Greetings,

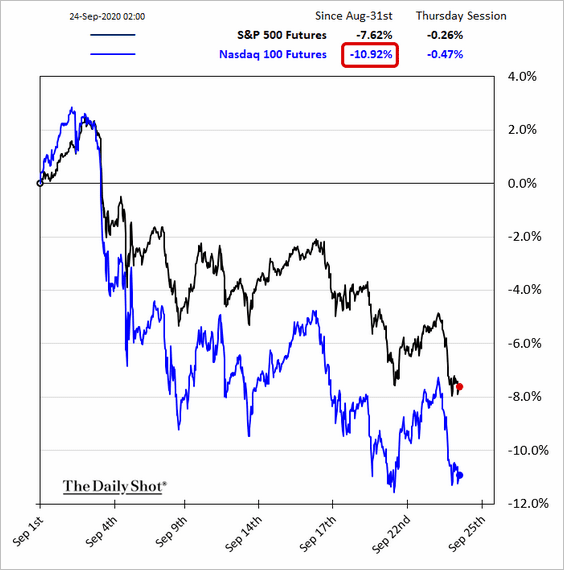

Equities: It’s been a rough month for stocks.

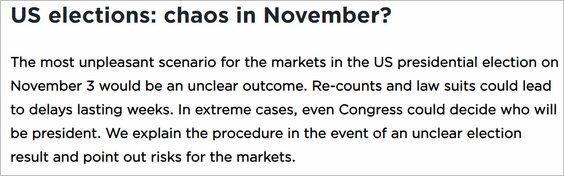

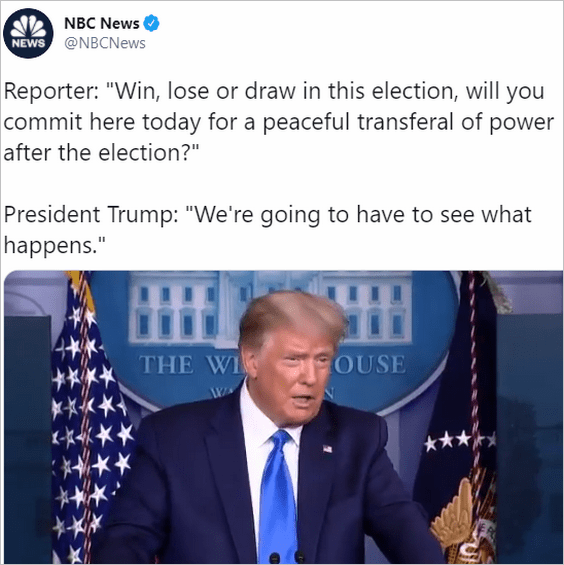

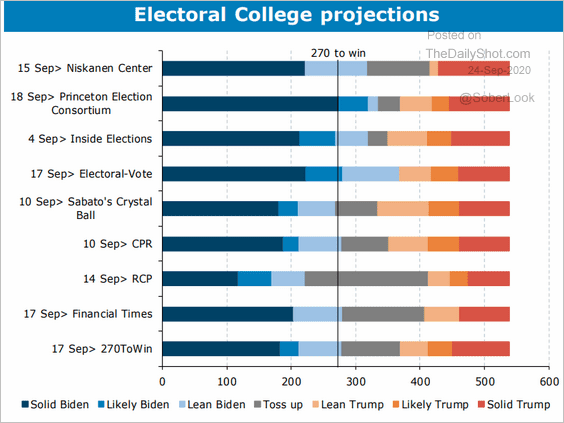

Rising political uncertainty is on the minds of some investors.

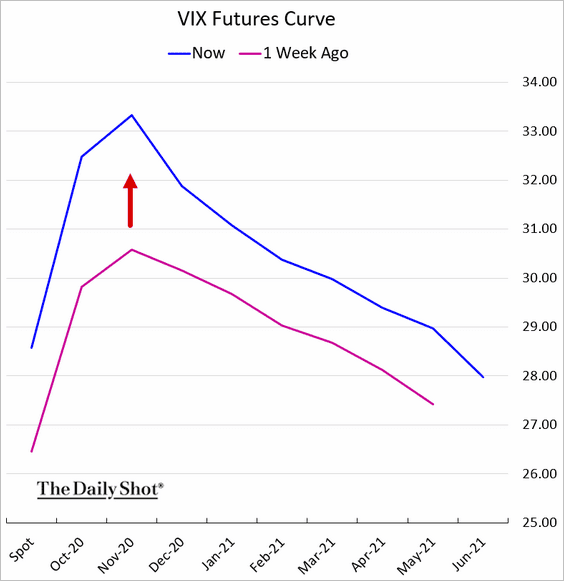

This risk is increasingly being priced into the options markets. Here is the VIX futures curve.

