Greetings,

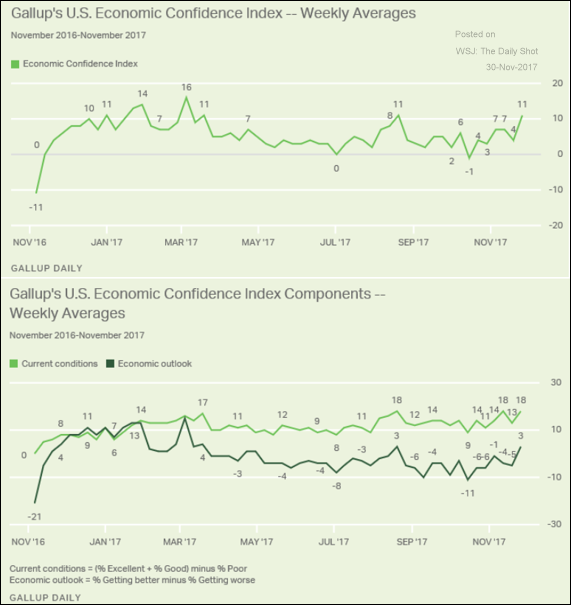

The United States: Surveys show US economic confidence bouncing over the Thanksgiving weekend.

The United Kingdom: Here is a GDP forecast out to 2020. Both consumption and investment are expected to be softer next year.\

Rates: Treasury issuance will increase meaningfully next year, with the biggest pop in the “belly” of the curve.

Equity Markets: Equity ETF inflows into large-caps have picked up again last week.

Bitcoin: Bitcoin blasted past $11,000, and then turned around and sold off 20% from the high.

Emerging Markets: Brazil’s central bank has shifted to a different regime in terms of consumer credit. It is unlikely to reverse course aggressively if credit improves.

China: China’s trade partners’ economic activity keeps improving (white line), suggesting that export orders should remain robust.

Food for Thought: Some consequences of the GOP tax bill.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com