Greetings,

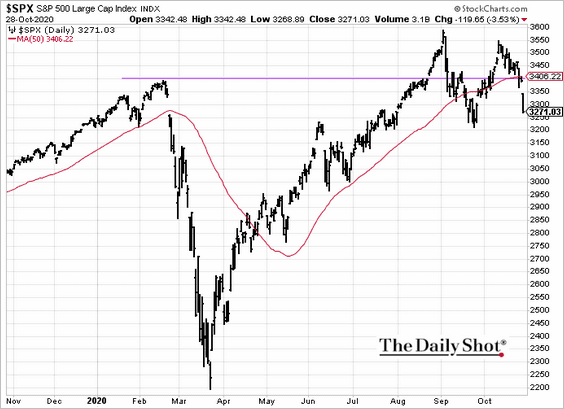

Equities: Stocks sold off sharply on Wednesday, with the S&P 500 giving up some 3.5%. Once we broke below 3400, the selloff intensified.

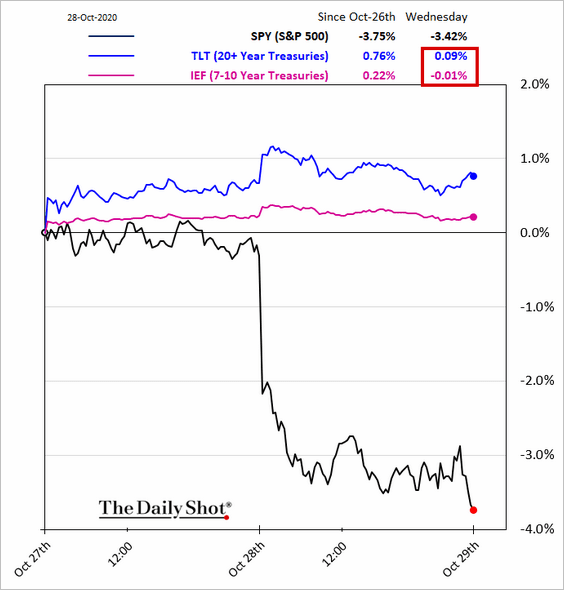

Traditional risk mitigation/hedging strategies weren’t very effective on Wednesday for US investors. Treasuries didn’t budge:

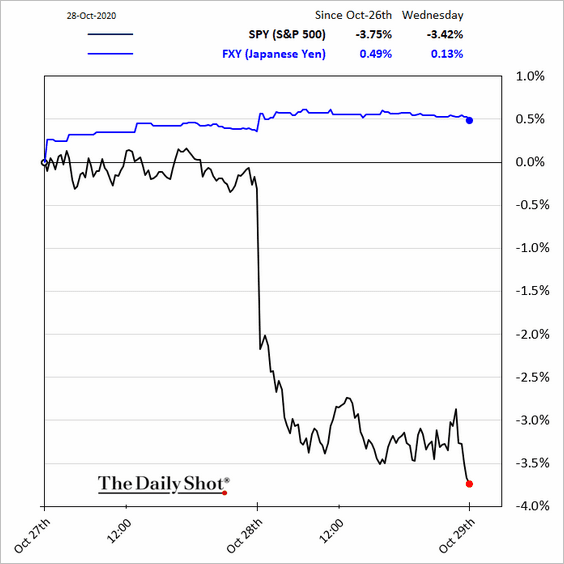

Neither did the Japanese yen:

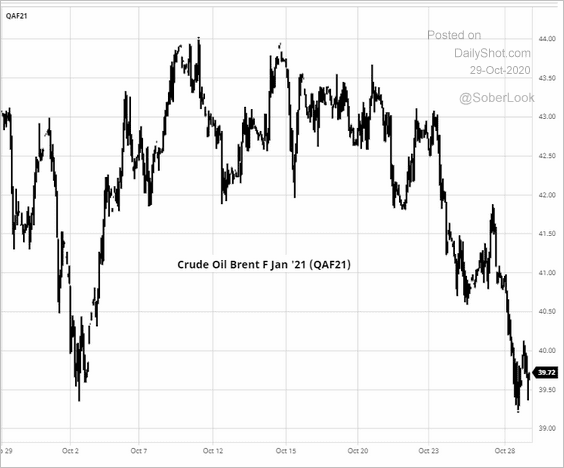

Energy: The January Brent contract is trading below $40/bbl.

