Greetings,

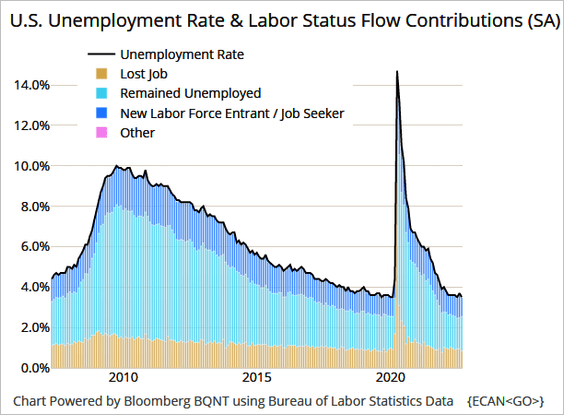

The United States: First, the September jobs report was stronger than expected, delivering another confirmation that the labor market remains tight. Here are the drivers of the unemployment rate.

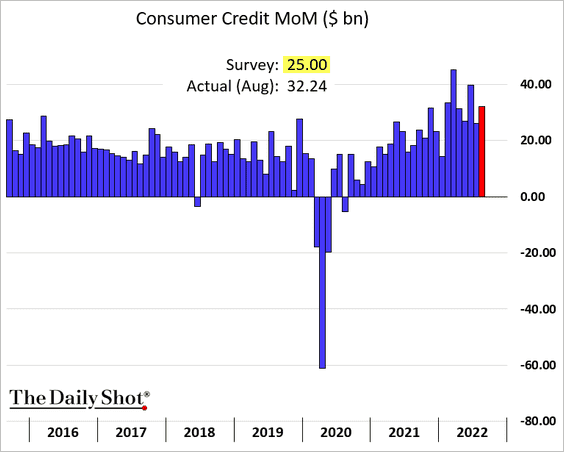

Consumer credit increased more than expected in August, driven by credit cards. Households continue to spend.

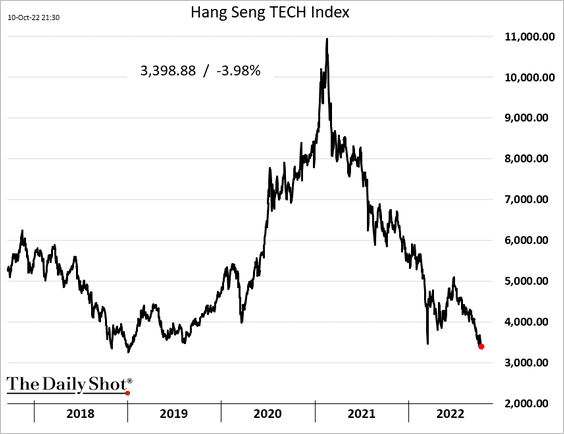

China: The US semiconductor sales curbs are putting pressure on the chip sector. Tech stocks in Hong Kong continue to fall.

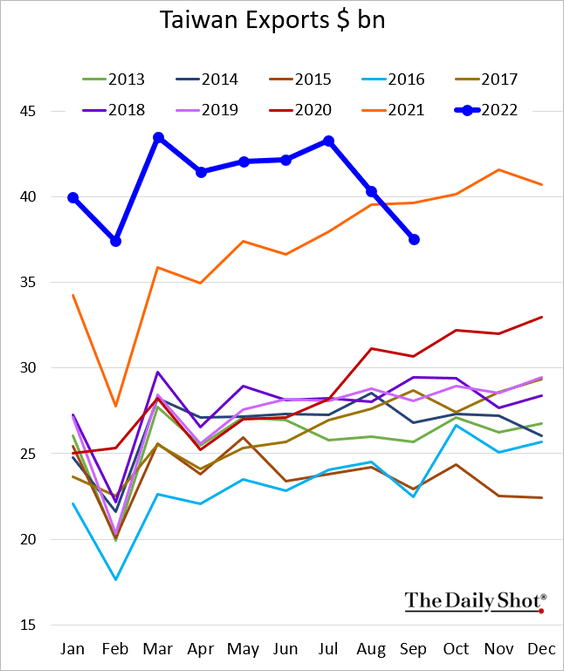

Asia – Pacific: At the same time, Taiwan’s exports are softening rapidly.

