Greetings,

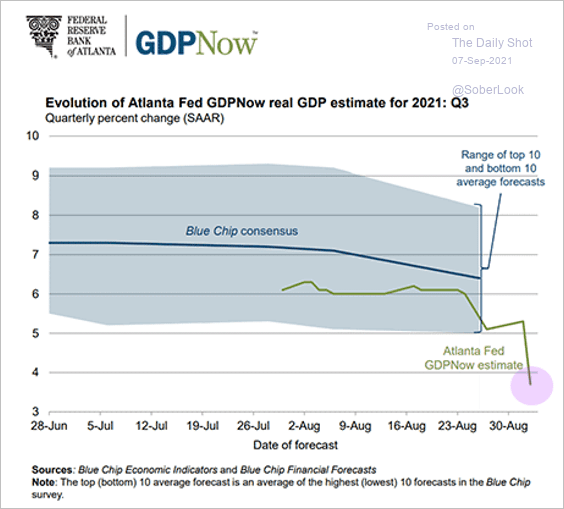

United States: The Atlanta Fed’s GDPNow model forecast for the Q3 GDP growth tumbled after the jobs report.

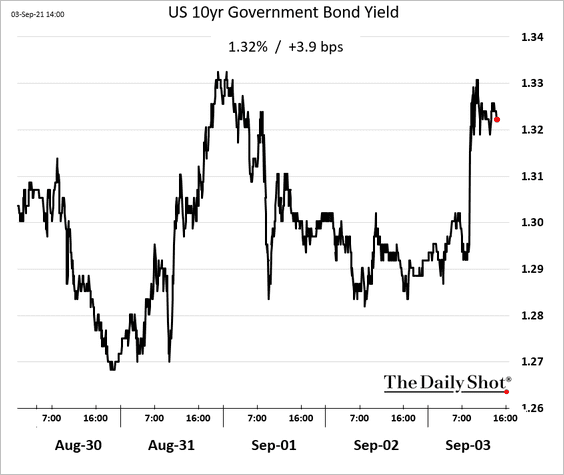

Bond yields jumped, with the market expecting the Fed to let inflation run hotter in response to softer job gains.

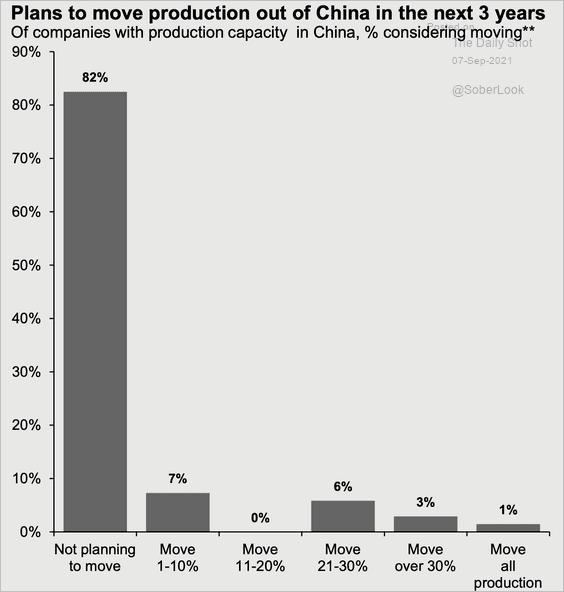

China: Majority of companies polled are not interested in moving production out of China.

Cryptocurrency: El Salvador purchased 200 BTC as it prepares to make the cryptocurrency legal tender.

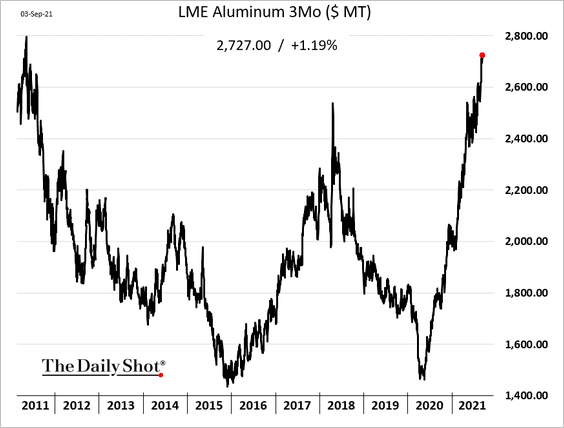

Commodities: Aluminum hit a decade high …

… after the news of a coup in Guinea.

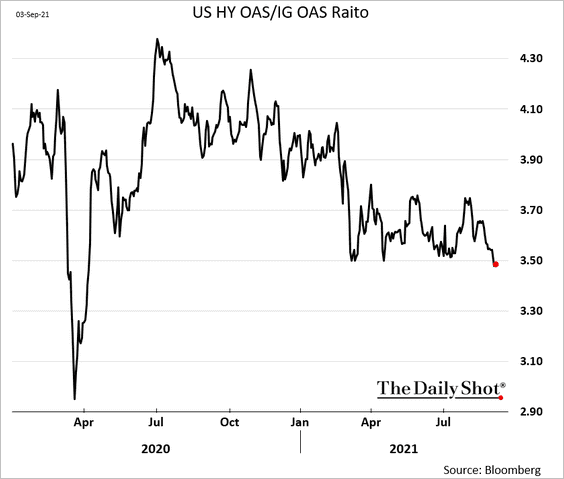

Credit: The ratio of US high-yield to investment-grade spreads continues to drift lower (HY outperforming).

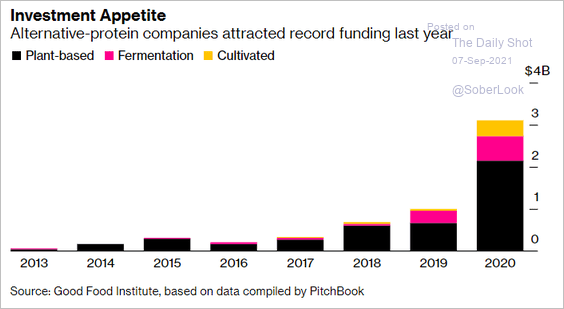

Food for Thought: Investments in alternative-protein companies:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com