Greetings,

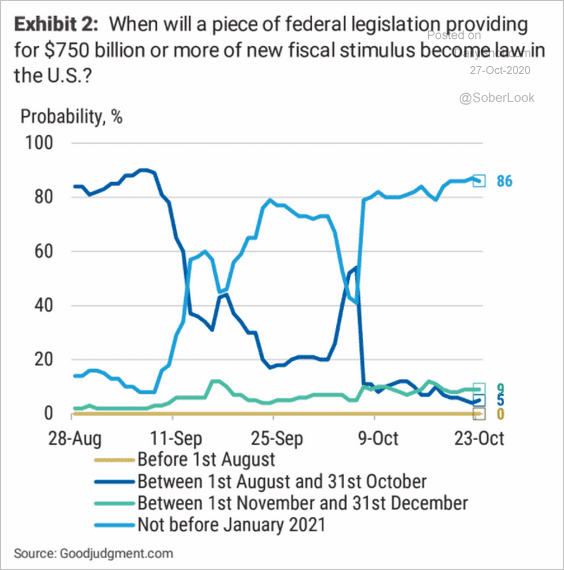

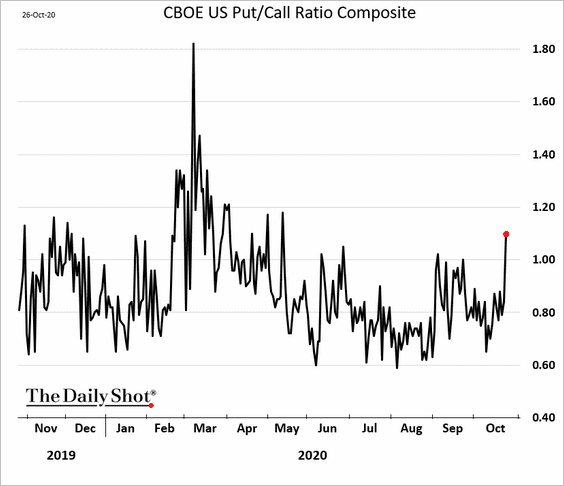

Equities: Stocks sold off on Monday amid rising COVID threat and stimulus uncertainty. Forecasters now don’t expect to see stimulus legislation before next year.

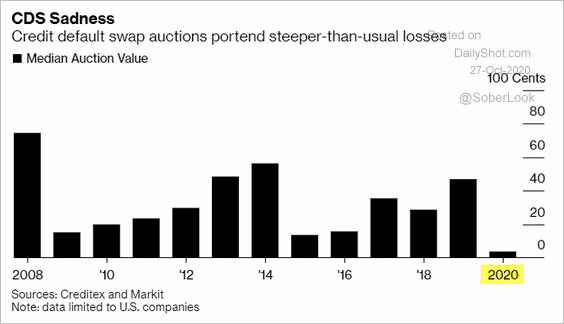

Credit: CDS auction recoveries (defaulted debt) have been extremely low this year, dominated by leveraged retailers with broken business models. Cov-lite debt structures exacerbated the losses.

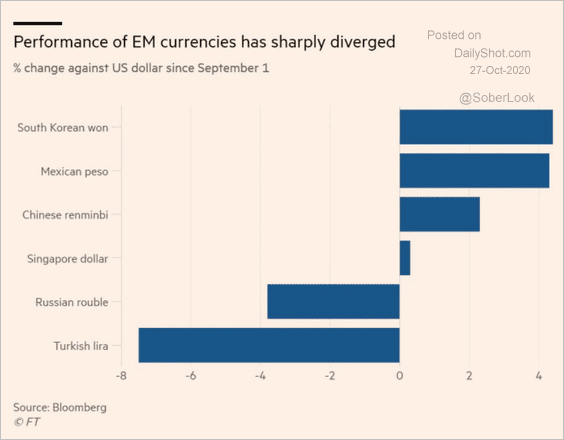

Emerging Markets: Expectations of a Biden win in the US are showing up in the currency markets.

