Greetings,

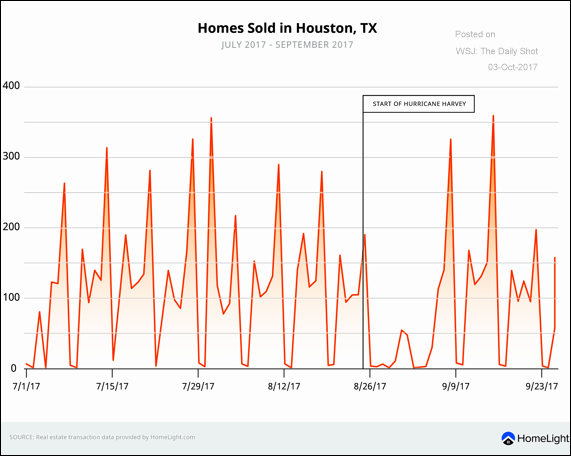

The United States: Houston home sales seem to have recovered much quicker than those in New Orleans after Katrina.

Credit: Here is a summary of the September performance for major asset classes. The spread compression really stands out (“LOAS” = option-adjusted spread to LIBOR).

The United Kingdom: Theresa May wants to “have her cake and eat it too.” No other country currently has the arrangements with the EU that the UK wants to have.

Emerging Markets: Which currencies are undervalued and also can be a lucrative carry trade?

The Eurozone: Germany’s manufacturing activity is expanding at the fastest rate since 2011.

Equity Markets: Stocks have been highly correlated with Treasury yields recently.

Food for Thought: What’s higher education worth? Depends on the country.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com