Greetings,

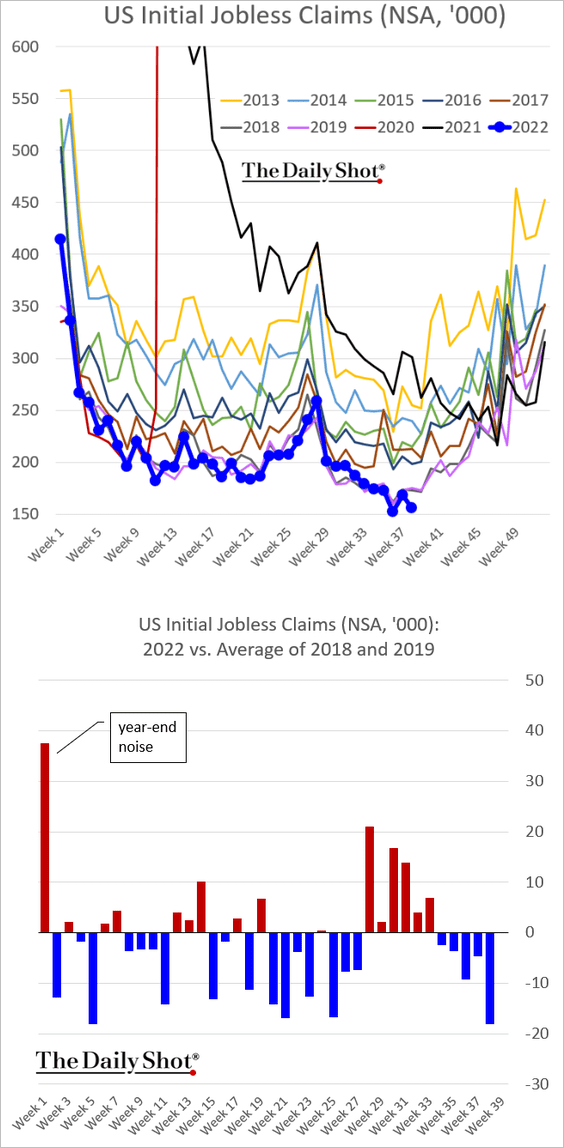

The United States: To begin, initial jobless claims hit another multi-year low, again running significantly below pre-COVID levels (2nd panel). Despite the headwinds, companies are unwilling to lay off employees (for now) given that it’s been so challenging and expensive to hire/retain workers.

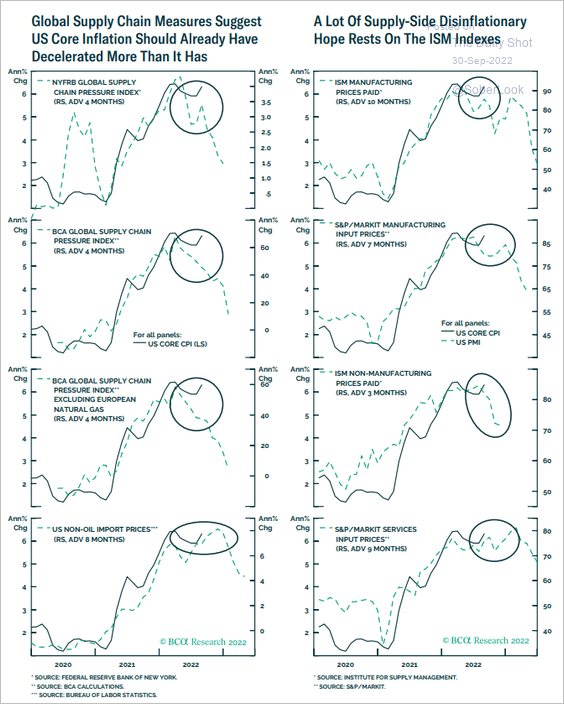

Multiple leading indicators suggest that inflation should be lower.

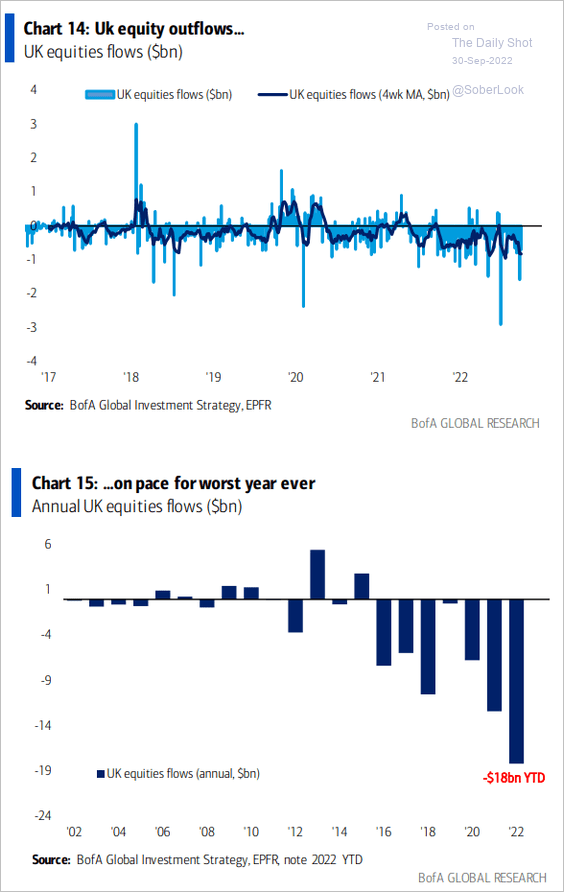

The United Kingdom: UK equity outflows hit a record this year, exacerbated by concerns about the government’s borrowing needs.

