Greetings,

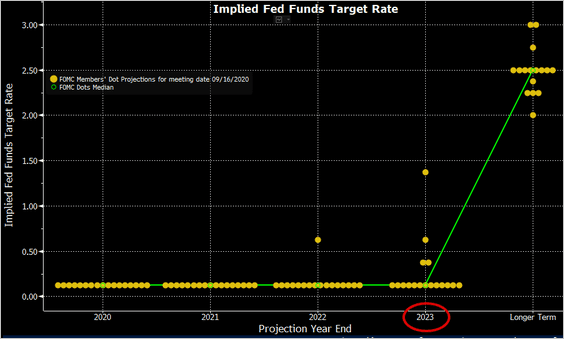

United States: The FOMC now expects rates to stay near zero through 2023. Here is the dot plot.

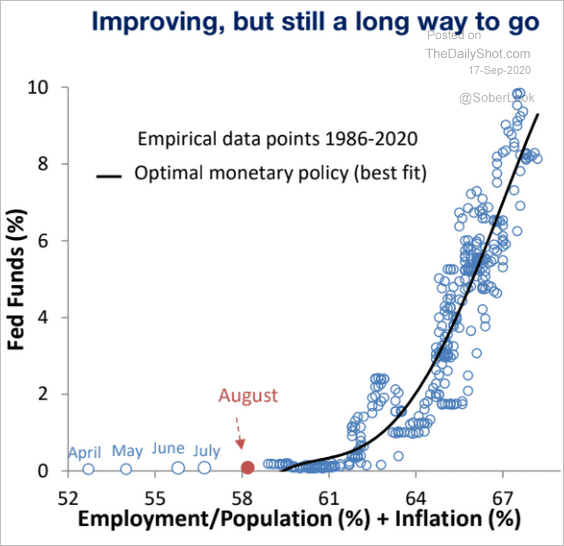

Even without the changes to inflation targeting, historical data suggest that the next rate hike is a long way off.

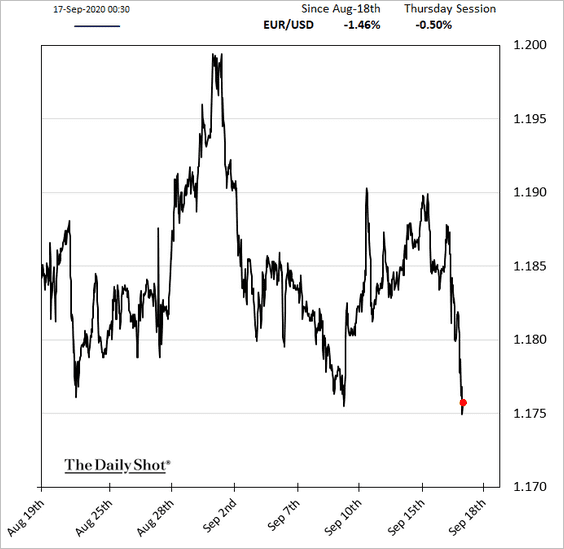

Eurozone: The euro is weaker after the Fed’s decision.

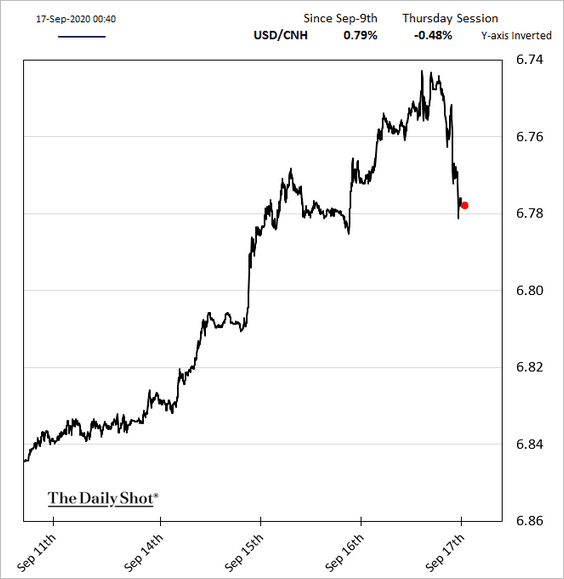

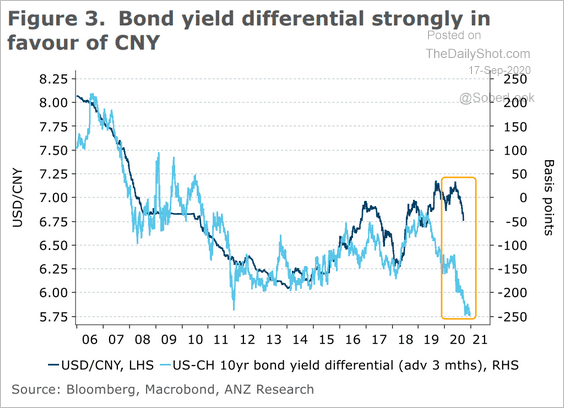

China: The renminbi also weakened vs. USD in response to the Fed’s policy announcement.

However, the bond yield differential with the US points to further strength in China’s currency.