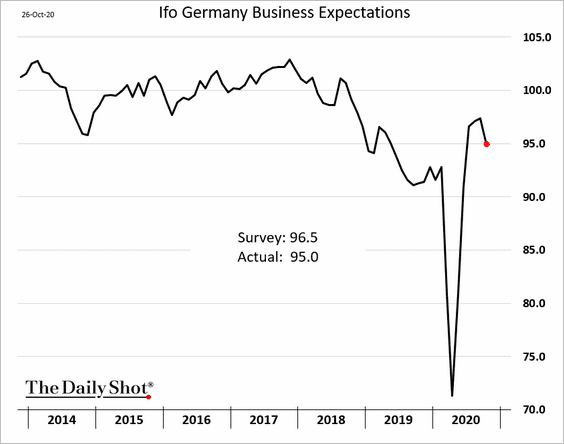

Eurozone: Germany’s Ifo business expectations index was weaker than expected.

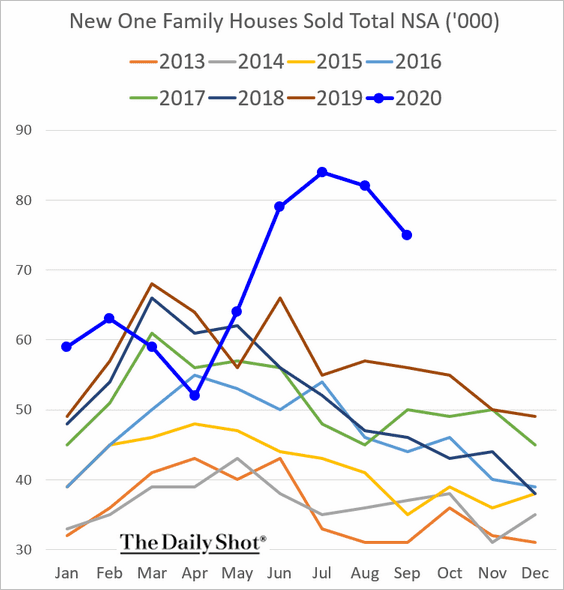

United States: New home sales were below market expectations along with new home inventories remaining depressed.

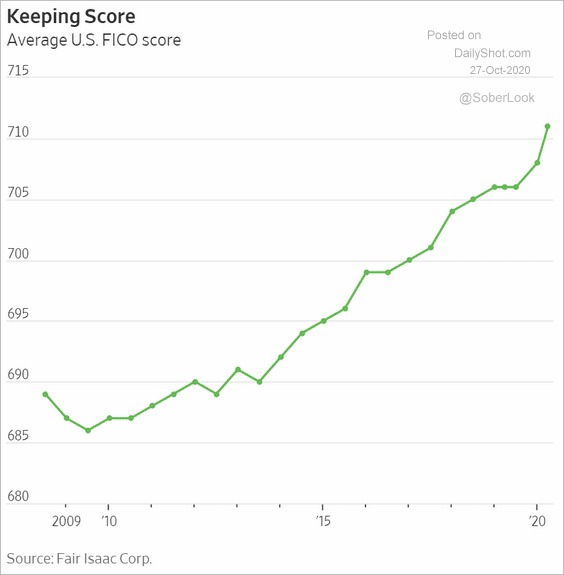

Food For Thought: Credit score inflation:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Dear Friends,

The full-length Daily Shot® is now an independent ad-free publication (see TheDailyShot.com). Here is a sample newsletter.

Daily Shot Brief subscribers are eligible to receive the full-length Daily Shot for $115/year (a $20 discount).

To subscribe with this discount, you must register here (NOTE: The regular subscription page will not acknowledge this coupon). The coupon number is DSB329075 (please click the “apply” button for the discount to take effect).

A monthly subscription is also available (here).

The Food for Thought section is available as a separate newsletter. You can sign up here.

Please note that The Daily Shot is not an investment newsletter and is not intended for broad distribution.

If you have any questions, please contact Lev.Borodovsky@TheDailyShot.com.

Sincerely,

Lev Borodovsky

Editor, The Daily Shot