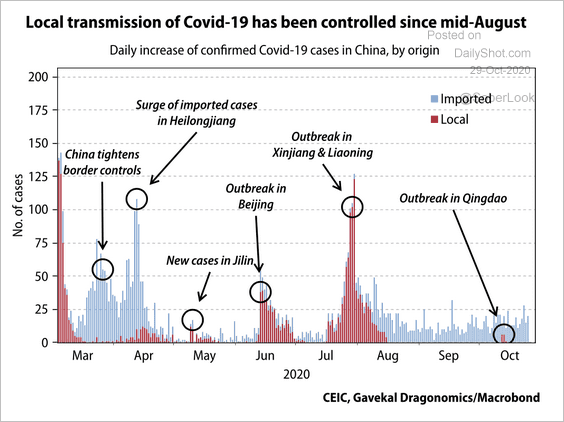

China: Most new COVID cases in China have been imported (assuming we can trust the data).

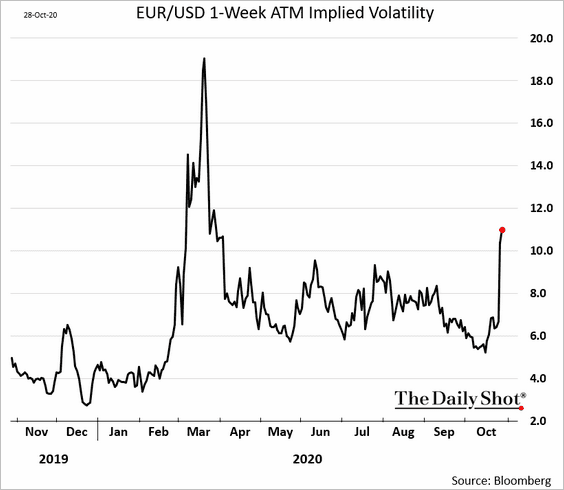

Eurozone: Euro short-term implied volatility is up ahead of the US election.

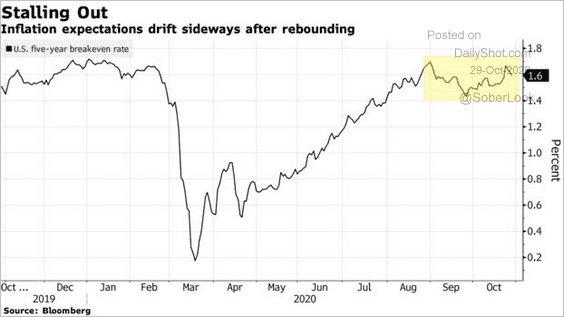

United States: Market-based inflation expectations have leveled off.

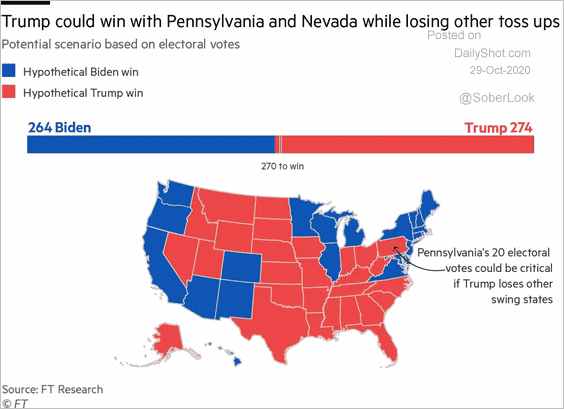

Food For Thought: The pivotal role of Pennsylvania in the presidential election:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Dear Friends,

The full-length Daily Shot® is now an independent ad-free publication (see TheDailyShot.com). Here is a sample newsletter.

Daily Shot Brief subscribers are eligible to receive the full-length Daily Shot for $115/year (a $20 discount).

To subscribe with this discount, you must register here (NOTE: The regular subscription page will not acknowledge this coupon). The coupon number is DSB329075 (please click the “apply” button for the discount to take effect).

A monthly subscription is also available (here).

The Food for Thought section is available as a separate newsletter. You can sign up here.

Please note that The Daily Shot is not an investment newsletter and is not intended for broad distribution.

If you have any questions, please contact Lev.Borodovsky@TheDailyShot.com.

Sincerely,

Lev Borodovsky

Editor, The Daily Shot