Greetings,

Administrative Update

As a reminder, The Daily Shot Brief will not be published from May 27th to May 31st.

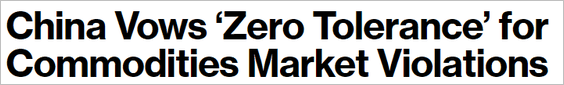

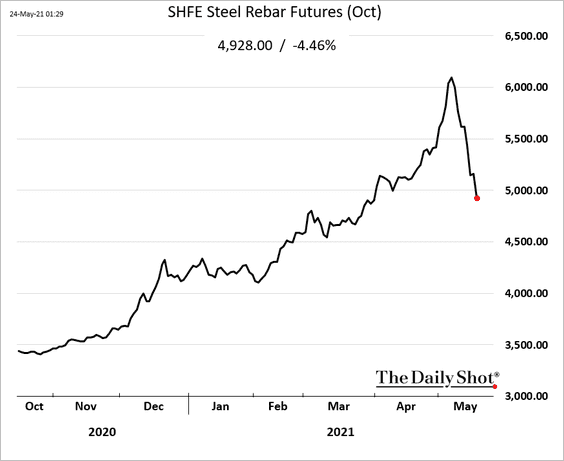

Commodities: Beijing has lost patience with the recent acceleration in commodity costs.

Industrial commodities are under pressure. Here are steel rebar futures in Shanghai:

And iron ore futures in Singapore:

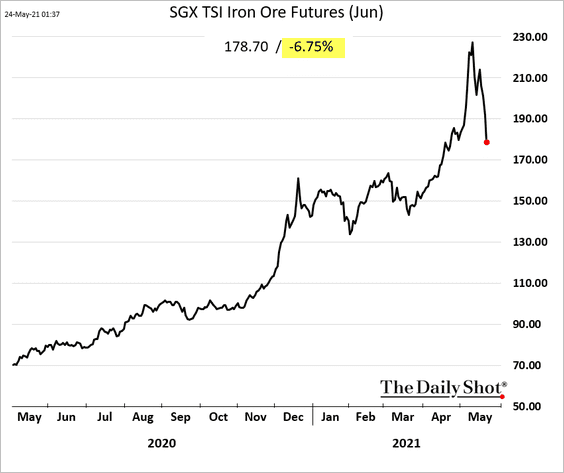

Equities: Adjusted for inflation, the S&P 500 earnings yield is back in negative territory.

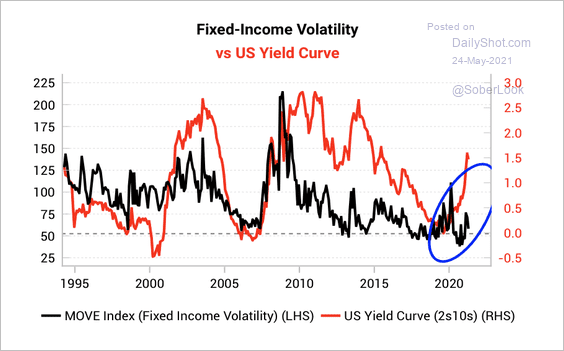

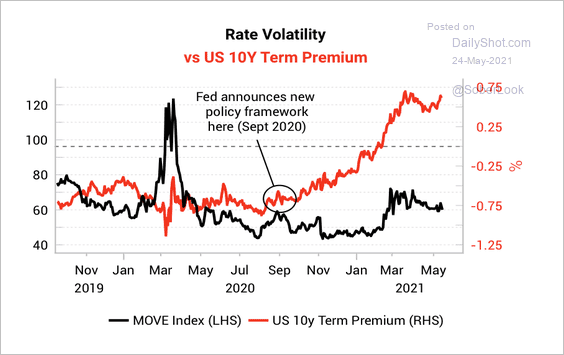

Rates: A steeper US yield curve points to higher fixed-income volatility.

High volatility means more risk to hold duration, which will help support the term premium. That, in turn, will help the yield curve steepen further, according to Variant Perception.

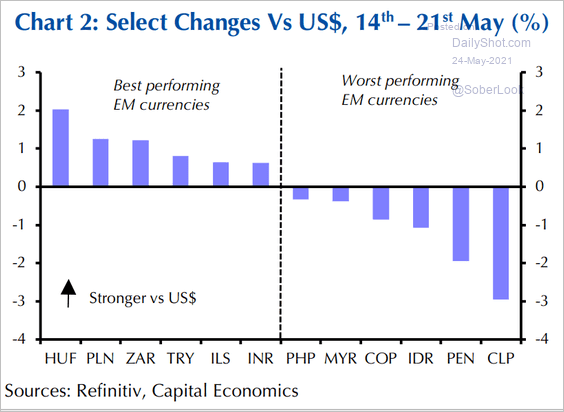

Emerging Markets: Here is last week’s performance for select EM currencies.

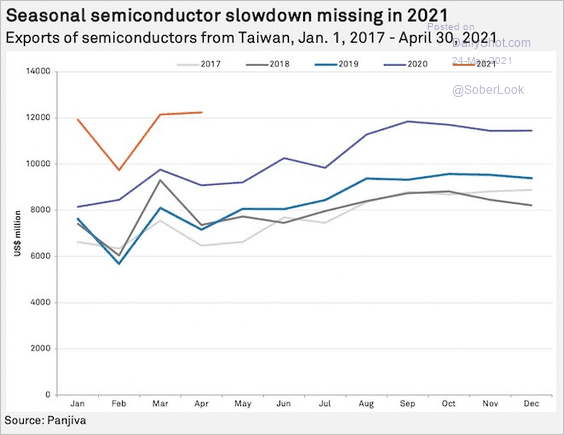

Asia-Pacific: Taiwan’s semiconductor exports did not pause last month (that’s not the typical seasonal pattern).

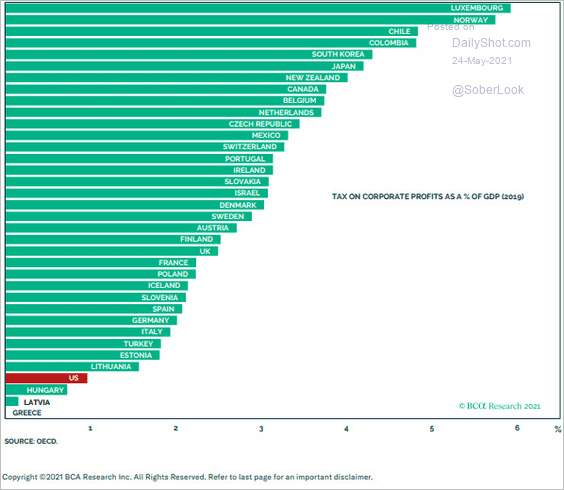

Food For Thought: Corporate taxes as a percentage of GDP:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com