Greetings,

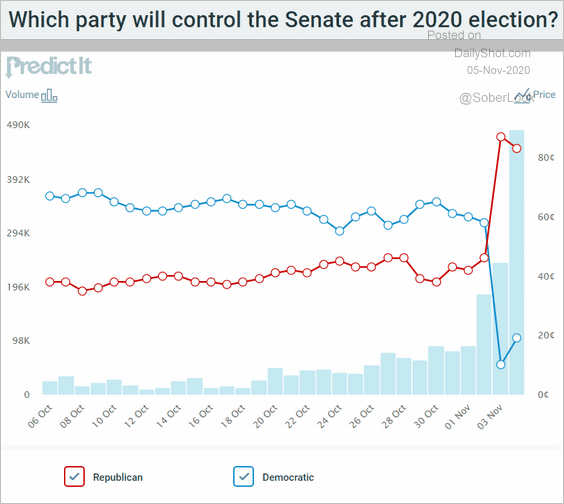

Equities: A “blue wave” is not likely as Republicans seem to retain Senate control.

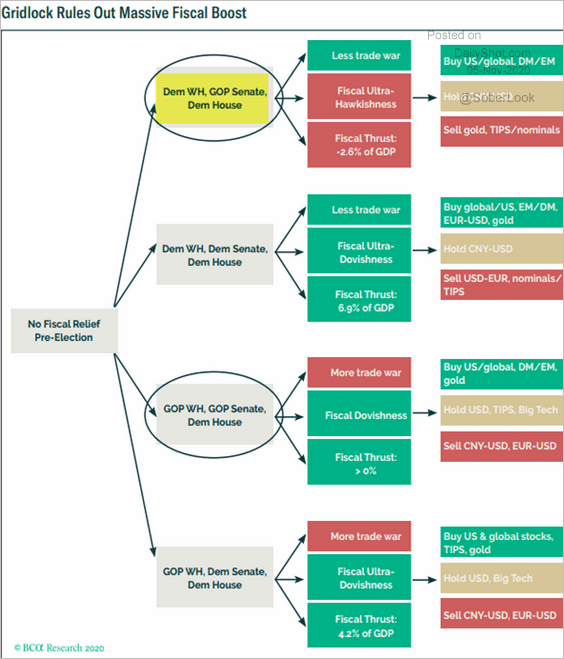

Here is what this means for the markets. Republicans in the Senate have no appetite for a massive stimulus bill.

With the year-end income cliff approaching (see this chart/comment from Oxford Economics), the Fed is now more likely to step in with a larger QE package.

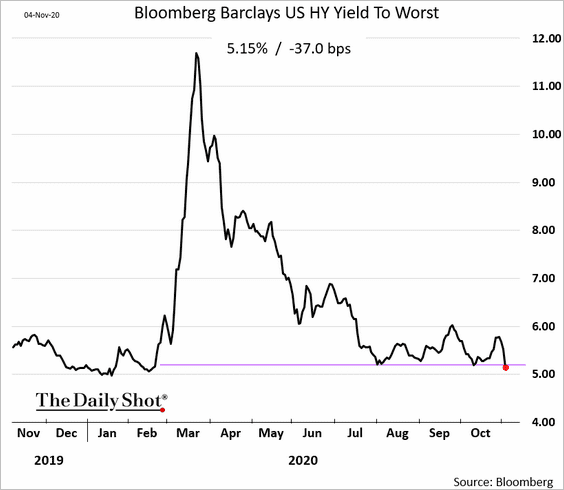

Credit: The yield on US high-yield bonds hit the lowest level since February.

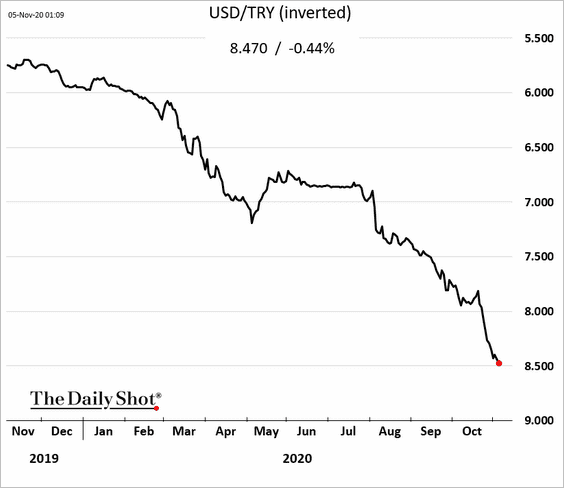

Emerging Markets: The Turkish lira resumed its decline. A Biden White House is not the best outcome for Erdogan.

