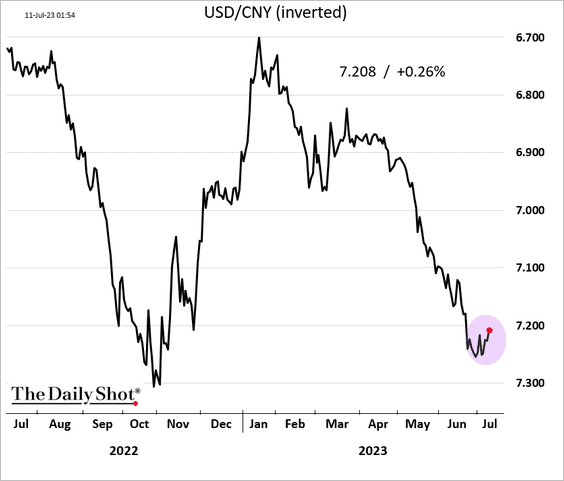

China: Beijing appears to have stabilized the renminbi.

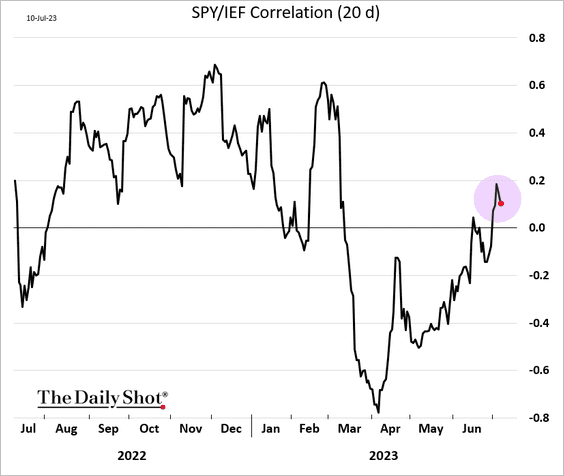

Equities: Hawkish signals from the Fed and robust US employment data sent the stock-bond correlation back into positive territory.

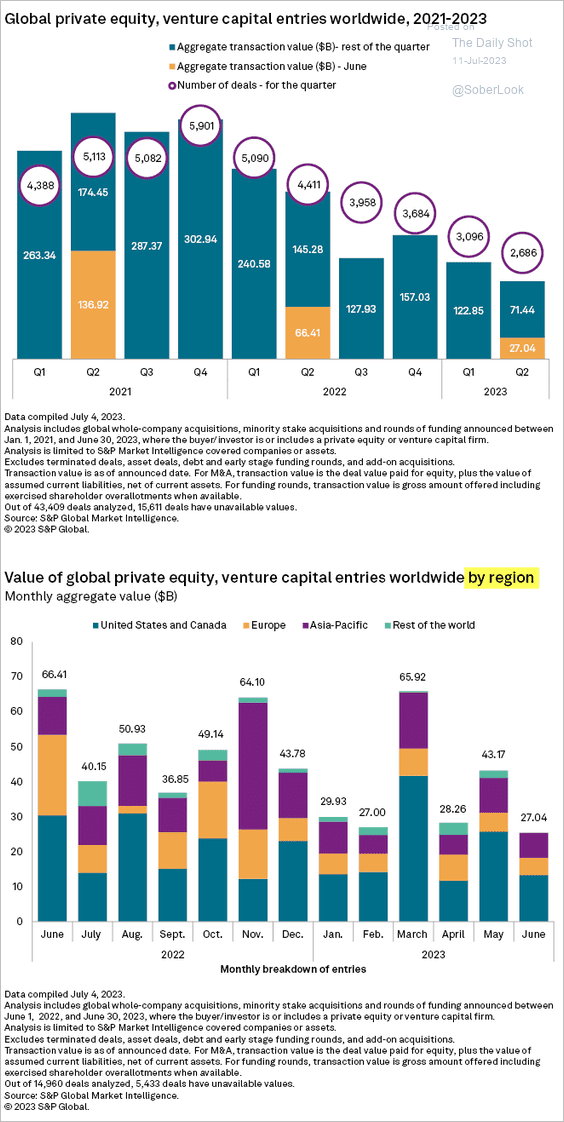

Alternatives: Global private equity activity has been running well below 2022 levels.

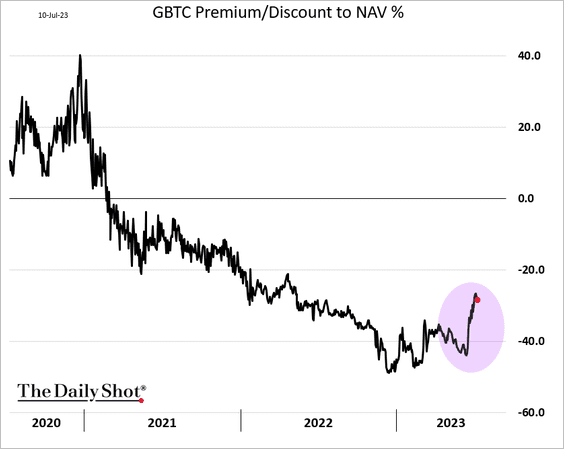

Cryptocurrency: The Grayscale Bitcoin Trust’s discount has narrowed significantly on hopes for a spot-bitcoin ETF conversion.

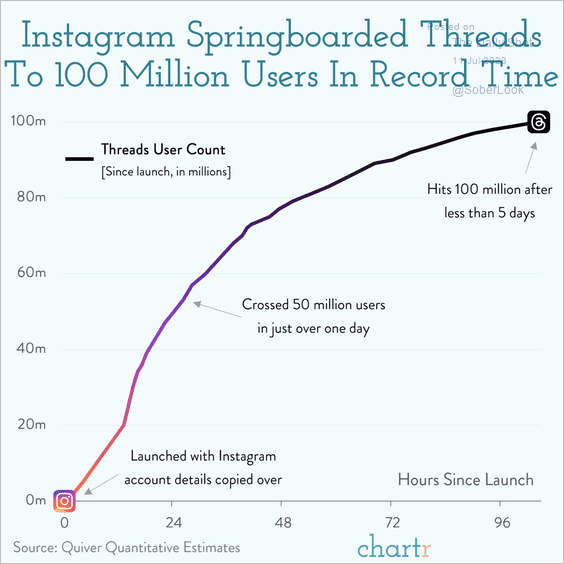

Food for Thought: Here is Threads’ user count:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief