Greetings,

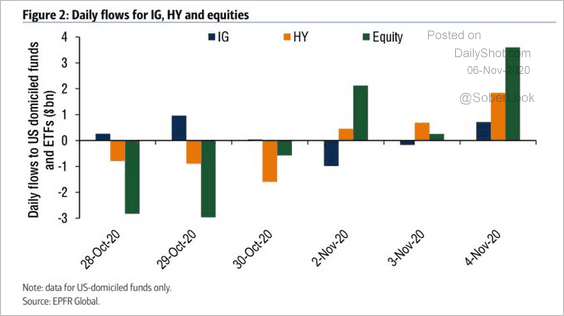

Credit: Corporate bonds saw substantial inflows this week as Treasury yields tumbled.

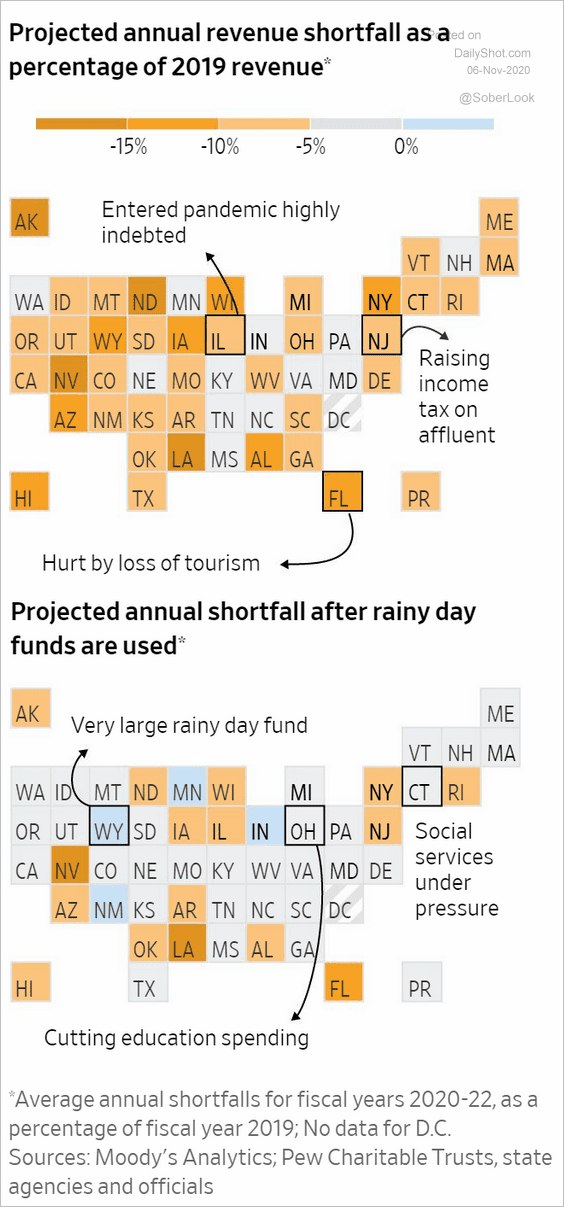

This chart shows states’ revenue shortfall this year. Since significant support from the federal government is unlikely at this point, it’s a bit surprising to see further strength in the muni market this week.

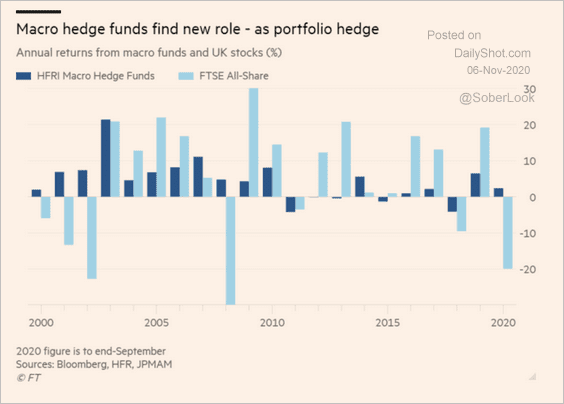

Alternatives: Macro hedge funds are now often used as a portfolio hedge.

