Greetings,

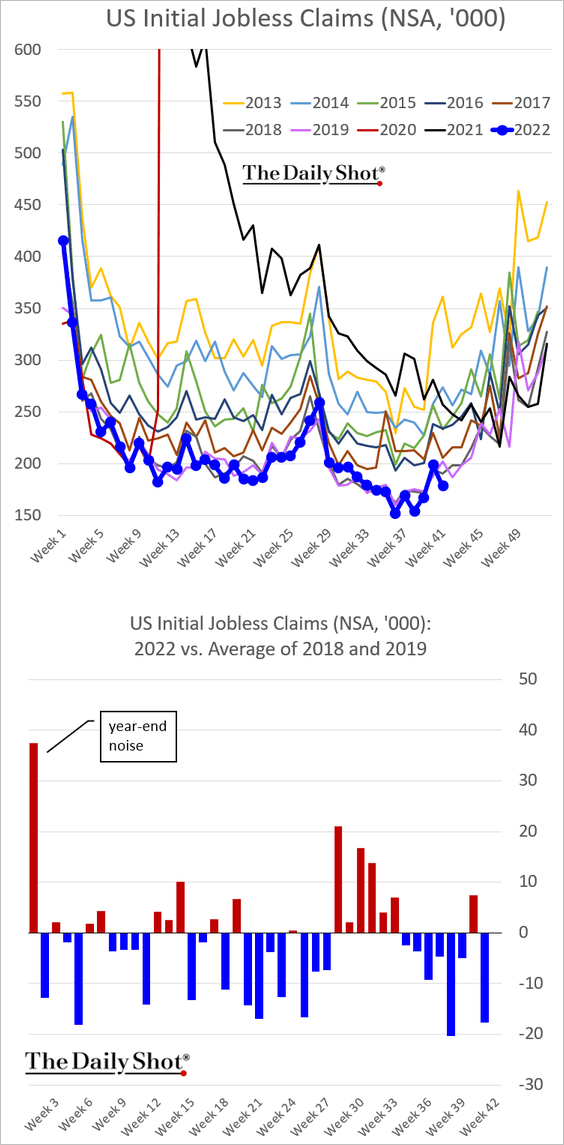

The United States: Initial jobless claims are back at multi-year lows, pointing to persistent strength in the labor market.

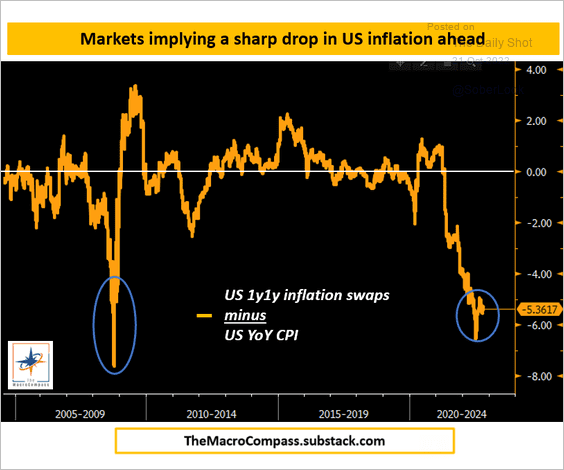

Also, the market expects a sharp decline in inflation over the next couple of years.

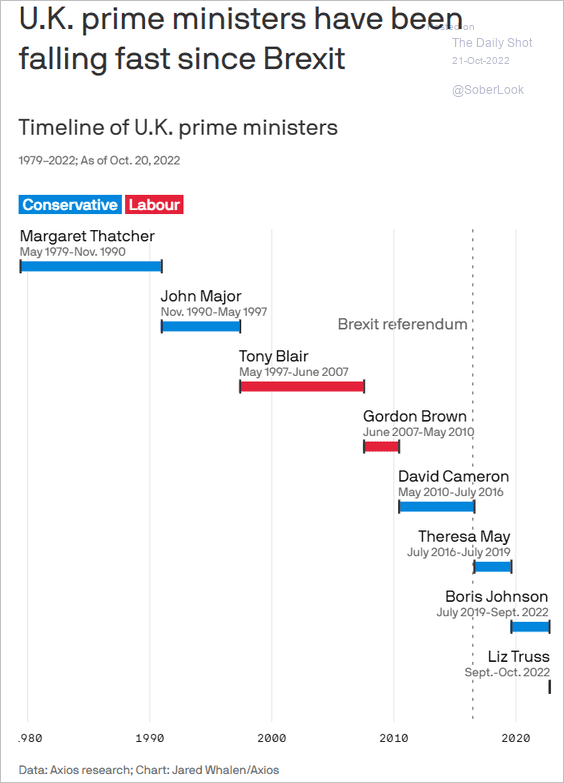

The United Kingdom: The UK’s political turmoil continues.

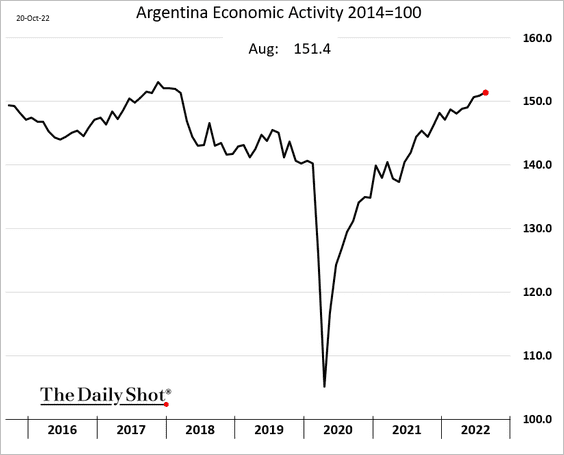

Emerging Markets: Argentina’s COVID-era economic recovery has been relatively strong.

