Greetings,

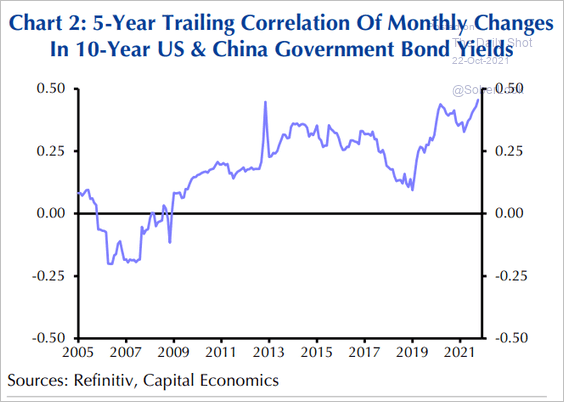

China: Long-term correlation between China’s government bonds and Treasuries has been climbing since the financial crisis.

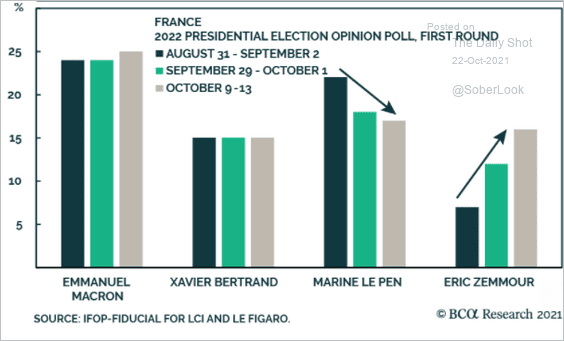

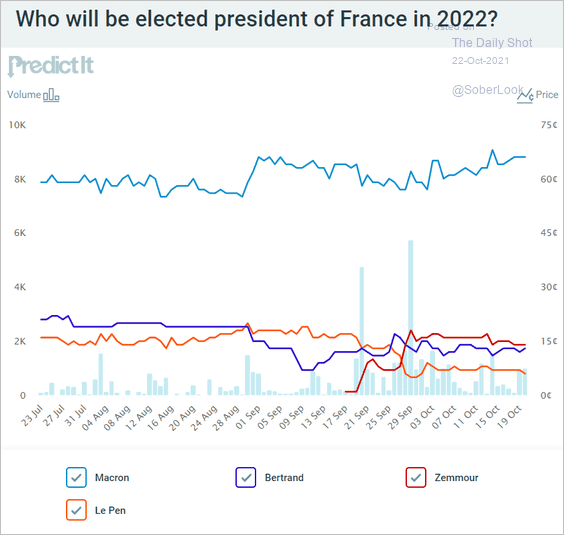

Eurozone: What are the polls and the betting markets telling us about the French presidential election?

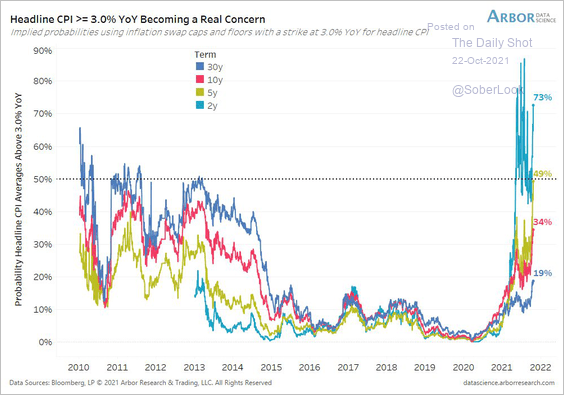

United States: Options markets are pricing in a higher probability of inflation exceeding 3% over a longer period.

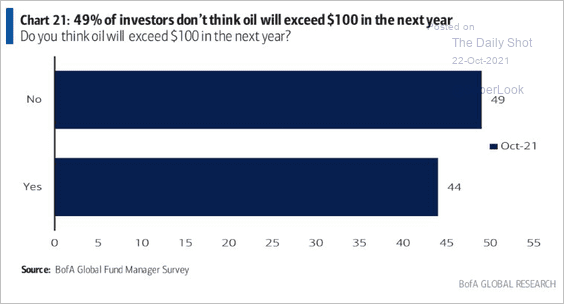

Energy: $100/bbl oil next year?

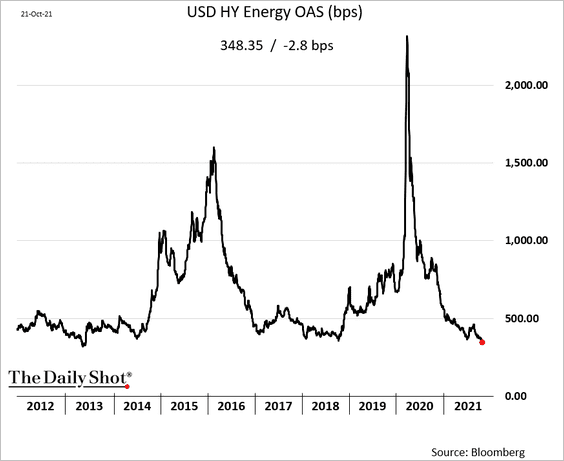

Credit: HY energy sector bond spreads tightened to the lowest level since 2013 as energy prices surge.

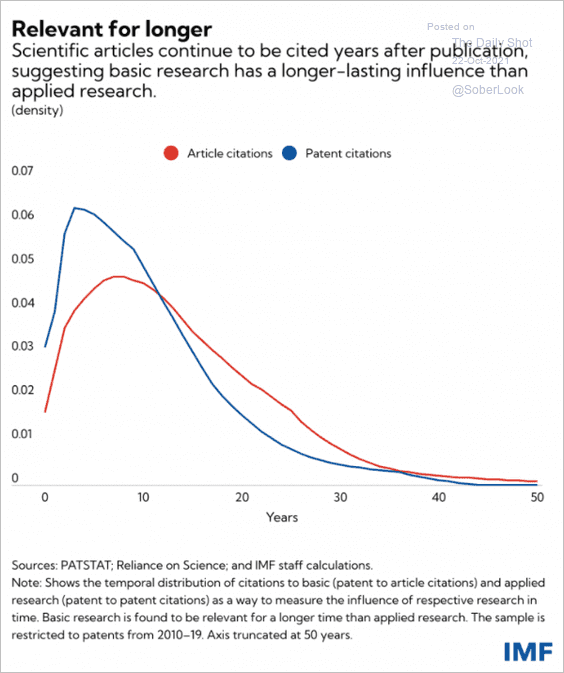

Food for Thought: Citations of patents vs. research publications:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

If you would like to subscribe to the full-length Daily Shot (see example), please register here.