Greetings,

Administrative Update: The Daily Shot Brief will not be published on November 24th, 25th, and 26th.

United States: The sharp rise in import costs has fed through to domestic prices over the past year. A stronger US dollar should slow import inflation.

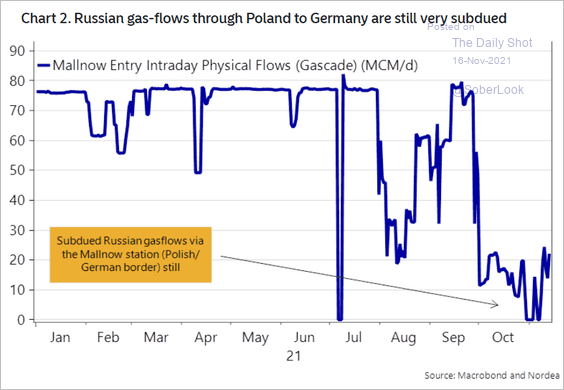

Europe: Russian natural gas flows remain tepid.

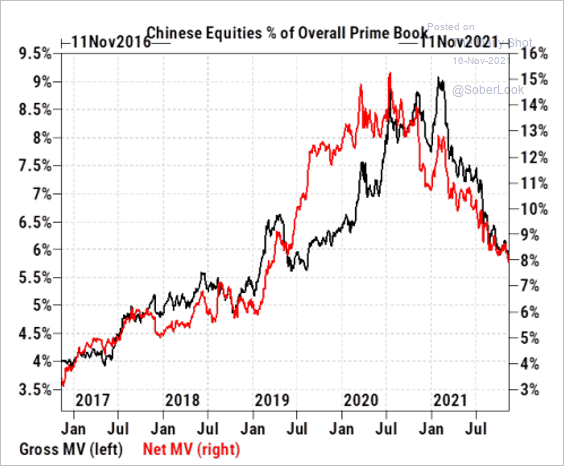

China: Goldman’s hedge fund clients have been cutting their exposure to Chinese stocks. A bullish sign?

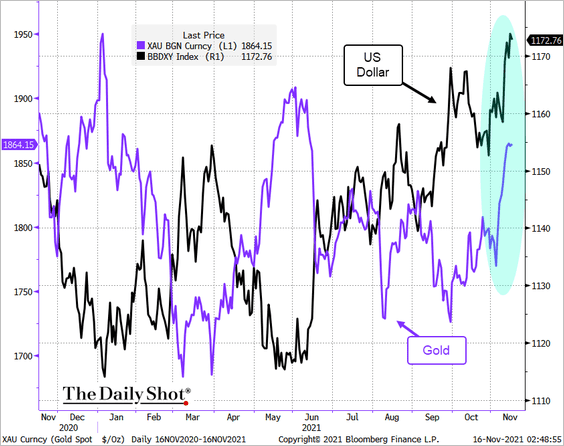

Commodities: Inflation concerns sent the US dollar and gold in the same direction, which is highly unusual.

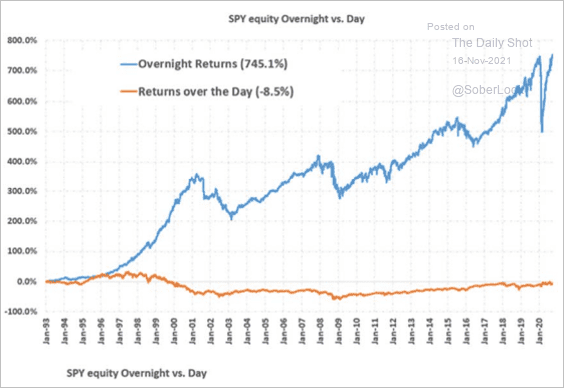

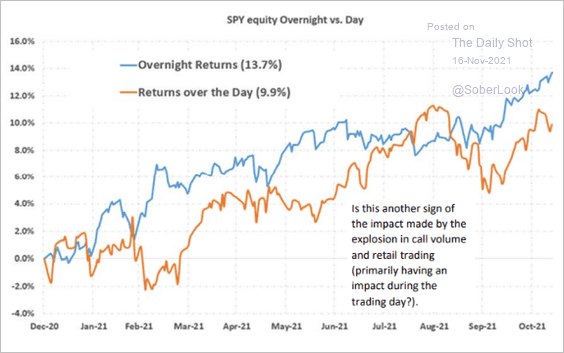

Equities: Over the years, the SPDR S&P 500 ETF (SPY) performance has been driven by overnight returns.

But that’s no longer the case as retail investors (and their options trades) are moving the market during regular trading hours.

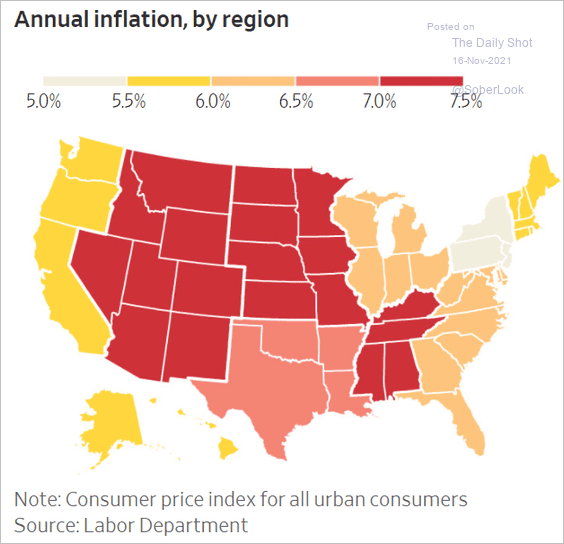

Food for Thought: Regional inflation rates in the US:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com