Greetings,

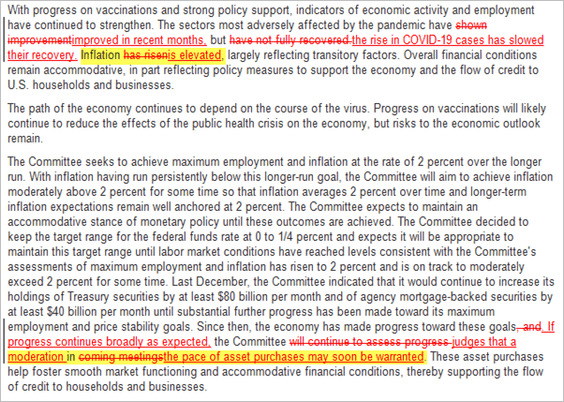

United States: The FOMC acknowledged the recent pandemic-induced economic slowdown but signaled the beginning of taper (probably in November). Moreover, Jerome Powell expects to complete tapering by mid-2022 (some analysts expected the Fed to reduce its purchases more gradually). Here is the September FOMC statement compared to the previous one.

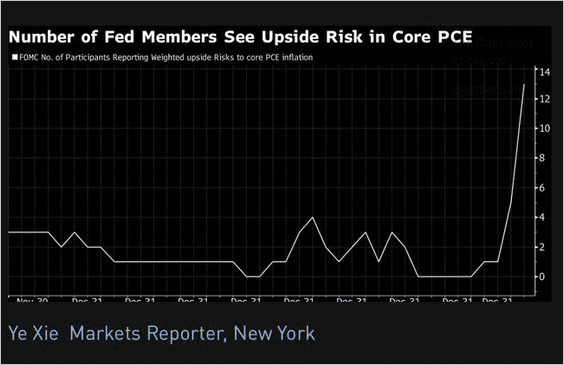

With more Committee members seeing upside risks to inflation, …

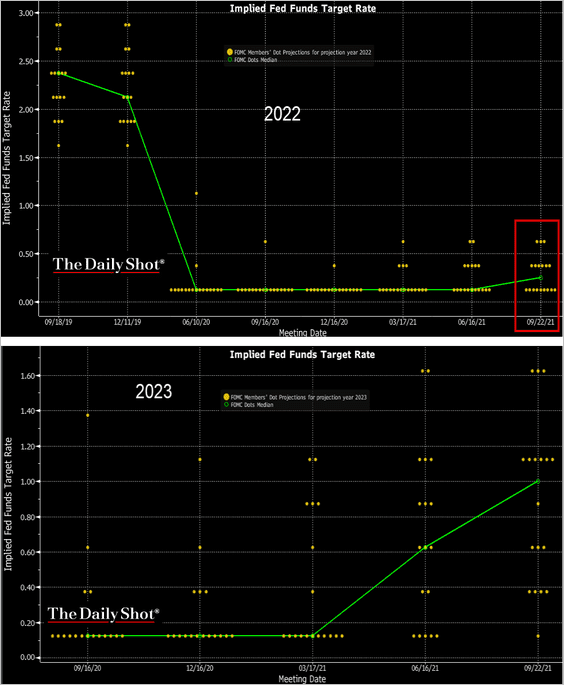

… the dot-plot was more hawkish. Two more FOMC members now expect rate hikes next year.

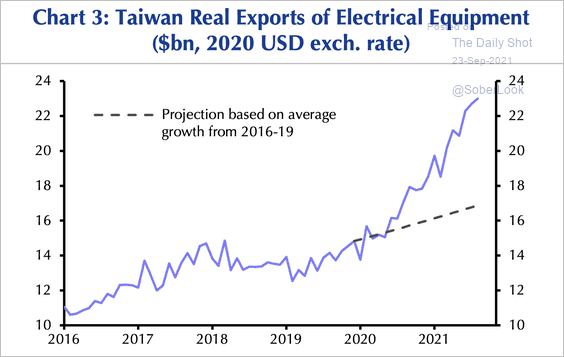

Asia-Pacific: Exports from Taiwan are well above trend, boosted by semiconductor supply shortages.

