Greetings,

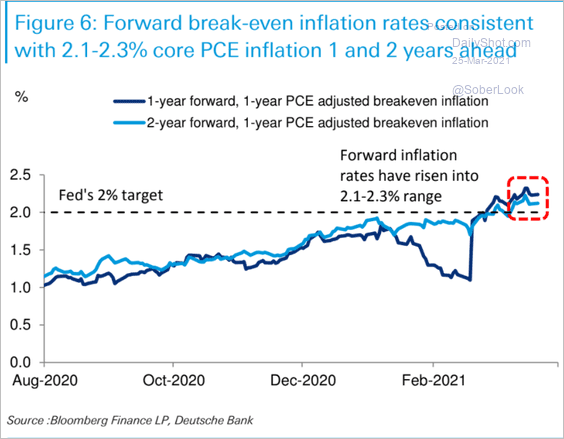

United States: Short-term market-based inflation expectations are pricing in 2.1-2.3% core PCE inflation one and two years ahead.

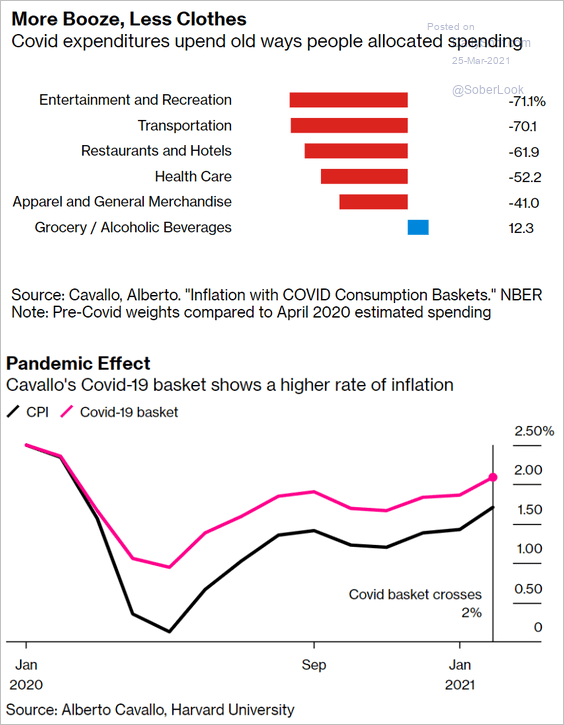

Adjusted for COVID-related changes in spending patterns, the CPI is substantially higher.

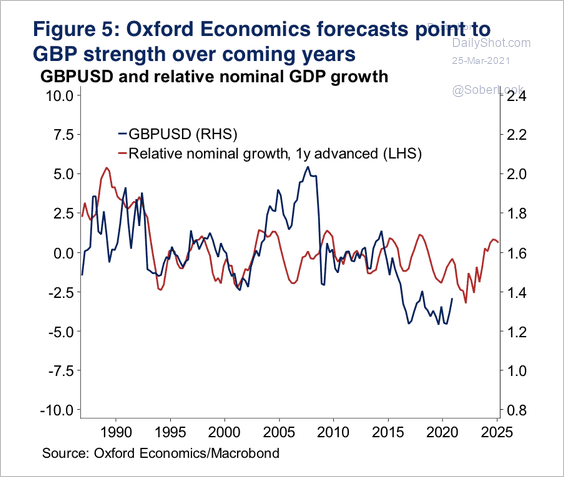

United Kingdom: Oxford Economics expects the pound to strengthen over the next few years.