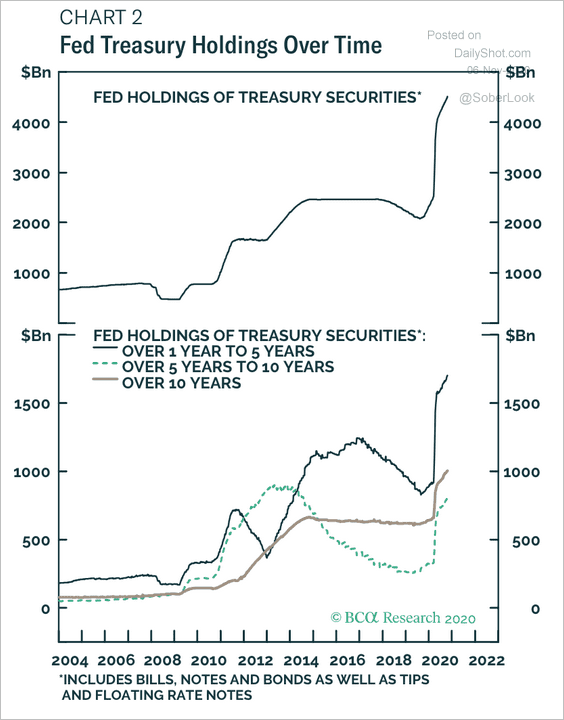

Rates: Will the Fed focus on longer maturities in the next easing phase?

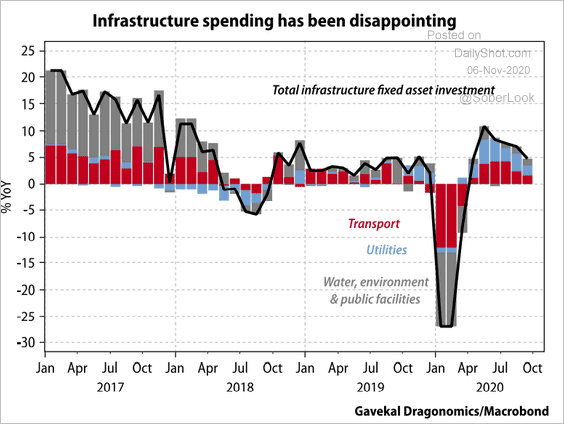

China: Infrastructure spending has been modest compared to the post-2015 stimulus.

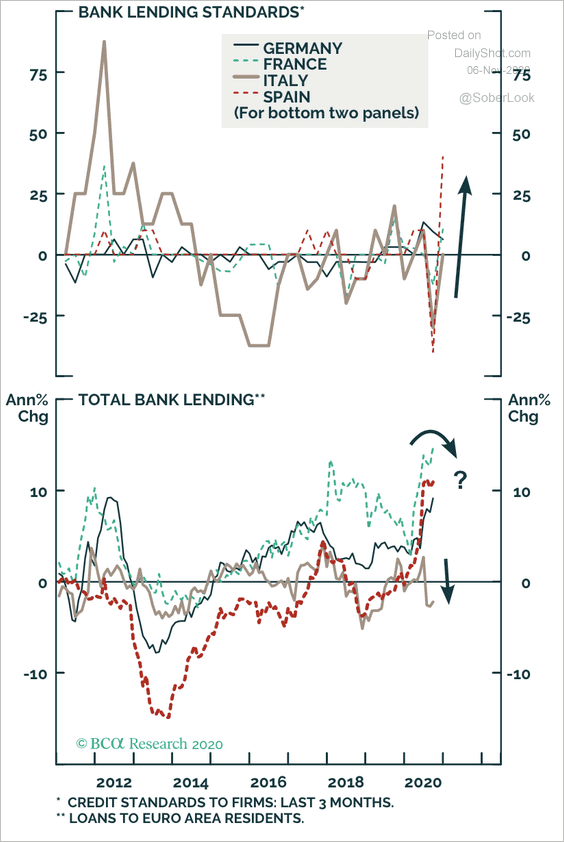

Eurozone: European banks have tightened lending standards.

