Greetings,

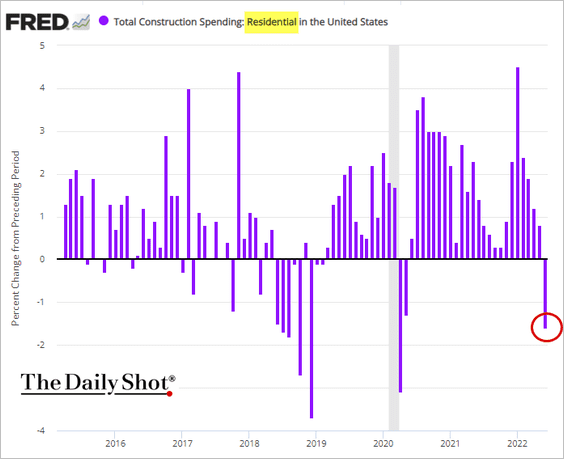

The United States: To begin, construction spending unexpectedly declined in June, driven by weakness in residential investment.

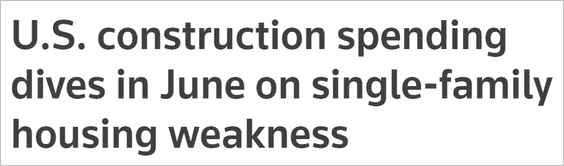

Looking at the yield curve, the 10-year – 3-month portion is about to invert. Some economists prefer this metric as a leading indicator of economic activity.

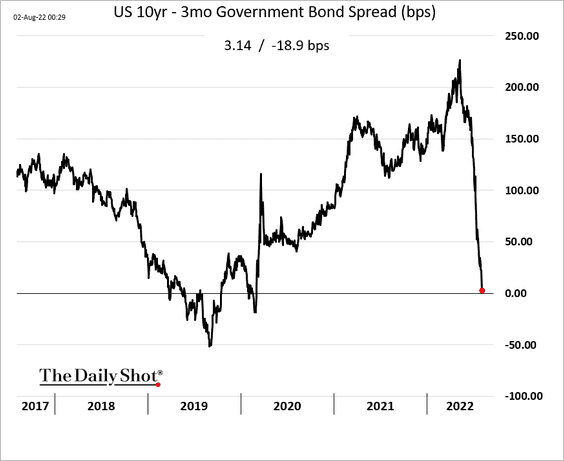

The Eurozone: The updated PMI report showed factory activity contracting throughout most Eurozone economies. Here is the PMI for the overall Eurozone:

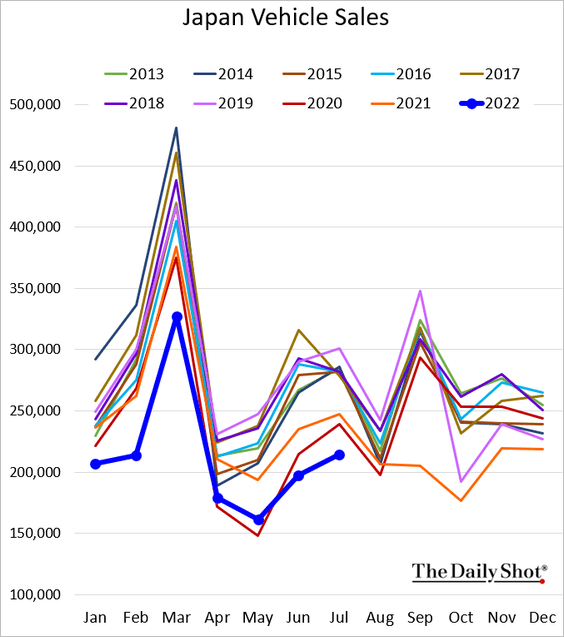

Asia–Pacific: Japan’s vehicle sales are very soft for this time of the year.

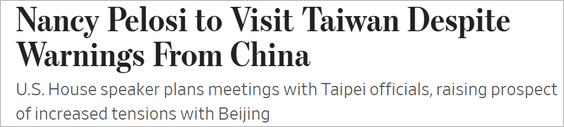

China: China’s threats against Pelosi’s Taiwan visit shifted global sentiment to risk-off. Equity declines accelerated.

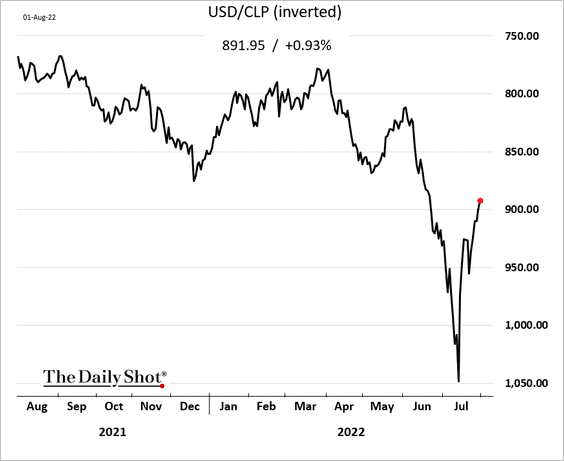

Emerging Markets: The Chilean peso is rebounding supported by the rise in copper prices in July. Copper production remains relatively weak.

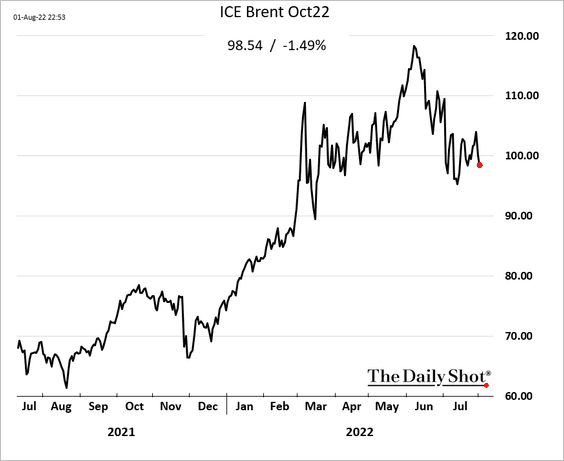

Energy: Brent dipped below $100 again as fears of slowed production given weaker demand heightened.

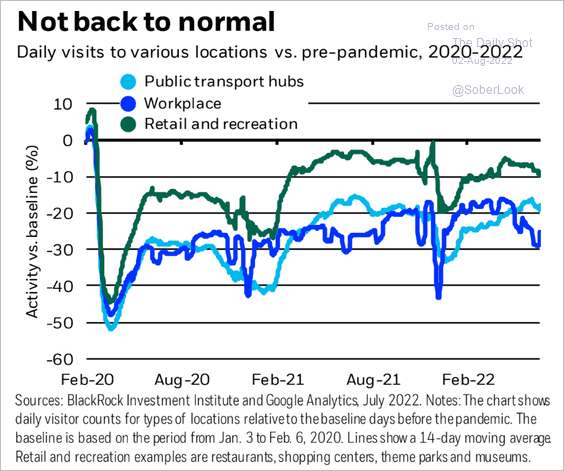

Food for Thought: Lastly, here are daily visits to various locations:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com