Greetings,

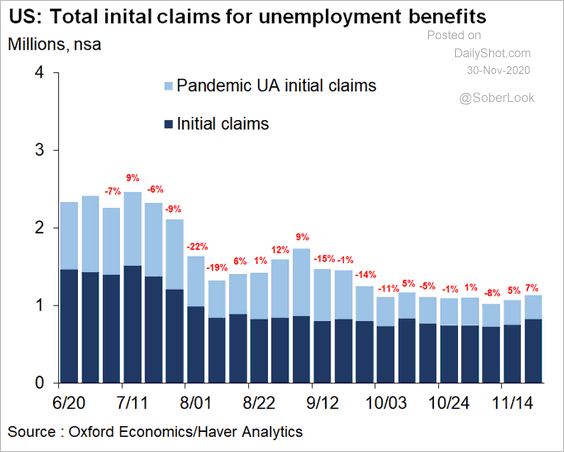

United States: Initial jobless claims rose again.

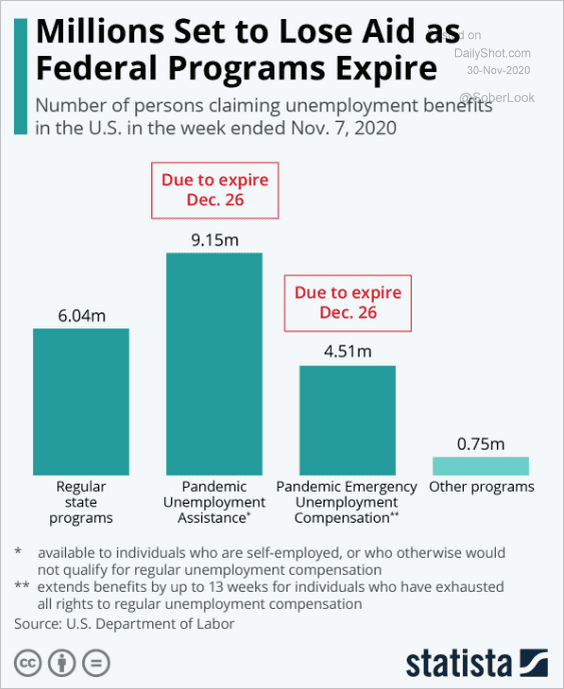

Many Americans are about to lose their emergency unemployment benefits, widening the “K-shaped” recovery gap.

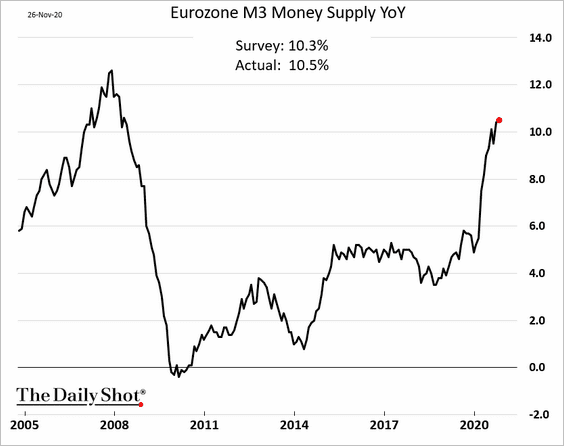

Eurozone: The broad money supply (M3) growth continues to climb.

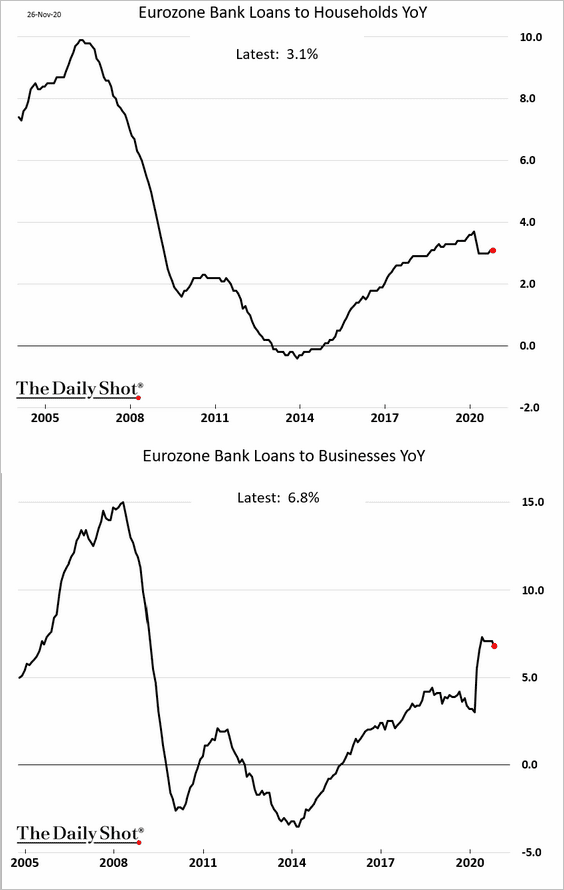

Here are the year-over-year changes in business and consumer loans. The acceleration in M3 has been driven by the ECB, not bank lending.

