Greetings,

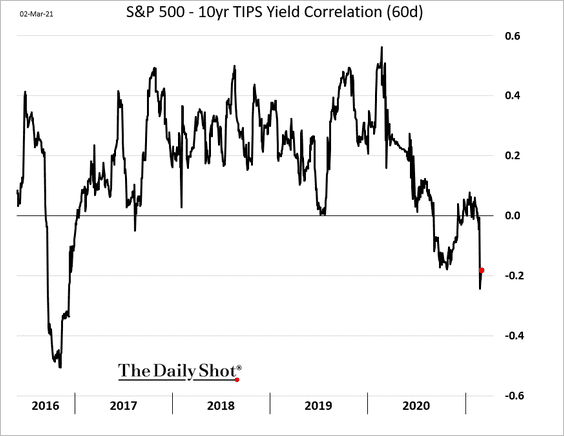

Equities: The stock market is vulnerable to an increase in real rates as the S&P 500 – TIPS yield correlation moves further into negative territory.

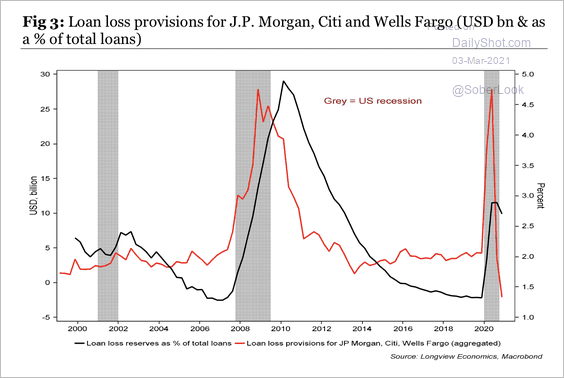

Credit: Loan loss provisions among large US banks are below pre-crisis levels but are still high as a percent of total loans. This means banks have extra balance sheet capacity.

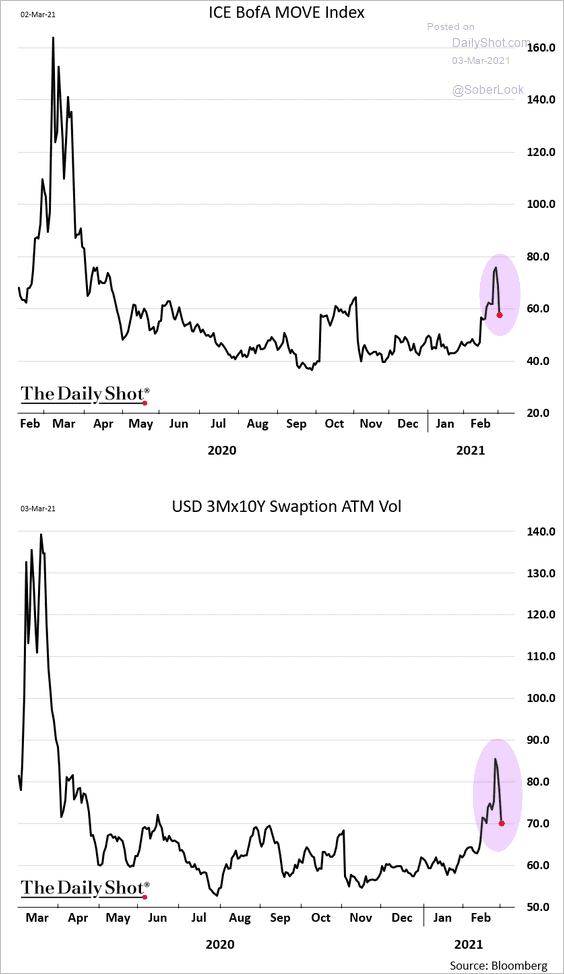

Rates: Rate implied volatility dropped sharply on Tuesday.

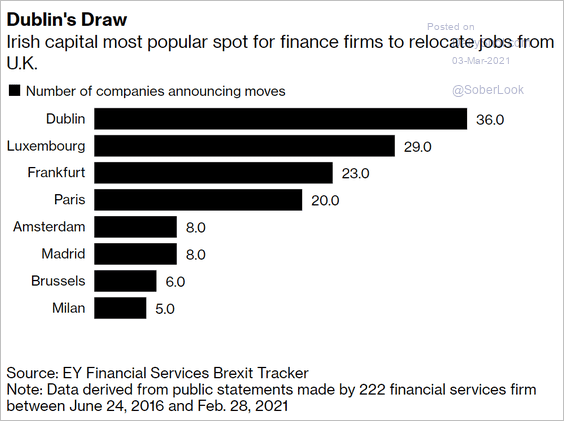

Eurozone: Dublin is the destination of choice for finance firms leaving the UK.

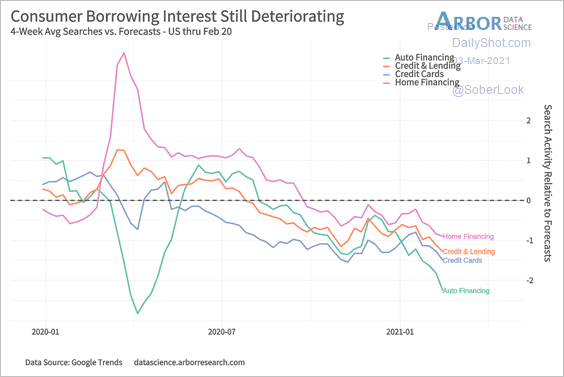

United States: Consumers continue to lose interest in borrowing.

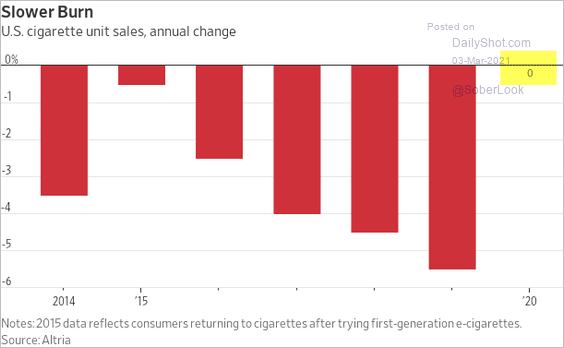

Food For Thought: US cigarette sales stopped declining last year.

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

If you would like to subscribe to the full-length Daily Shot (see example), please register here.