Greetings,

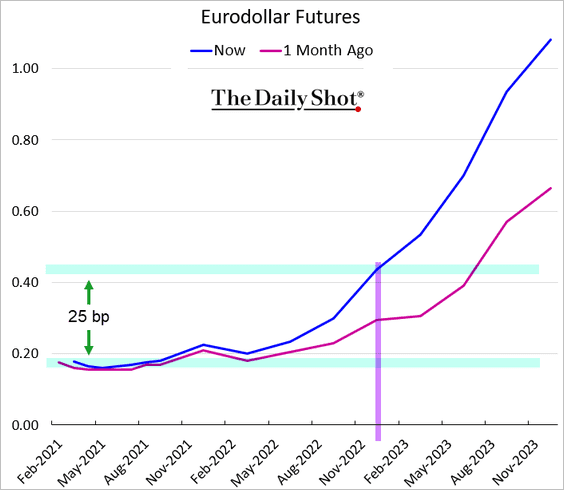

Rates: Jerome Powell’s comments on Thursday were dovish as usual. However, traders wanted to hear about how the Fed may address rising bond yields. In particular, there has been talk about the central bank shifting its bond purchases to longer maturities. The market didn’t get its wish, sending bond yields higher.

The market is now pricing in a full 25 bps hike by early 2023, with a substantial probability of liftoff next year.

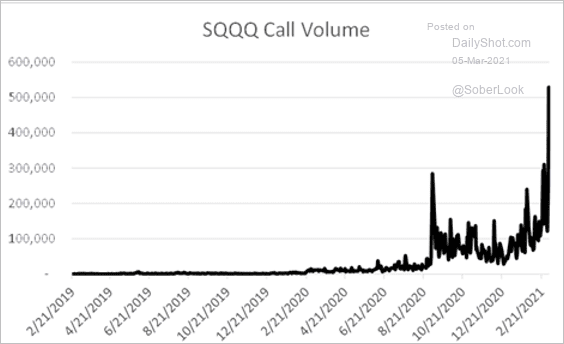

Equities: The SQQQ call option volume spiked. SQQQ is 3x short QQQ (Nasdaq 100) – so this is a bearish bet.

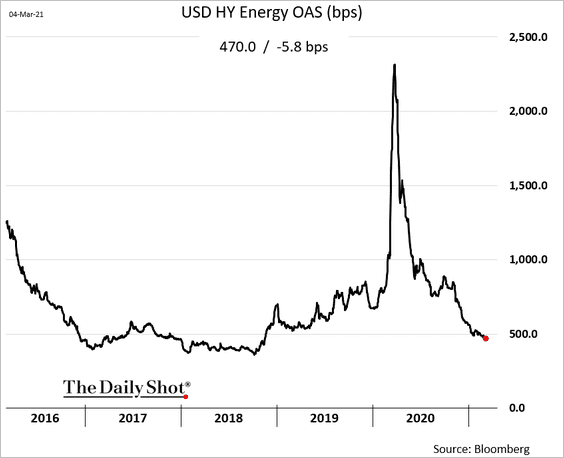

Credit: Energy-sector high-yield spreads hit the lowest level since 2018 as oil prices climb.

Energy: OPEC extended its production cuts, sending crude oil prices sharply higher.

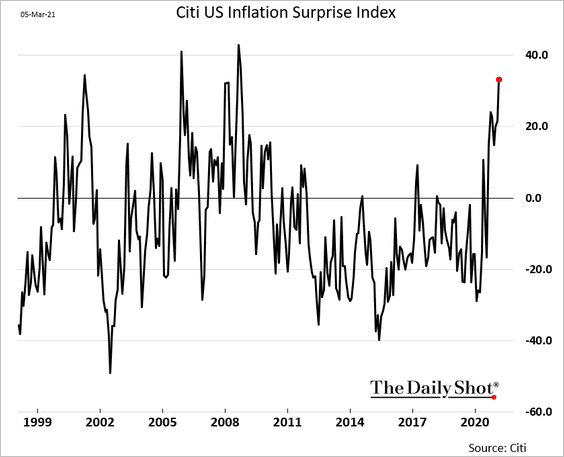

United States: The Citi inflation surprise index has been rising.

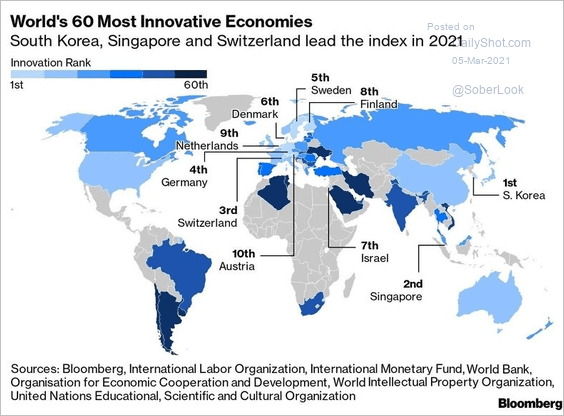

Food For Thought: Most innovative economies:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com