Greetings,

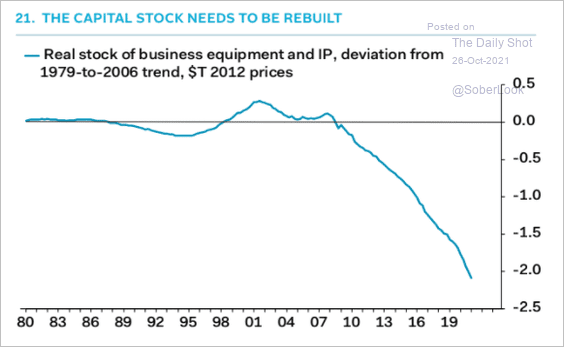

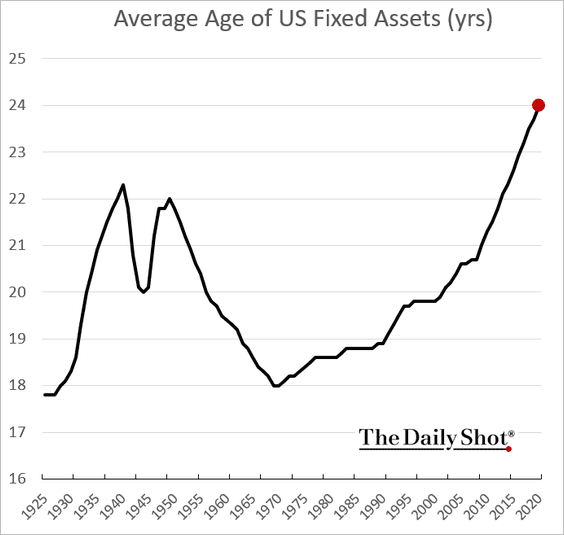

United States: The nation’s capital expenditures have been relatively slow since the pre-financial-crisis trend.

US fixed assets are rapidly aging. Combined with labor shortages, these trends point to robust business investment ahead.

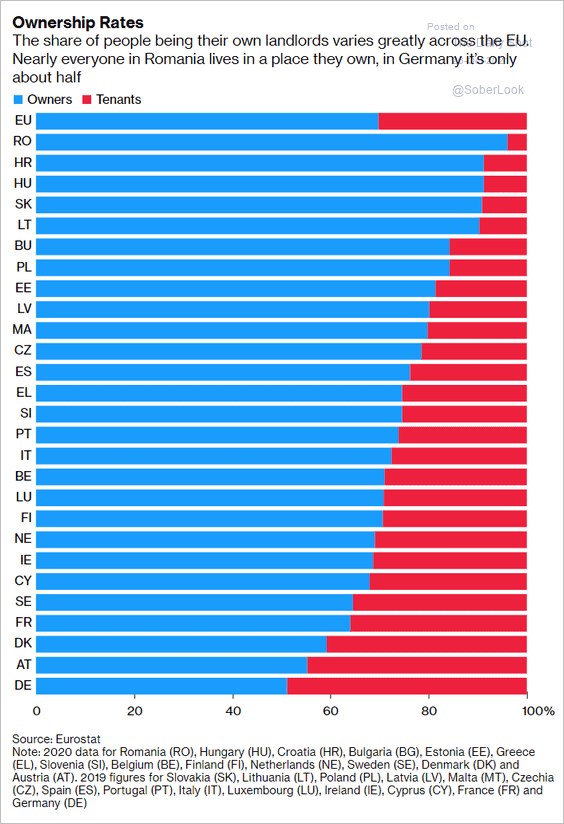

Europe: This chart shows homeownership rates in the EU.

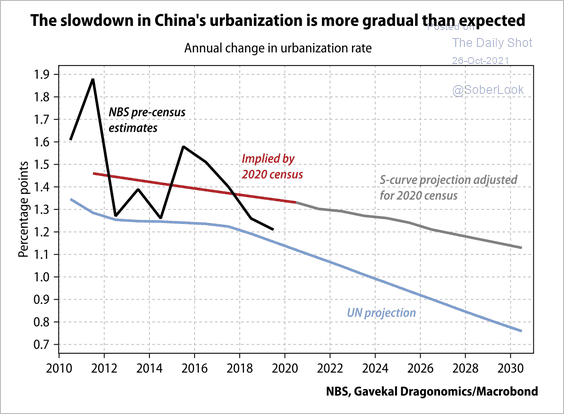

China: China’s urbanization rate is increasing but at a slowing pace. The latest census data found that the urban population was higher than previously estimated, suggesting this pace is more gradual.

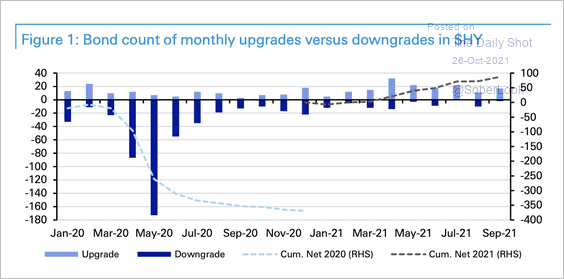

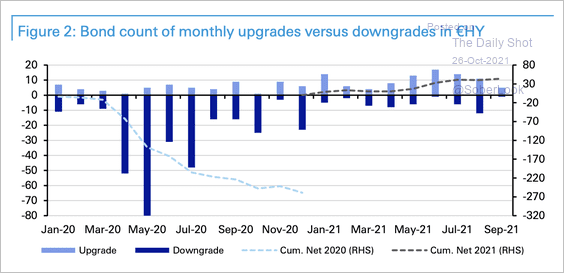

Credit: US and European high-yield upgrades have outnumbered downgrades this year (2 charts).

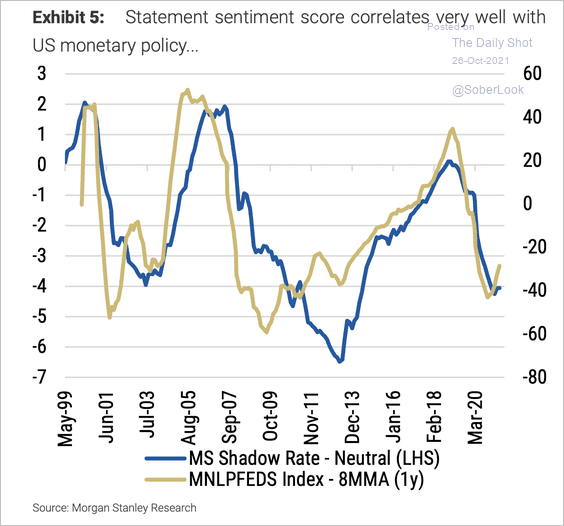

Rates: Morgan Stanley used machine learning to parse Fed statements and compile a composite score that correlates very well with monetary policy with a one-year lead.

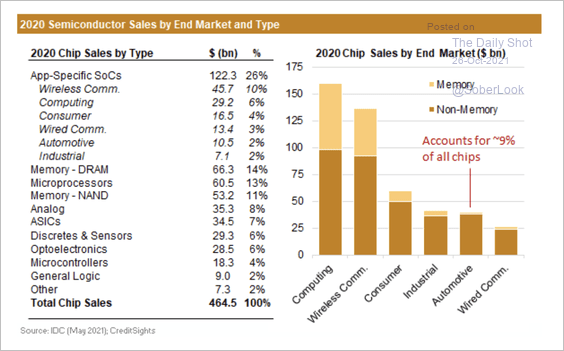

Food for Thought: Semiconductor sales by end market type:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com