Greetings,

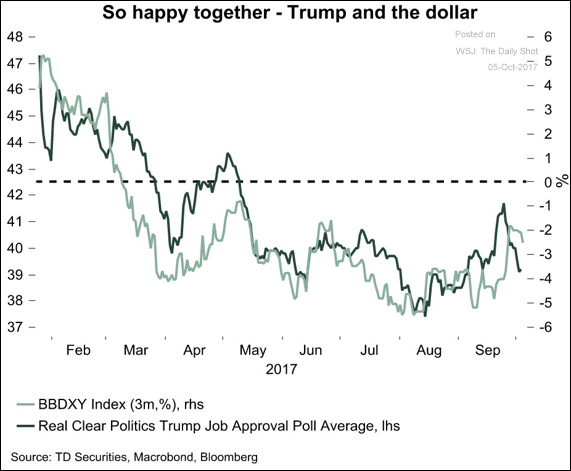

The United States: The dollar and President Trump’s approval ratings have been correlated. Both indicate the level of confidence in the “reflation trade.”

Credit: Corporate investment-grade fund inflows continue (the first chart below is ETPs, the second is mutual funds).

Europe: Elsewhere in Europe, the UK has a massive age gap in national priorities.

Emerging Markets: Brazil’s business activity moves into expansion mode (PMI > 50).

Equity Markets: A small biotech firm changed its name to Riot Blockchain and here is the result (below). Some readers may remember companies adding a “.com” to their name in the 90s.

Energy Markets: NYMEX crude closed below $50 despite what appears to be a bullish report from the Department of Energy. The weekly inventory draw was larger than expected.

And stockpiles remain below last year’s level.

Food for Thought: People in Latin America score highly on the self-reported life satisfaction index (relative to their country’s GDP per capita).

Edited by Paul Menestrier

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com