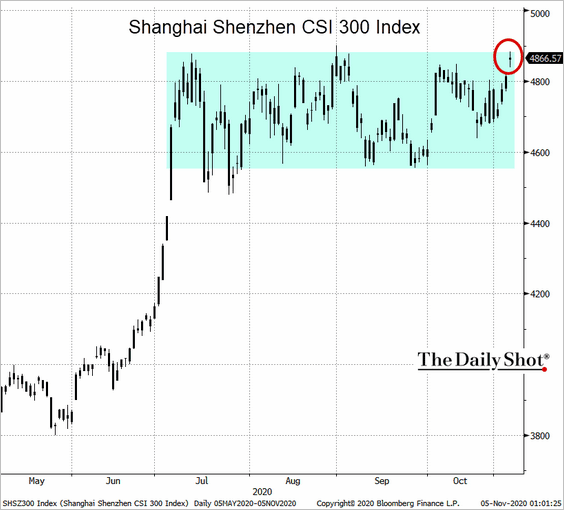

China: China’s stock benchmark is in the upper end of the trading range again. Will we see a breakout (perhaps based on better trade relations with the US under the Biden administration)?

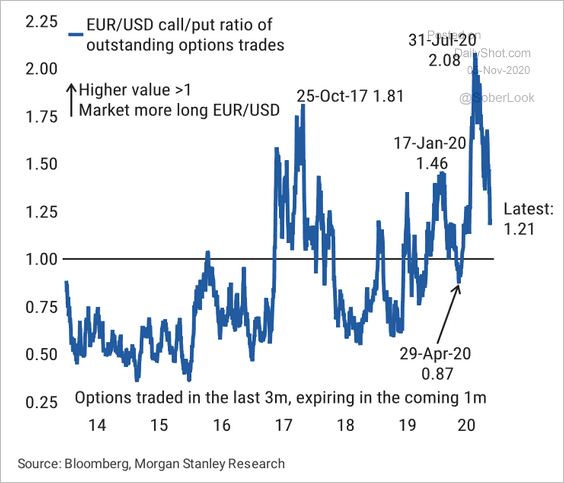

Eurozone: The options market’s sentiment on the euro has soured.

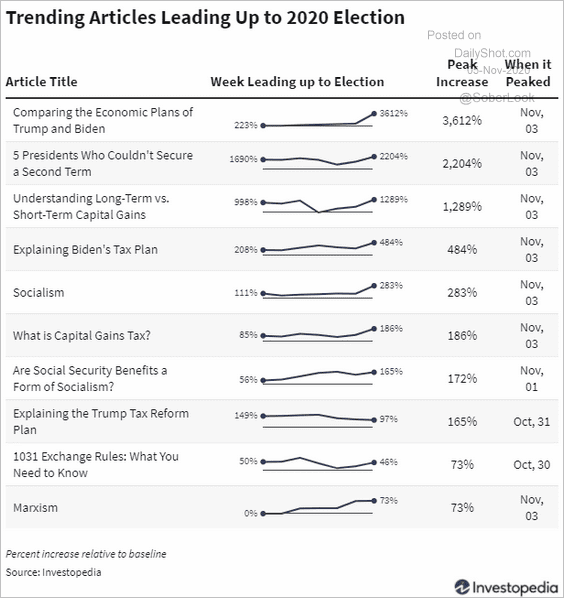

Food For Thought: Trending Investopedia articles leading up to the elections:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Dear Friends,

The full-length Daily Shot® is now an independent ad-free publication (see TheDailyShot.com). Here is a sample newsletter.

Daily Shot Brief subscribers are eligible to receive the full-length Daily Shot for $115/year (a $20 discount).

To subscribe with this discount, you must register here (NOTE: The regular subscription page will not acknowledge this coupon). The coupon number is DSB329075 (please click the “apply” button for the discount to take effect).

A monthly subscription is also available (here).

The Food for Thought section is available as a separate newsletter. You can sign up here.

Please note that The Daily Shot is not an investment newsletter and is not intended for broad distribution.

If you have any questions, please contact Lev.Borodovsky@TheDailyShot.com.

Sincerely,

Lev Borodovsky

Editor, The Daily Shot