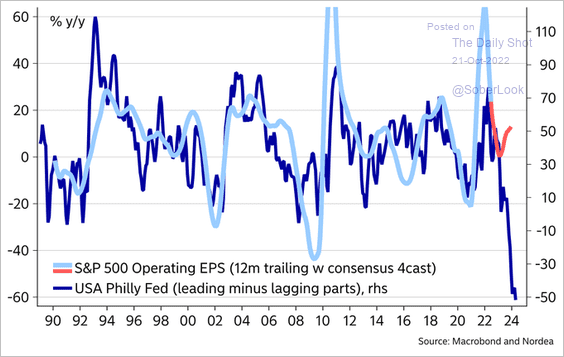

Equities: The Philly Fed’s manufacturing index points to a crash in corporate earnings.

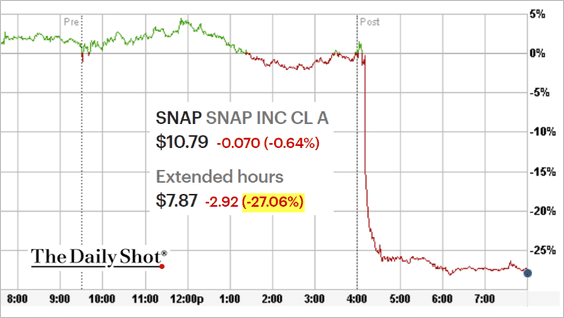

SNAP was down 27% after the close as advertisers pull back, which could impact the whole sector.

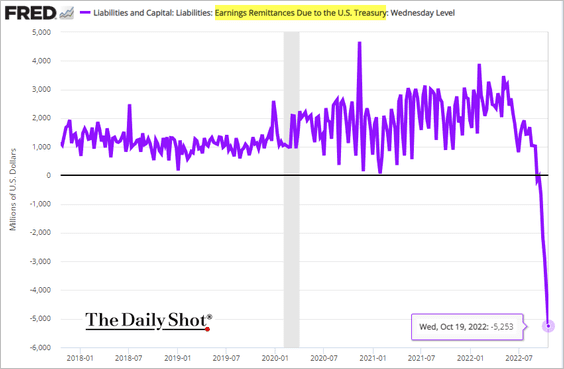

Rates: There will be no cash remittances from the Fed to the US Treasury for a while.

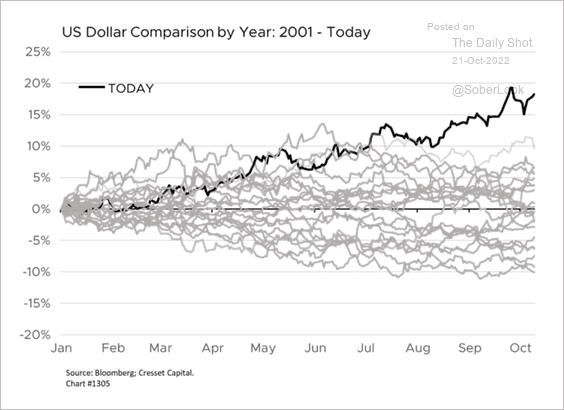

The dollar has surged to its strongest level in about a decade, partly due to the Fed’s aggressive rate hikes.

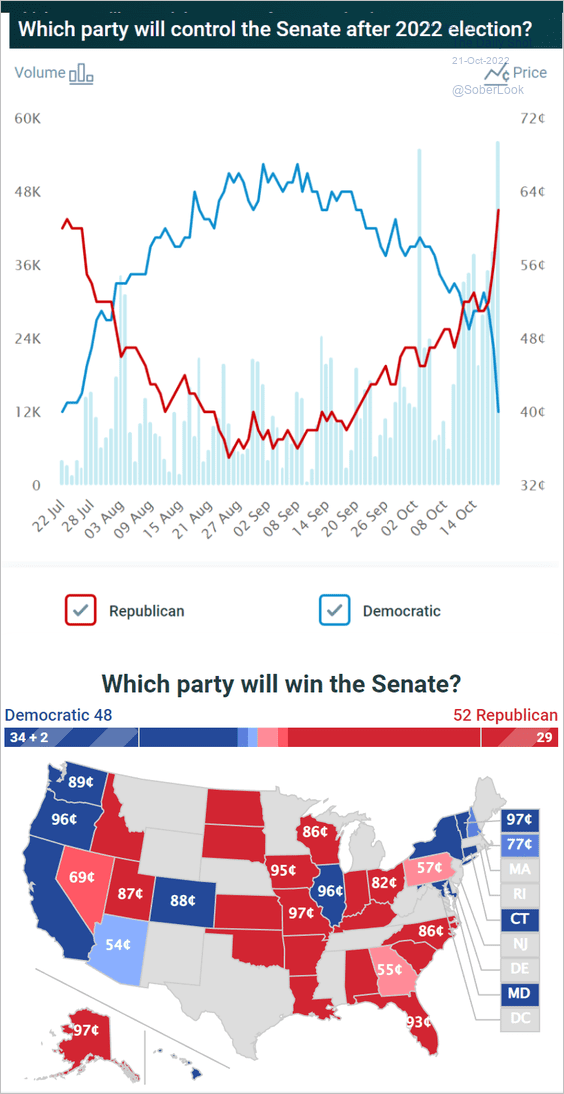

Food for Thought: Here’s a look at betting markets’ probability of which party will control the US Senate.

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com