Greetings,

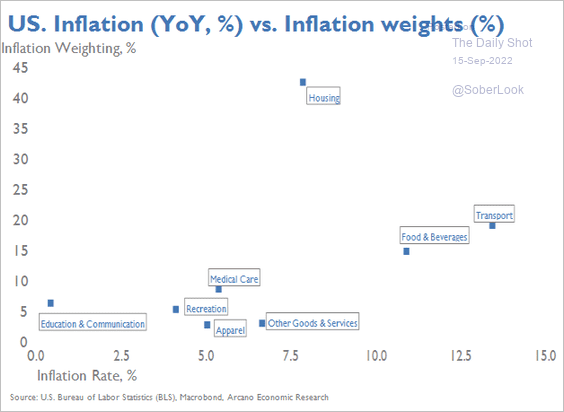

The United States: First, here are the inflation rates and corresponding weights of CPI components.

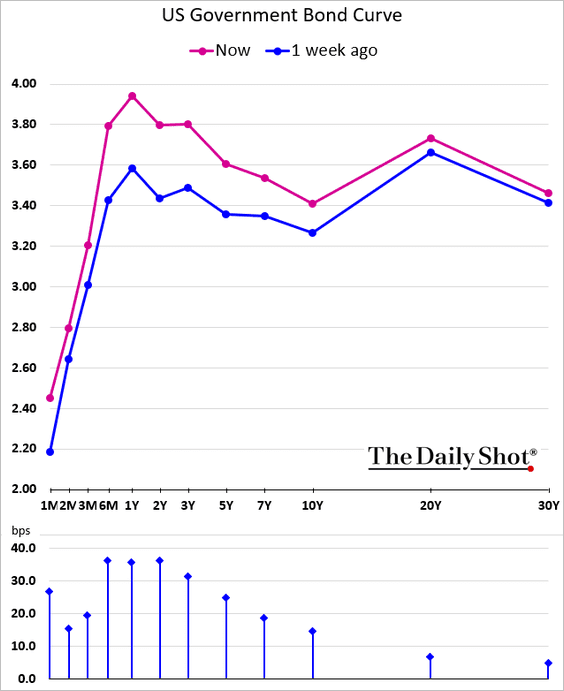

The US Treasury curve is increasingly inverted, which comes as a 75 bps rate hike this month seems very likely.

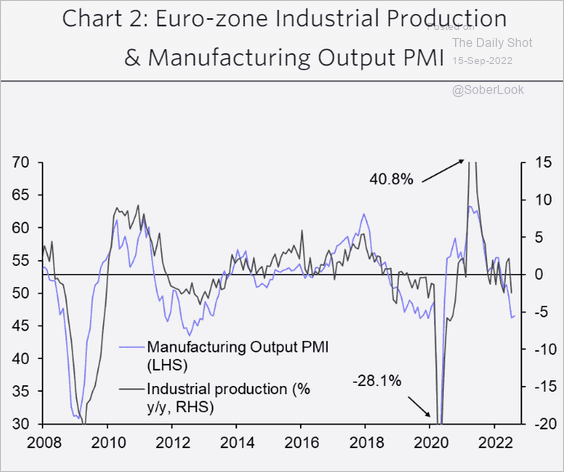

The Eurozone: The PMI index points to downside risks for euro-area industrial production.

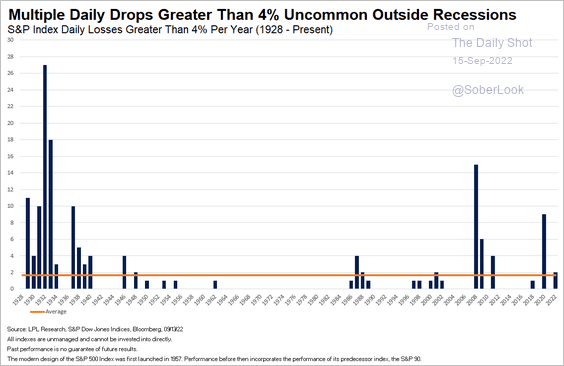

Equities: In equity markets, multiple 4% one-day market declines are not common outside of recessions.