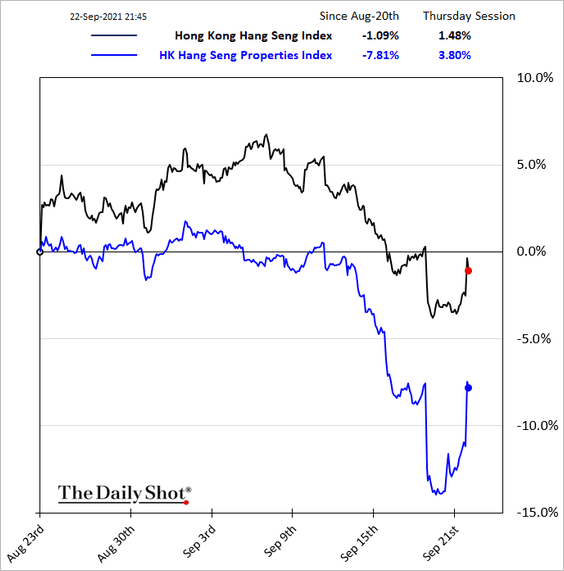

China: Stocks rebounded in Hong Kong, including property shares.

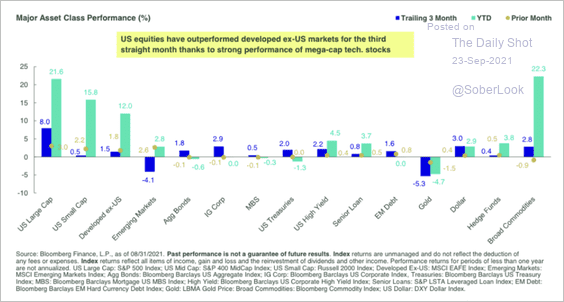

Equities: US equities continue to outperform other major assets this year (except broad commodities), mainly driven by large and mega-cap stocks.

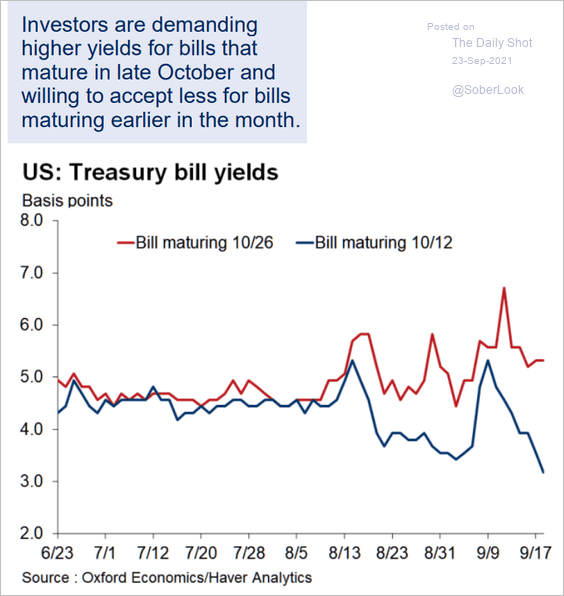

Rates: The US Treasury default risk (the debt ceiling not lifted) is priced into the T-bill market.

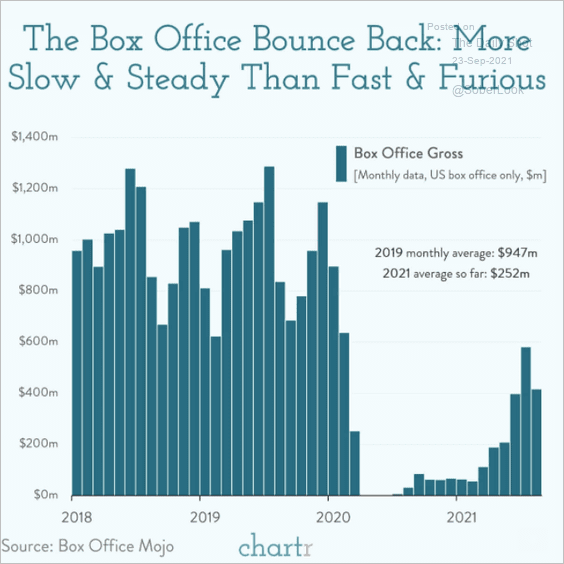

Food for Thought: US box office rebound:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com