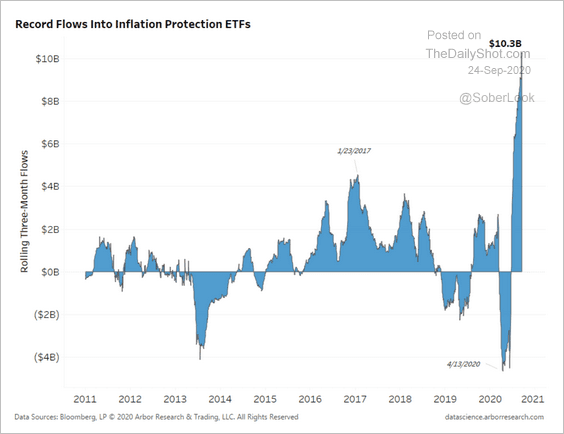

Rates: TIPs continue to see record inflows, amassing $10.3 billion over the past 3 months.

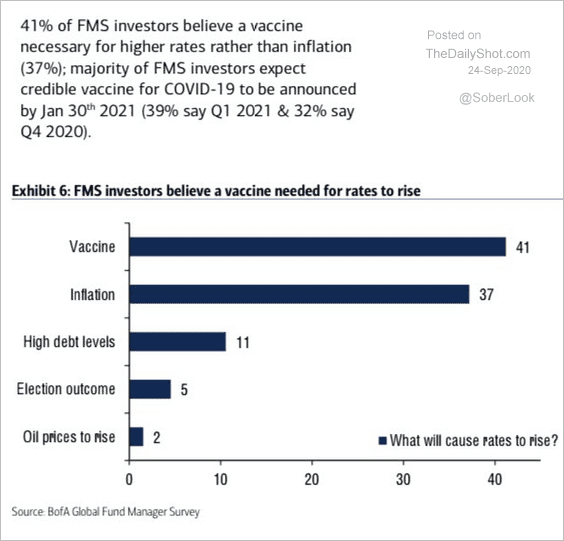

What would it take for rates to rise?

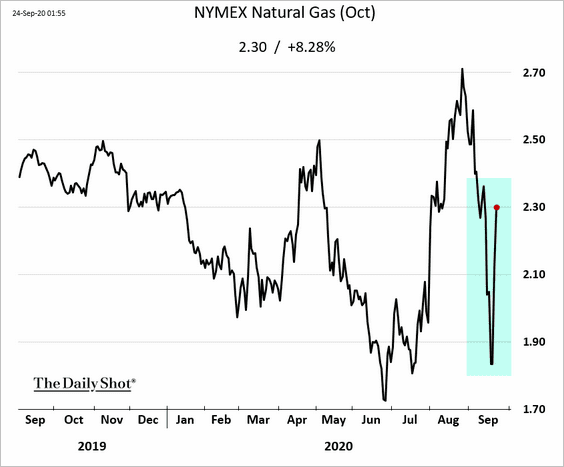

Energy: US natural gas prices came roaring back after the recent collapse and are now up over 25% from the lows.

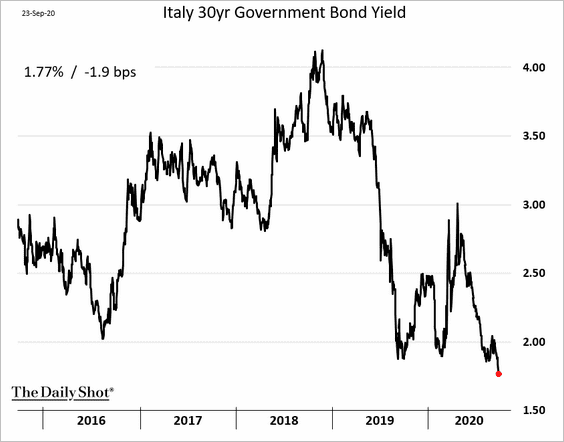

Eurozone: Italy’s 30yr bond yield hit a record low.

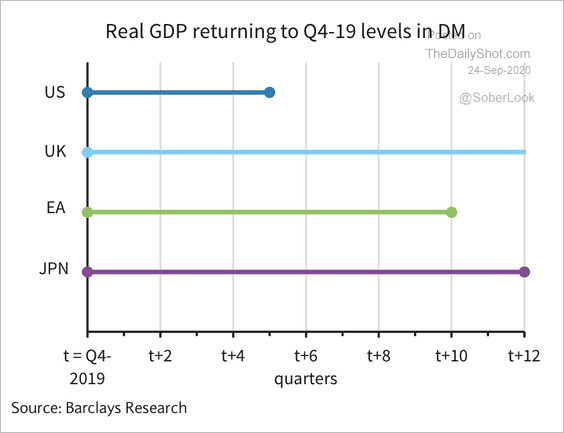

Global Developments: Advanced economies will need some time to fully recover from the global recession, according to Barclays.

Food For Thought: US Electoral College projections:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Dear Friends,

The full-length Daily Shot® is now an independent ad-free publication (see TheDailyShot.com). Here is a sample newsletter.

Daily Shot Brief subscribers are eligible to receive the full-length Daily Shot for $115/year (a $20 discount).

To subscribe with this discount, you must register here (NOTE: The regular subscription page will not acknowledge this coupon). The coupon number is DSB329075 (please click the “apply” button for the discount to take effect).

A monthly subscription is also available (here).

The Food for Thought section is available as a separate newsletter. You can sign up here.

Please note that The Daily Shot is not an investment newsletter and is not intended for broad distribution.

If you have any questions, please contact Lev.Borodovsky@TheDailyShot.com.

Sincerely,

Lev Borodovsky

Editor, The Daily Shot