Greetings,

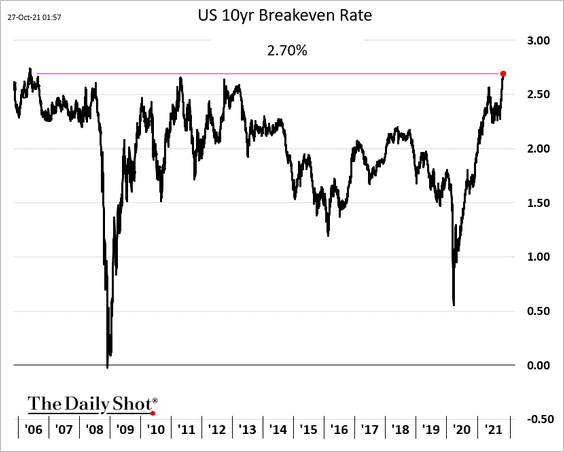

United States: Market-based inflation expectations are climbing. The 10yr breakeven rate reached 2.7% for the first time since 2006.

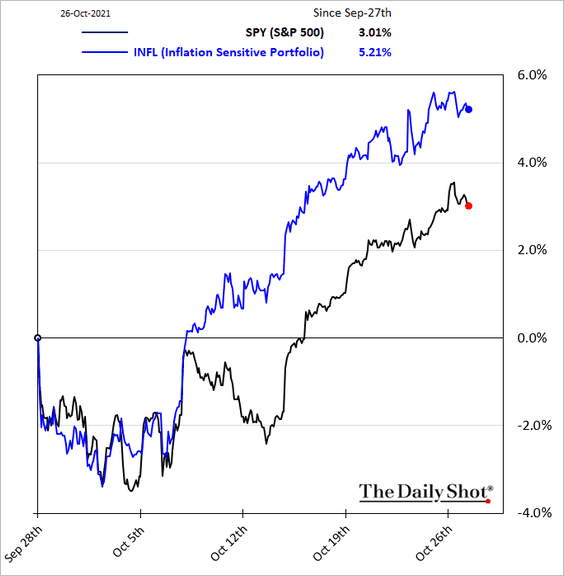

The stock market is also betting on higher inflation. The Horizon Kinetics Inflation Beneficiaries ETF has been outperforming.

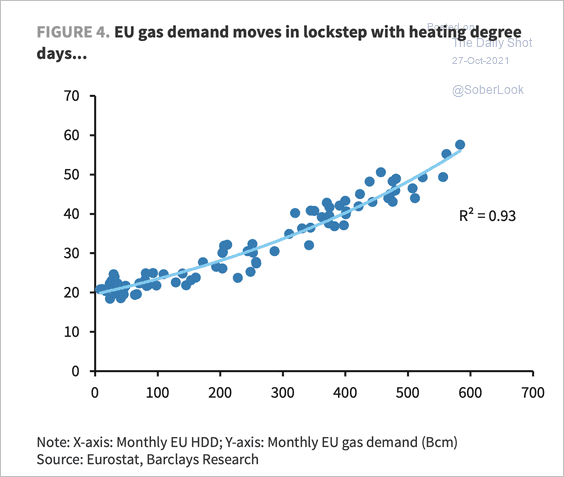

Europe: EU gas demand depends mainly on the weather. The current supply situation, according to Barclays, suggests that even a mild winter will lead to continued high gas prices.

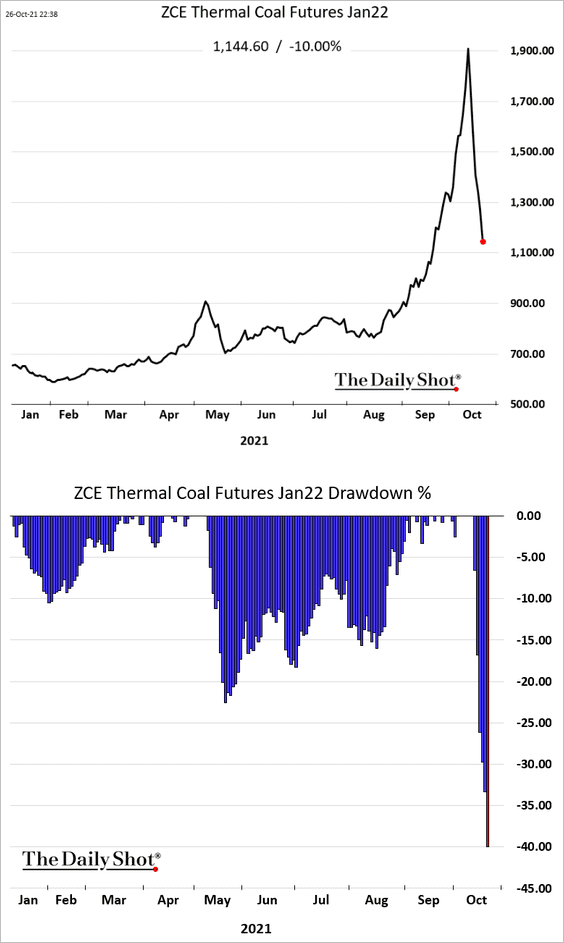

China: Thermal coal prices are down 40% from the highs.

