Greetings,

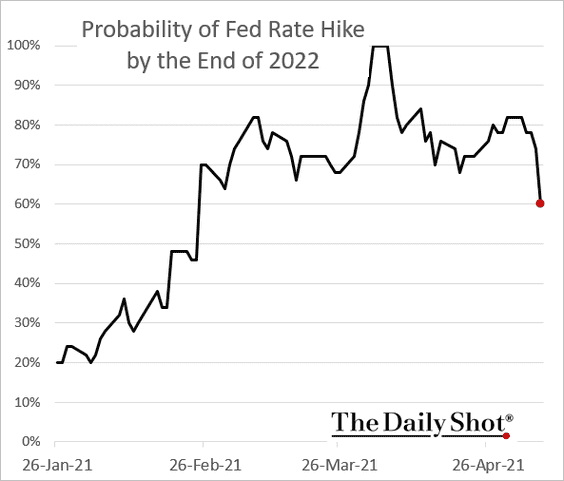

United States: Markets sees the weak employment report keeping the Fed on hold for longer. Perhaps taper is off the table this year? The futures-based probability of a 2022 rate hike declined sharply.

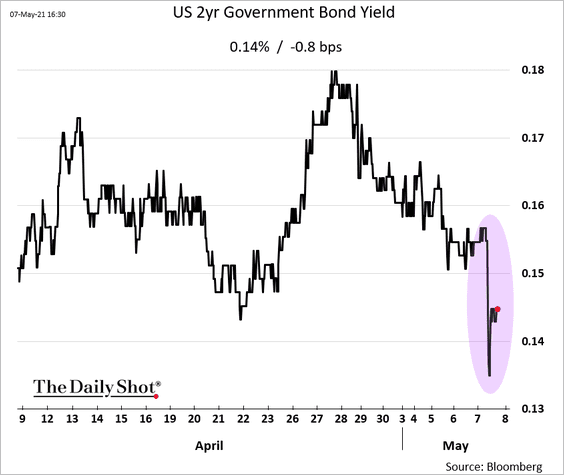

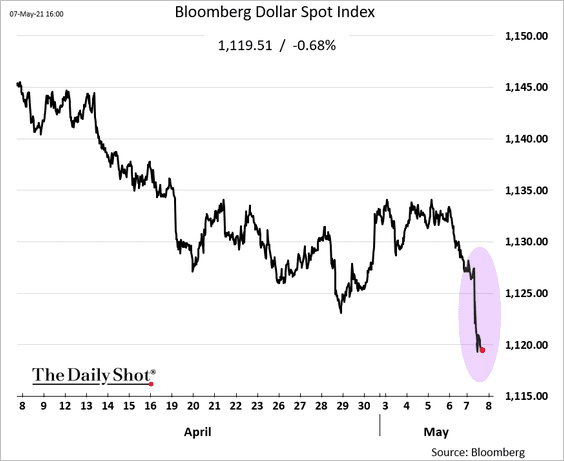

Short-term Treasury yields dipped, and the US dollar slumped.

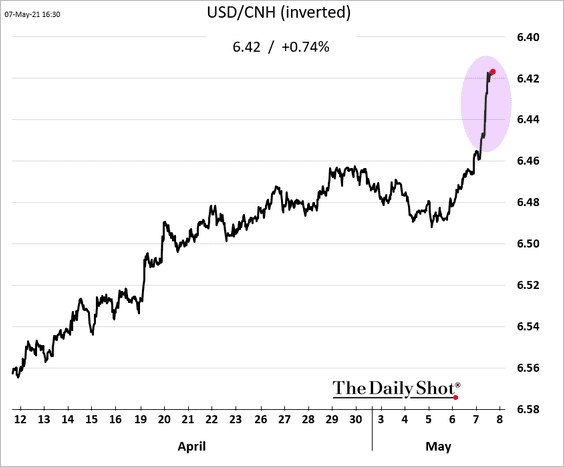

China: The renminbi rose sharply in response to the soft US jobs report.

