Greetings,

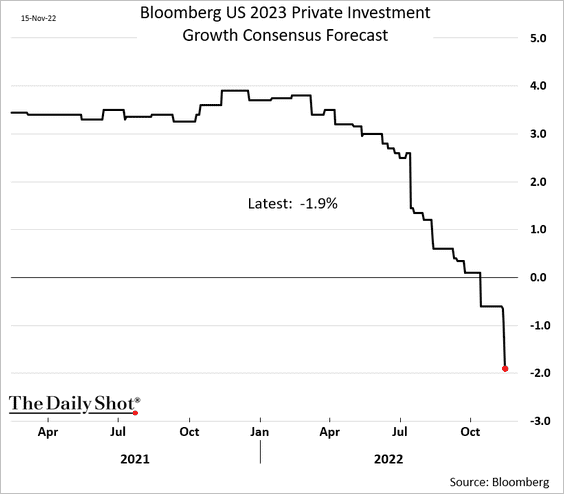

The United States: US private investment is expected to tumble next year, driven mostly by stalling residential construction.

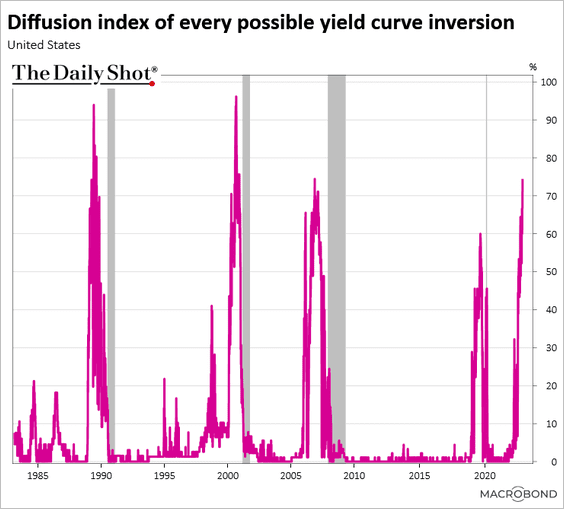

Much of the Treasury curve is now inverted.

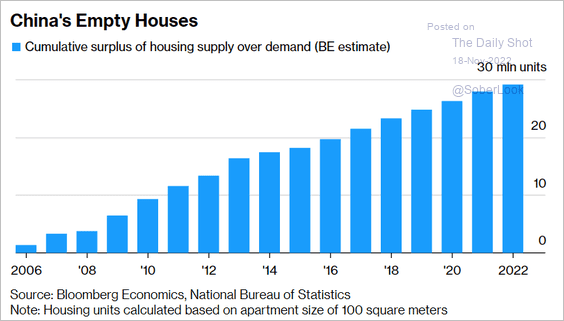

China: The housing surplus is massive.

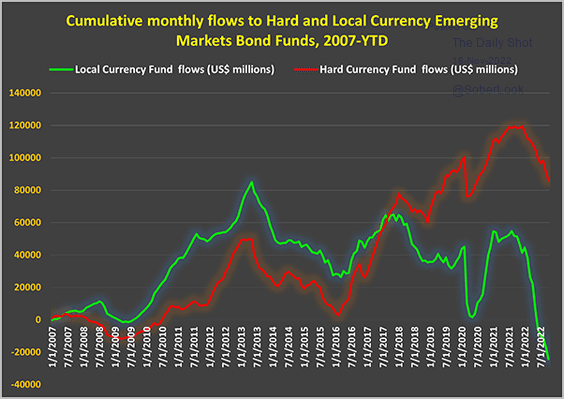

Emerging Markets: Bond fund outflows have been most severe in local-currency debt.