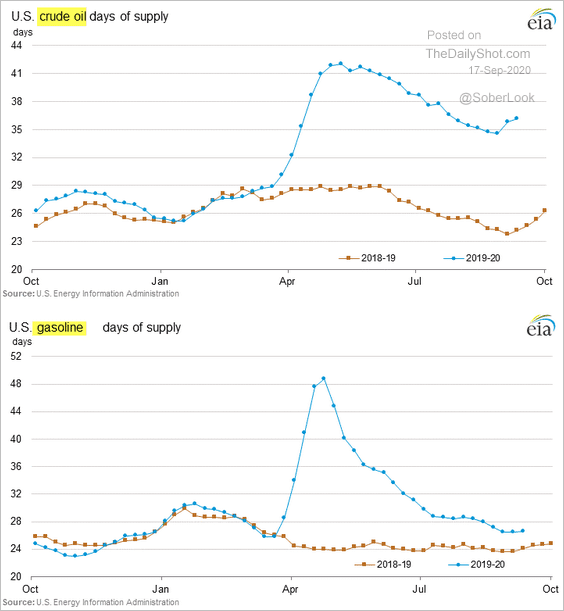

Energy: US crude oil inventories were lower than expected last week, boosting oil prices.

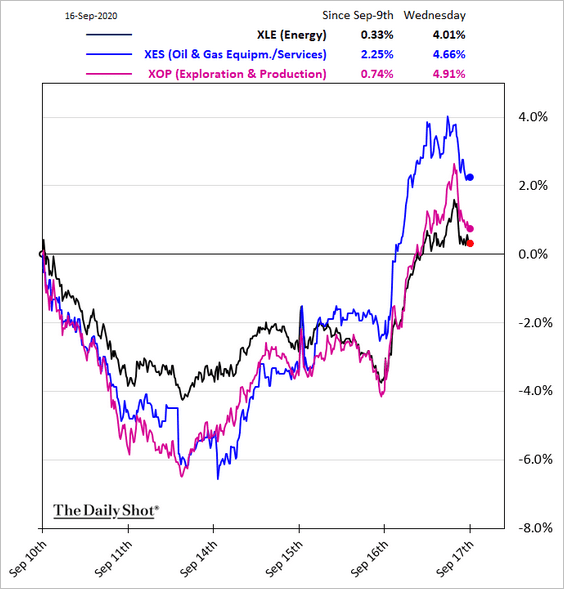

Energy shares outperformed.

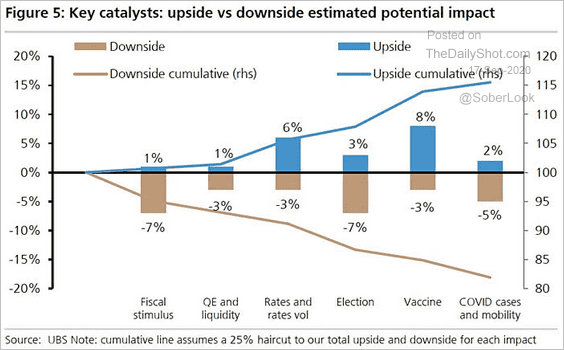

Equities: What are the macro catalysts for US equities going forward?

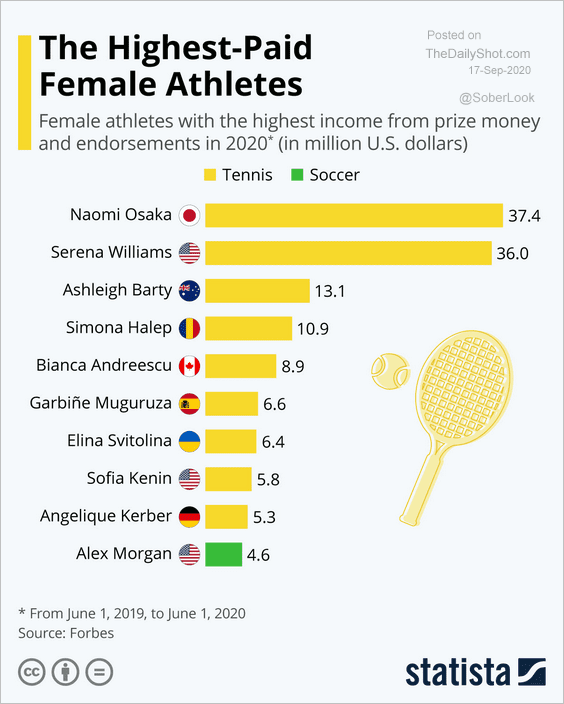

Food For Thought: Highest-paid female athletes:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Dear Friends,

The full-length Daily Shot® is now an independent ad-free publication (see TheDailyShot.com). Here is a sample newsletter.

Daily Shot Brief subscribers are eligible to receive the full-length Daily Shot for $115/year (a $20 discount).

To subscribe with this discount, you must register here (NOTE: The regular subscription page will not acknowledge this coupon). The coupon number is DSB329075 (please click the “apply” button for the discount to take effect).

A monthly subscription is also available (here).

The Food for Thought section is available as a separate newsletter. You can sign up here.

Please note that The Daily Shot is not an investment newsletter and is not intended for broad distribution.

If you have any questions, please contact Lev.Borodovsky@TheDailyShot.com.

Sincerely,

Lev Borodovsky

Editor, The Daily Shot