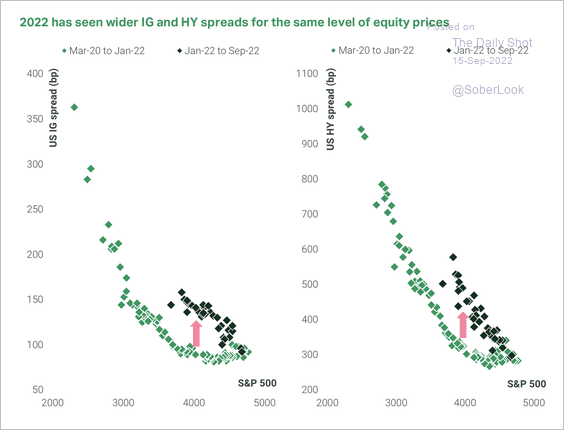

Credit: Credit spreads have been wider this year compared with last year for the same level of equity prices. This suggests investors get more compensation for risk in credit than equities, according to TS Lombard.

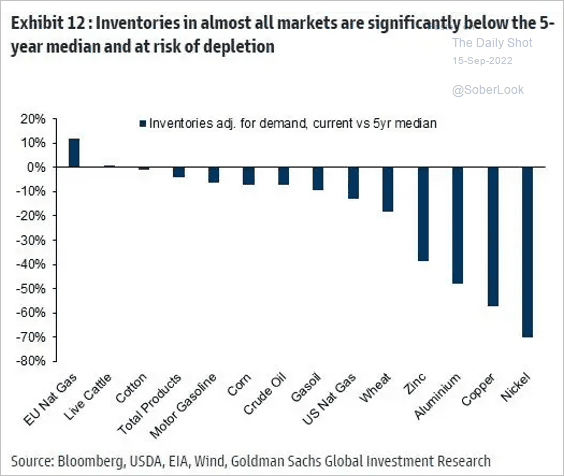

Commodities: Inventories of key commodities are running below 5-year averages.

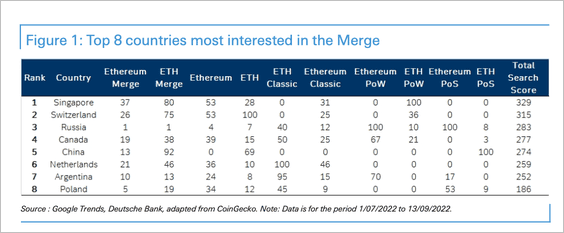

Cryptocurrency: The “Ethereum Merge” (a more efficient network upgrade) is attracting attention around the world.

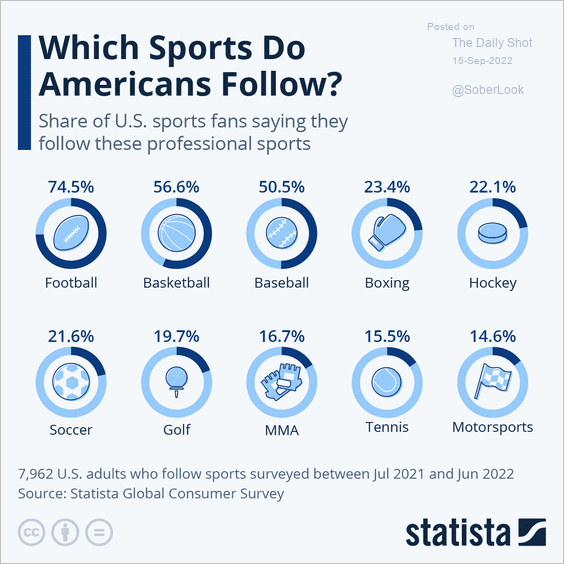

Food for Thought: Lastly, here is the popularity of different sports in the US.

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com