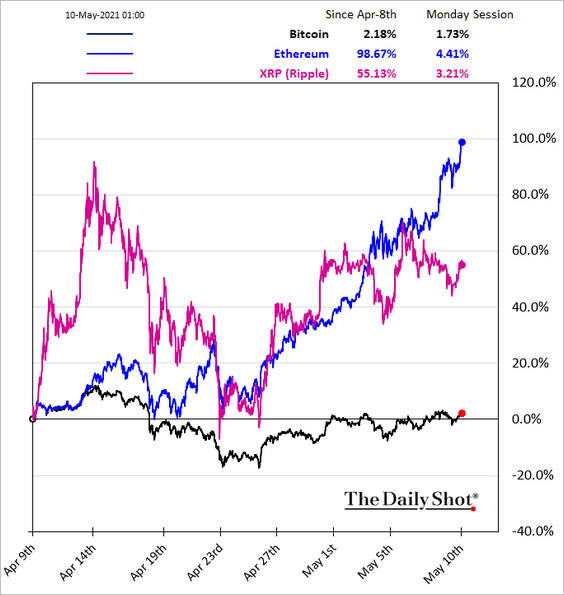

Cryptocurrency: Ethereum blasted past $4k.

Here is the relative performance over the past month.

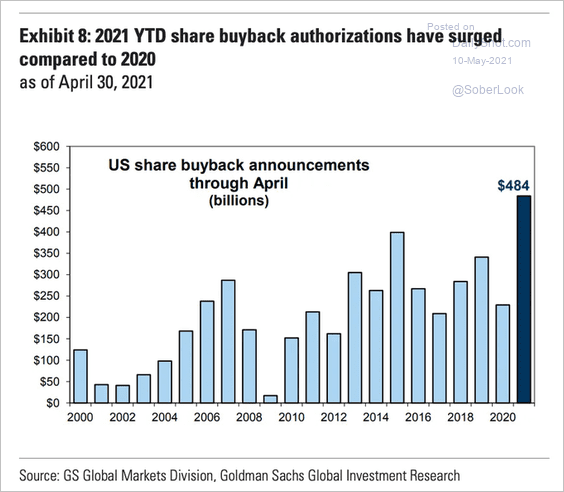

Equities: Share buybacks are surging.

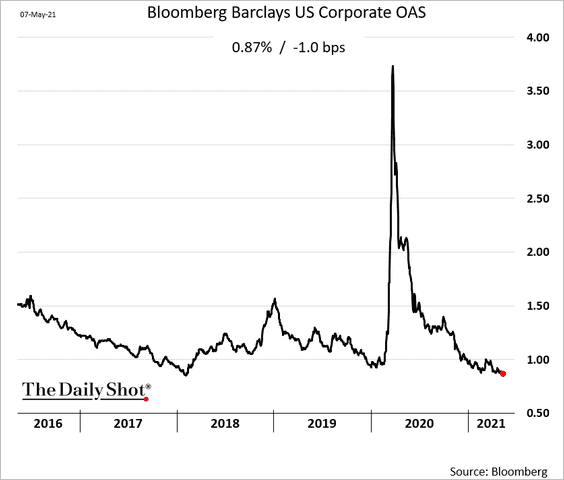

Credit: US investment-grade bond spreads hit the lowest level since 2018.

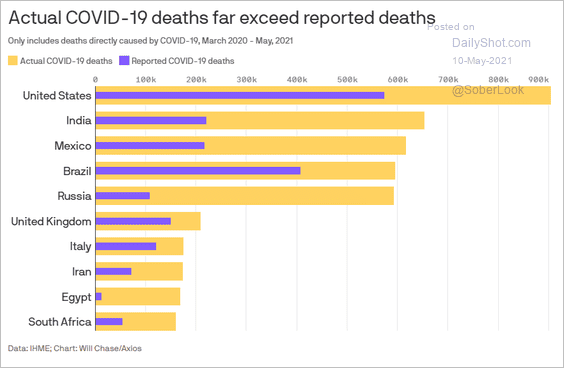

Food For Thought: Actual vs. reported COVID deaths:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

If you would like to subscribe to the full-length Daily Shot (see example), please register here.