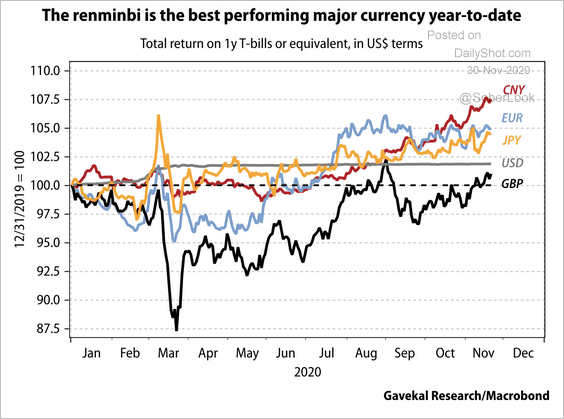

China: Renminbi gains have outstripped other currencies this year.

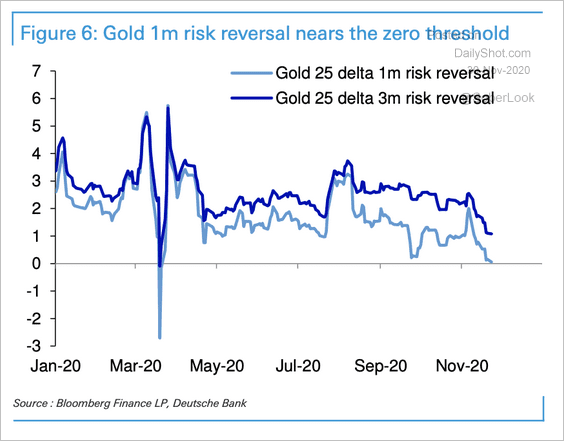

Commodities: Gold’s 1-month risk reversals are on the verge of turning negative for the first time since March. A deterioration in risk reversals was the precursor to gold’s last bear cycle, according to Deutsche Bank.

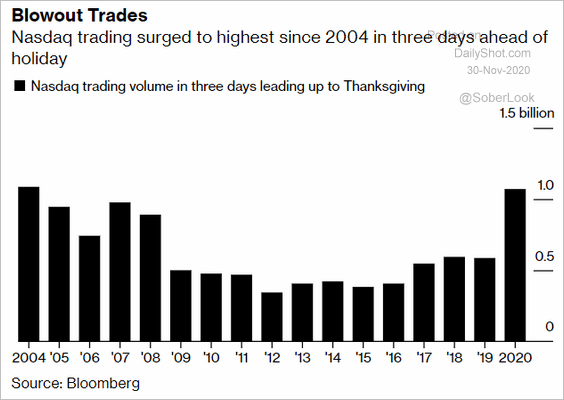

Equities: Nasdaq trading volume hit the highest level since 2004.

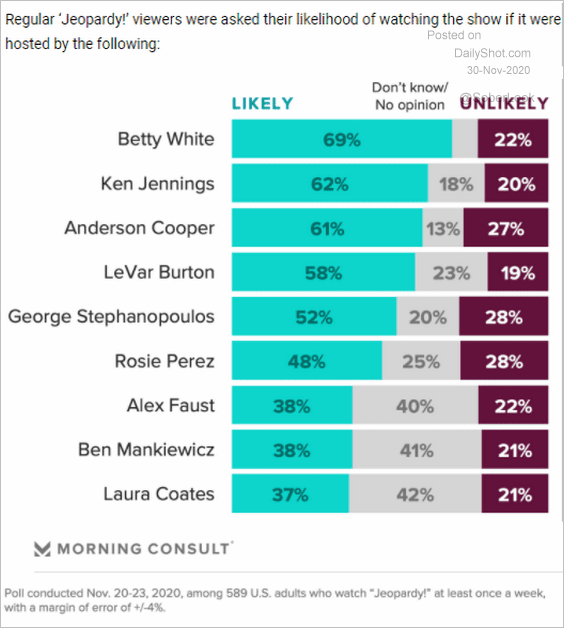

Food For Thought: Who should host Jeopardy?

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Dear Friends,

The full-length Daily Shot® is now an independent ad-free publication (see TheDailyShot.com). Here is a sample newsletter.

Daily Shot Brief subscribers are eligible to receive the full-length Daily Shot for $115/year (a $20 discount).

To subscribe with this discount, you must register here (NOTE: The regular subscription page will not acknowledge this coupon). The coupon number is DSB329075 (please click the “apply” button for the discount to take effect).

A monthly subscription is also available (here).

The Food for Thought section is available as a separate newsletter. You can sign up here.

Please note that The Daily Shot is not an investment newsletter and is not intended for broad distribution.

If you have any questions, please contact Lev.Borodovsky@TheDailyShot.com.

Sincerely,

Lev Borodovsky

Editor, The Daily Shot