Greetings,

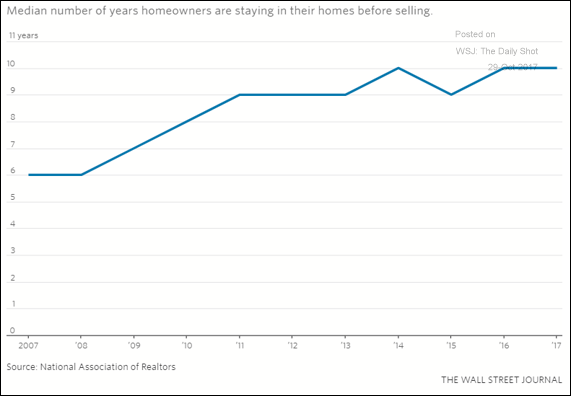

The United States: Americans have been staying in their homes longer (before deciding to sell).

Moody’s is projecting that many more homes will be sold next year as homeowners finally make their move.

The forecast of over 700k more units sold, however, contradicts other assessments.

The Eurozone: Based on the ECB’s announcement last week, here are the central bank’s securities purchases projected into 2019.

The ECB’s securities holdings will keep climbing, albeit at a slower rate.

Emerging Markets: Venezuela said that it made the principal payment on the amortizing debt on Friday. Investors were worried that the government wouldn’t be able to meet its obligations. Bond yields dipped on the news, but more such lumpy payments are coming up soon.

Equity Markets: Jamie Dimon made some good calls buying JPMorgan stock for his personal account.

Global Developments: Here is the Fed’s, the ECB’s, and the BoJ’s balance sheets as a percentage of each economy’s GDP.

Food for Thought: Since we are talking about Spain and Catalonia, here is a map of Europe in 1470. Catalonia was part of Aragon.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com