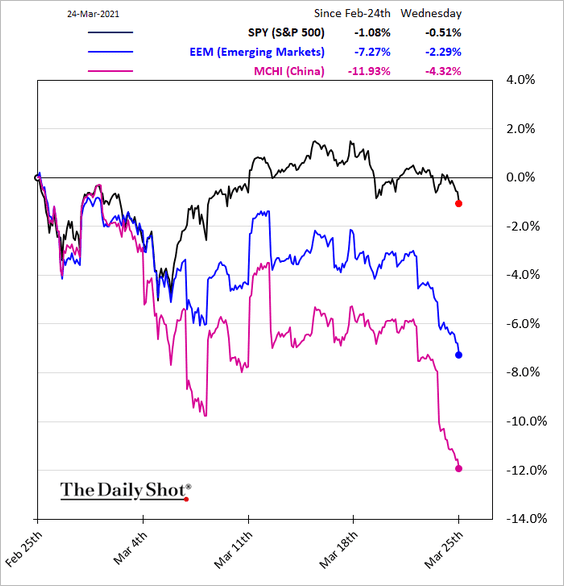

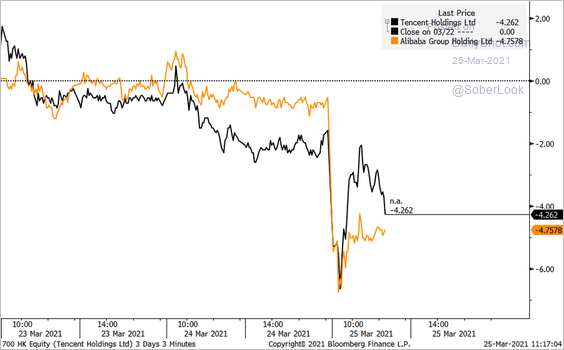

China: Stocks continue to underperform.

Renewed talk of US delistings is pressuring tech stocks.

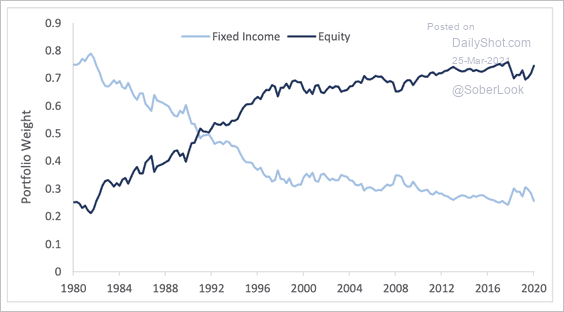

Equities: Public pensions are heavily overweight equities.

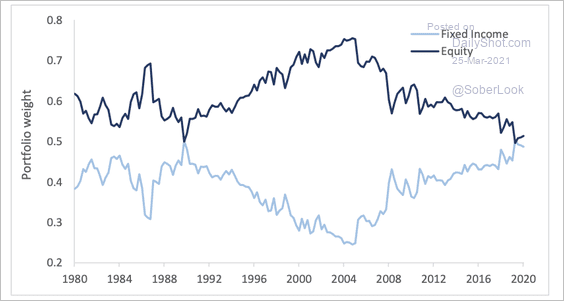

However, private pensions returned to a more balanced 50/50 equity/fixed income mix over the past decade.

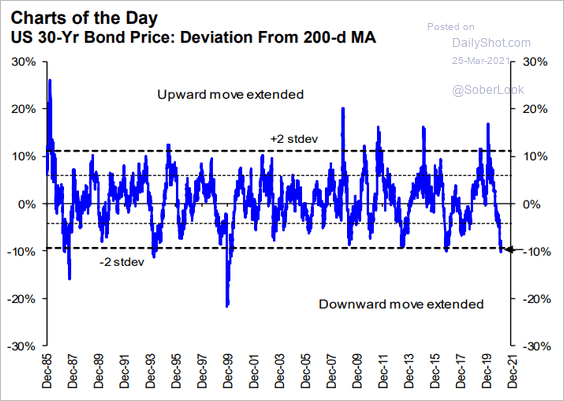

Rates: The long-bond selloff looks overextended.

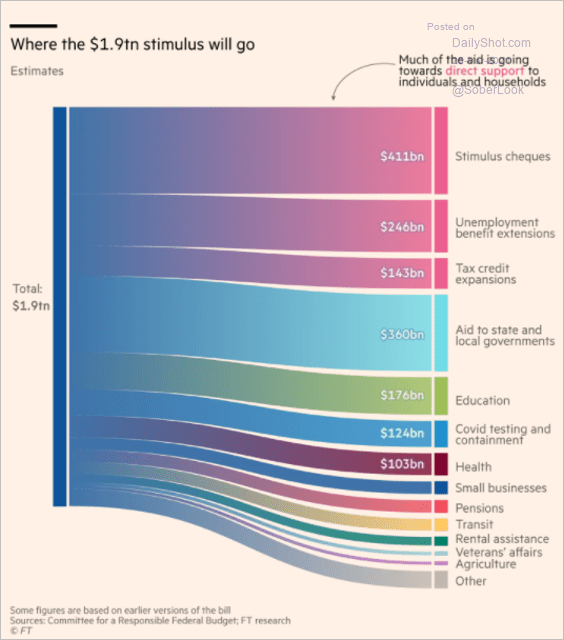

Food For Thought: The US $1.9 trillion fiscal package:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com