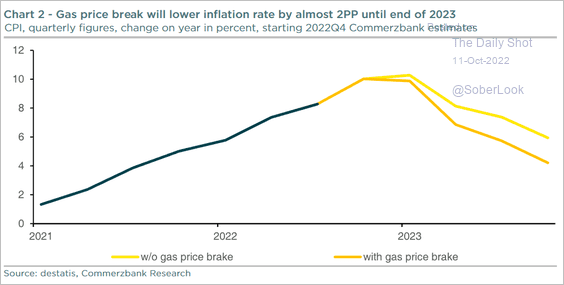

The Eurozone: Germany’s effort to ease the energy burden should cut inflation.

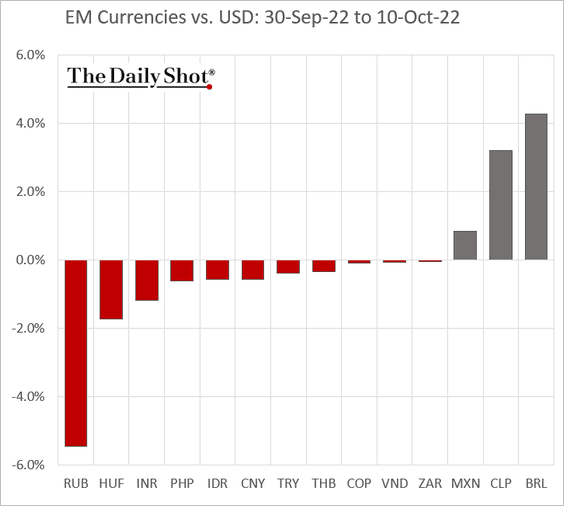

Emerging Markets: Here is month-to-date performance data of EM currencies.

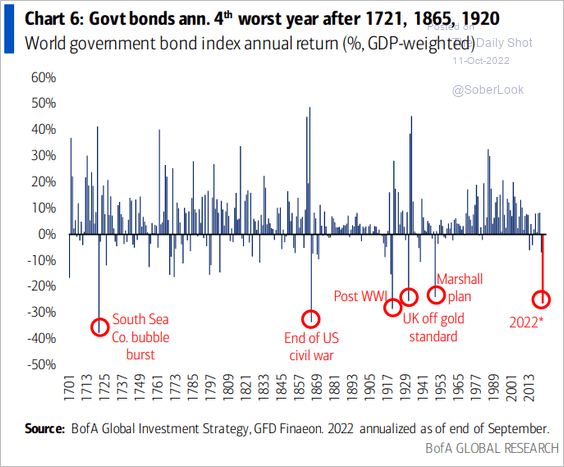

Global Developments: It’s been an ugly year for government bonds.

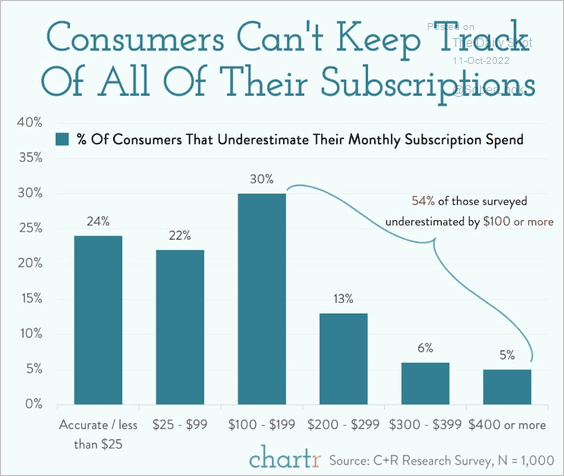

Food for Thought: Lastly, consumers are underestimating the total cost of their subscriptions (streaming video/music, news services, coffee shops, software, razor subscriptions, etc.).

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com