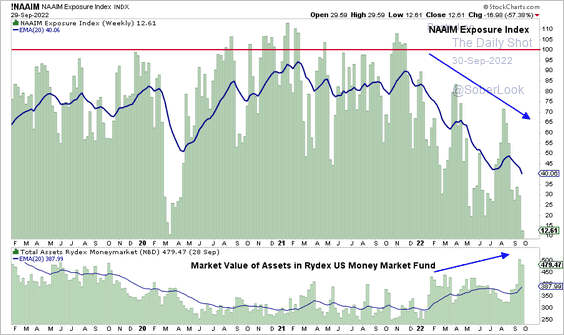

Equities: Managers continue to reduce their exposure to equities while the value of assets in money market funds rises.

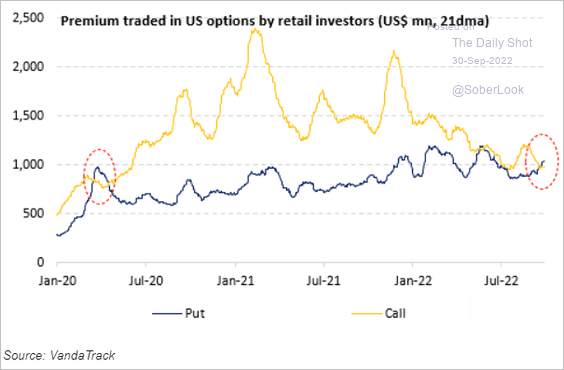

Retail investors’ put options have now exceeded calls, as they did in early 2020.

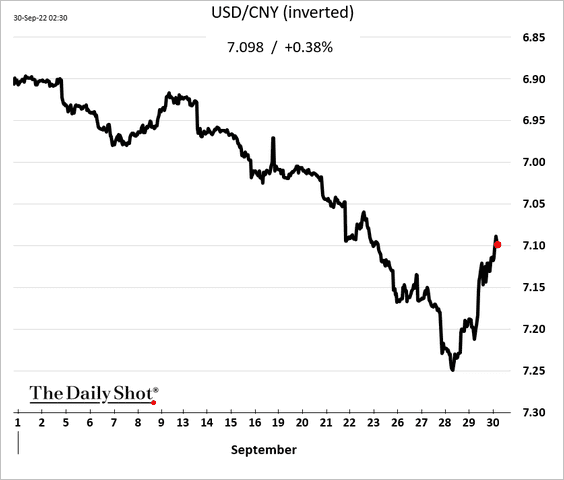

China: The PBoC is getting more aggressive in its attempt to halt the renminbi’s slide. The currency bounced from multi-year lows this week.

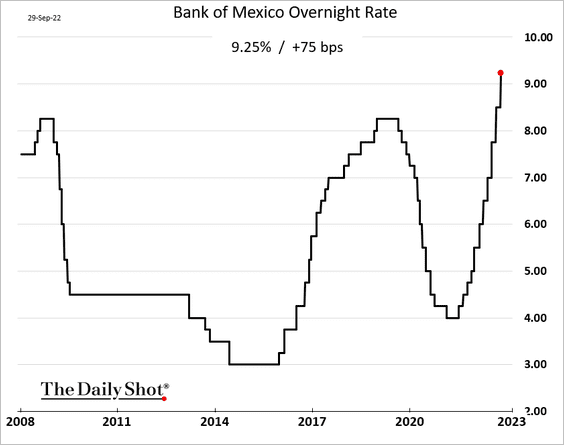

Emerging Markets: Banxico followed the Fed with a 75 bps rate hike..

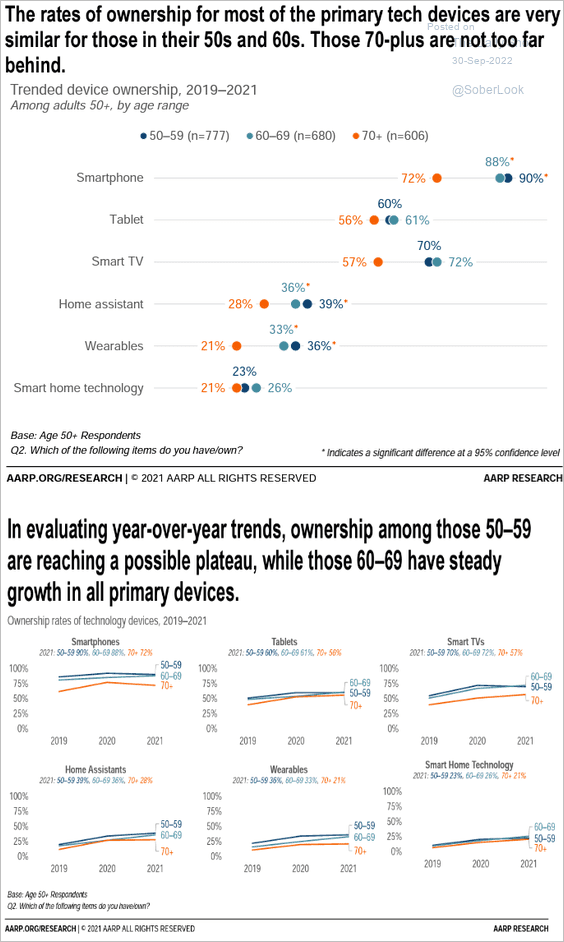

Food for Thought: Lastly, here is the ownership of primary tech devices among older Americans:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com