Greetings,

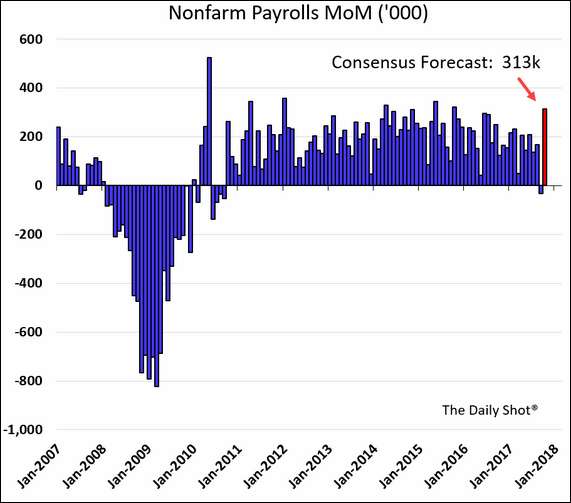

The United States: Economists expect a massive jump in the number of new nonfarm payrolls in October (reported later today). The report is expected to show a reversal of the September hurricane-driven decline.

The Eurozone: The euro area’s factories are doing well, with the manufacturing index hitting the highest level since 2011.

Here is Italy’s manufacturing index, for example.

Just like in the US (see chart), economists remind us that there is still a disconnect between “soft” and “hard” data.

Emerging Markets: The dollar-denominated EM bond issuance will hit a new record this year. Take a look at the EM high-yield bond activity.

Equity Markets: Here is the percentage of US households who believe that stock prices will be up next year.

Global Developments: Global factory activity continues to expand.

Food for Thought: The sales growth of spirits around the world.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com