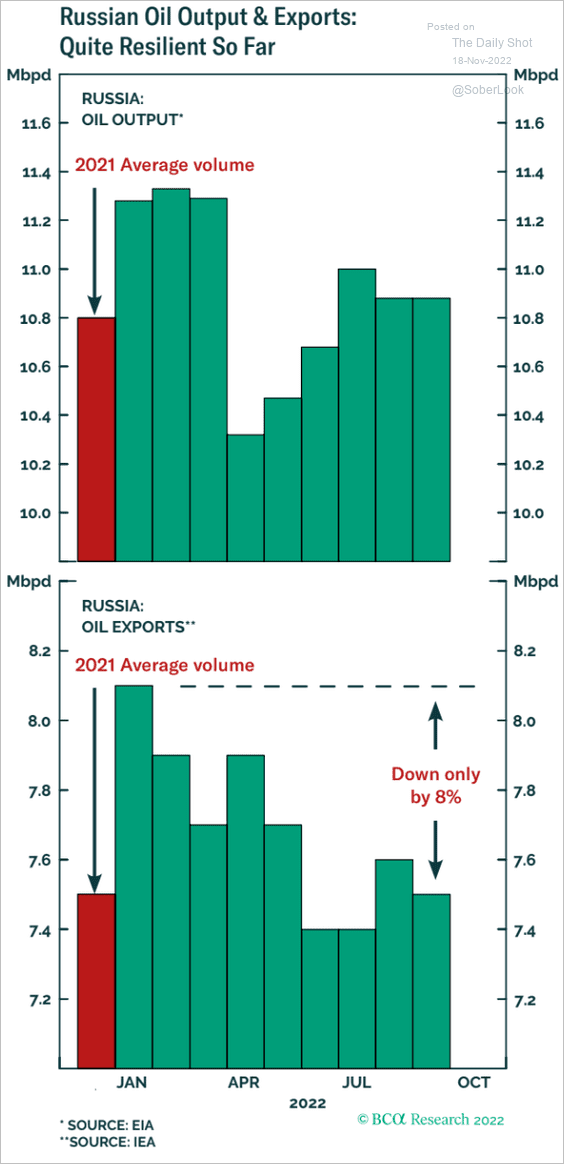

Energy: Russian oil output has been resilient.

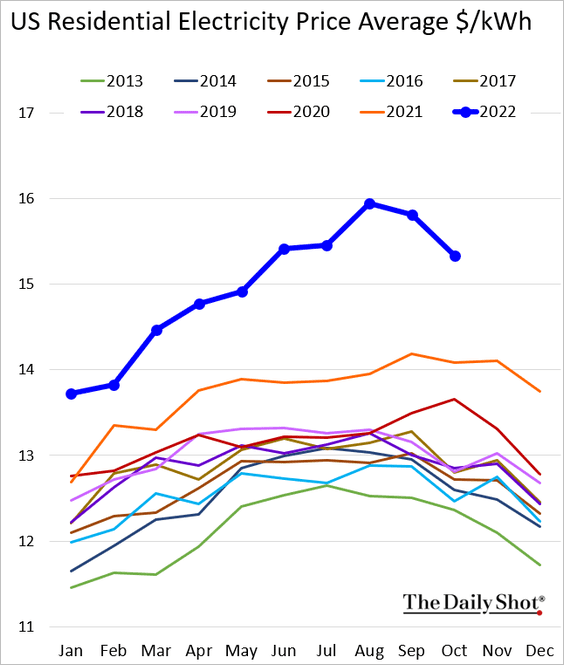

US residential electricity prices are very high.

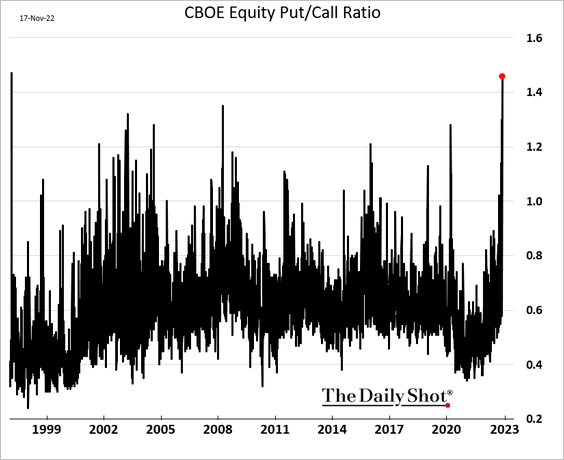

Equities: The put/call ratio hit the highest level since 1997. Short-term options volume has exploded.

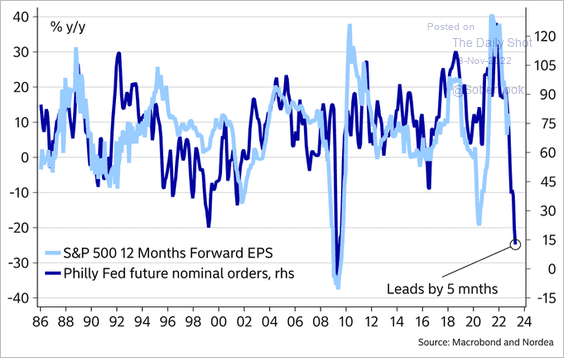

The Philly Fed’s manufacturing index is signaling a sharp decline in earnings expectations.

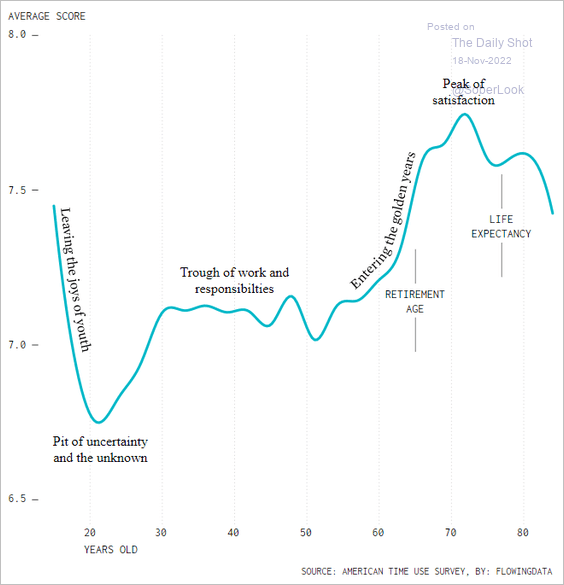

Food for Thought: Lastly, here’s a look at life satisfaction by age.

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com