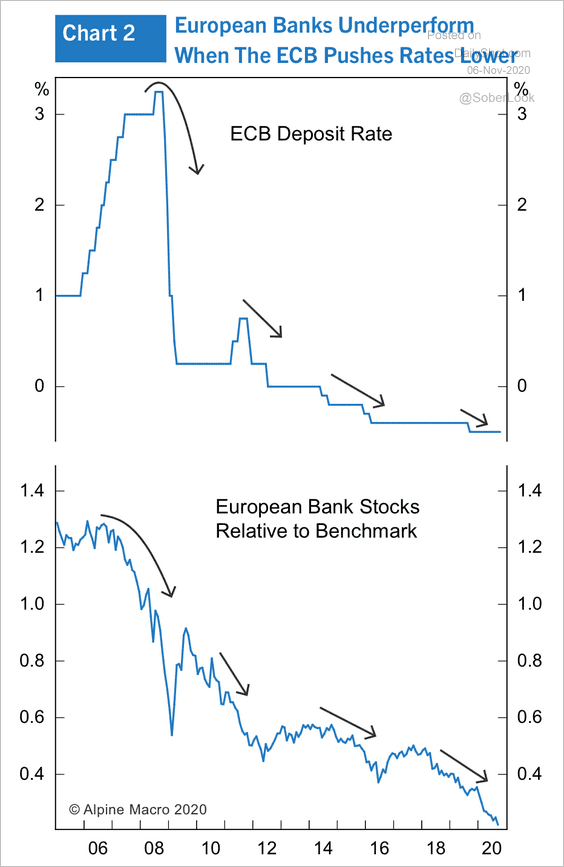

Low rates have squeezed bank net-interest margins, contributing to more than a decade of underperformance. Is the bottom in?

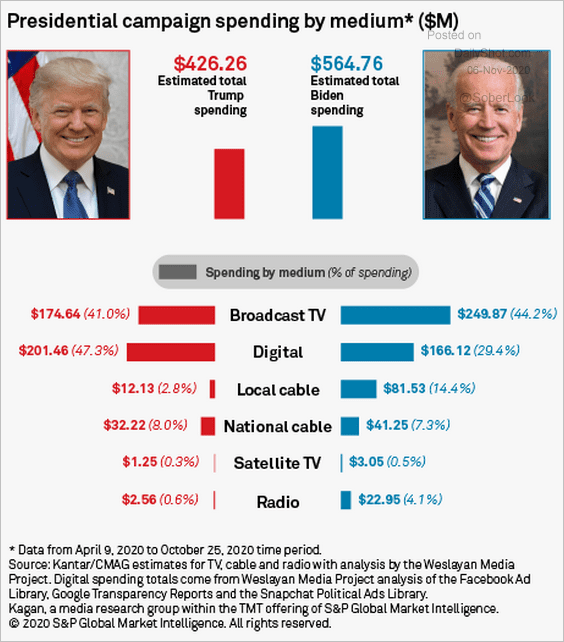

Food For Thought: Campaign spending data:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Dear Friends,

The full-length Daily Shot® is now an independent ad-free publication (see TheDailyShot.com). Here is a sample newsletter.

Daily Shot Brief subscribers are eligible to receive the full-length Daily Shot for $115/year (a $20 discount).

To subscribe with this discount, you must register here (NOTE: The regular subscription page will not acknowledge this coupon). The coupon number is DSB329075 (please click the “apply” button for the discount to take effect).

A monthly subscription is also available (here).

The Food for Thought section is available as a separate newsletter. You can sign up here.

Please note that The Daily Shot is not an investment newsletter and is not intended for broad distribution.

If you have any questions, please contact Lev.Borodovsky@TheDailyShot.com.

Sincerely,

Lev Borodovsky

Editor, The Daily Shot