Greetings,

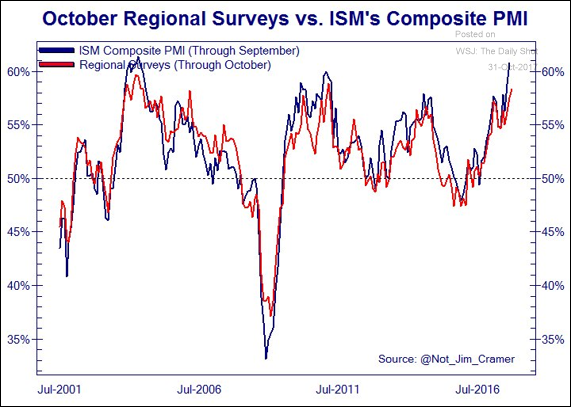

The United States: The regional manufacturing surveys point to a very strong (national) ISM report on Wednesday (although lower than the September figure, which was distorted by the hurricanes).

Here is a comment from Merrill Lynch on the concept of tax cuts “paying for themselves.”

- BofA Merrill Lynch: – “President Clinton worked with Republicans and cut the capital-gains tax rate from 28% to 20% in 1997. Capital-gains tax cuts are among the most likely to generate greater revenues because taking a capital gain is optional. If the tax on the gain is 20%, you are more likely to realize the gain and pay taxes than if the tax rate is 90%. If you don’t take the gain, there are no tax revenues. The booming stock market in the late 1990s generated a wealth of potential gains, and more were realized at lower tax rates. While it is common to hear pundits in the financial media say something to the effect that “no respectable economist believes that tax cuts can pay for themselves,” the late-1990s experience is a case study in why “respectable” economists are so often wrong. Indeed, that was the last time that the U.S. government ran a fiscal surplus and the bounty of capital-gains revenues was a major factor behind the budget surpluses of the late 1990s.”

The Eurozone: The Eurozone’s GDP growth and the unemployment rate were both better than expected.

Emerging Markets: Mexico’s GDP contracted for the first time since 2013.

Equity Markets: Market reaction to better than expected earnings reports has been muted (on average).

Credit: Despite slow rate increases by the Fed, US regional banks have seen improvements in interest margins (4 consecutive quarters of increases).

Global Developments: Here is the number of protectionist trade measures enacted over time.

China is the main target of these measures.

Food for Thought: Wages for men and women by age and birth cohort.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com