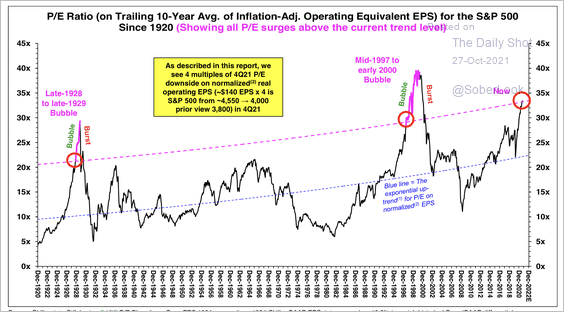

Equity: Many analysts continue to warn that equity valuations are nearing bubble territory.

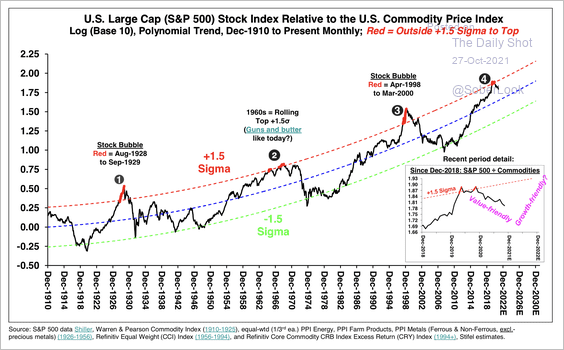

Stocks also appear stretched relative to commodities, which typically favors value over growth sectors.

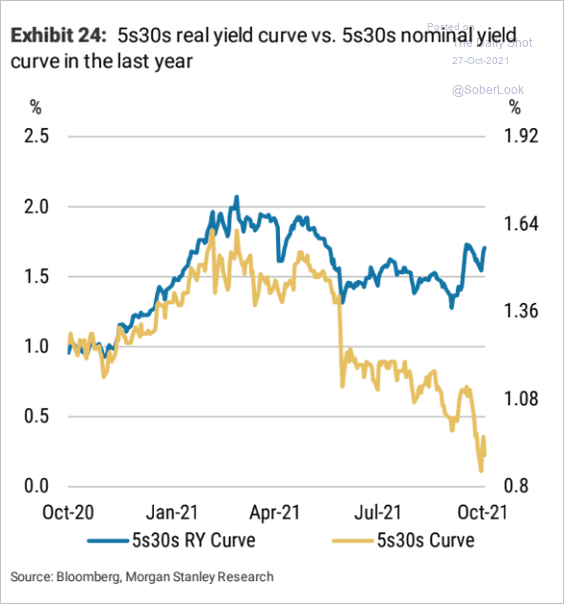

Rates: The nominal yield curve has been flattening. That hasn’t been the case with the real curve.

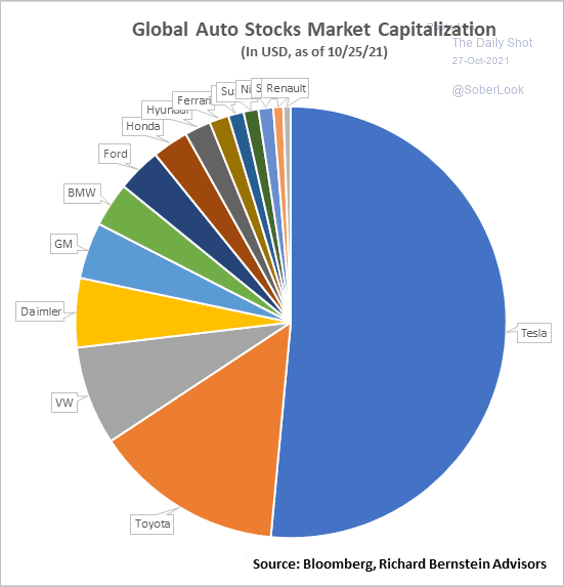

Food for Thought: Market capitalization of global automakers:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com