Greetings,

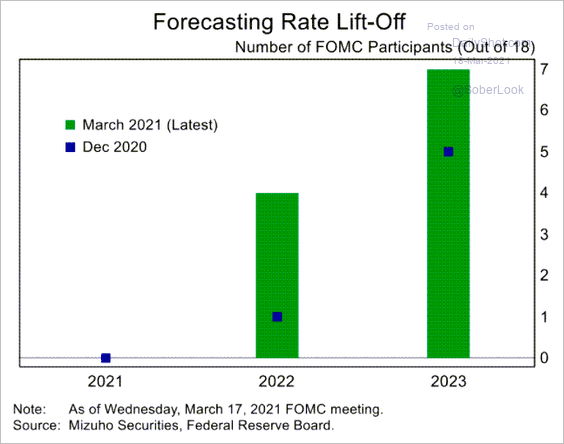

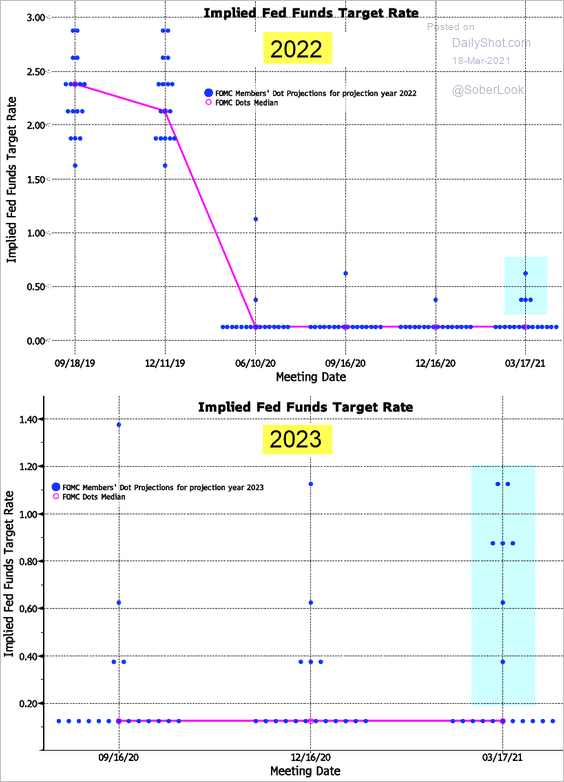

United States: The Fed held the line on its dovish stance, showing no signs of potential policy adjustments in the near-term. A few more FOMC members boosted their rate projections for 2022 and 2023, …

… but the bulk of the Committee expects rates to stay near zero. Here is the dot plot.

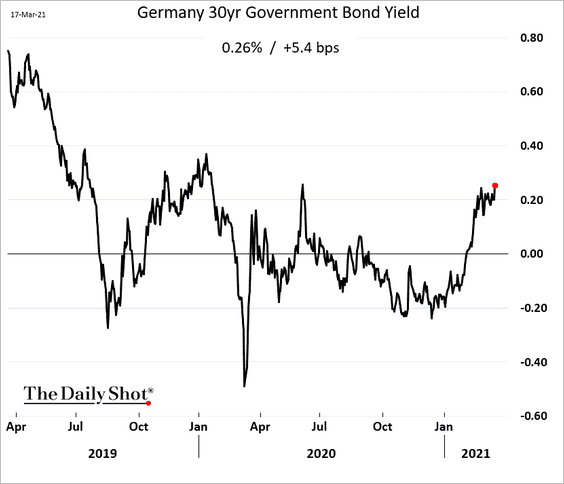

Europe: Longer-dated Bund yields are grinding higher.

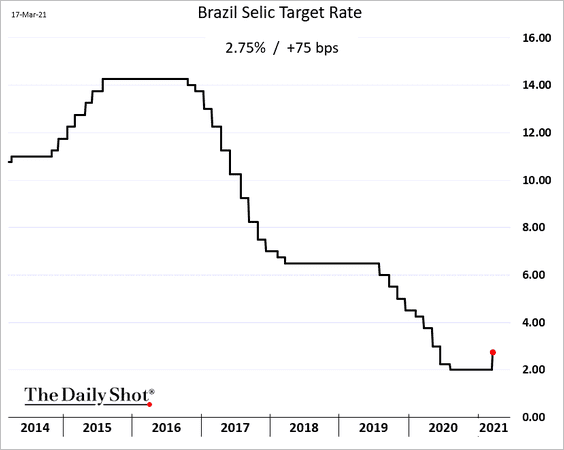

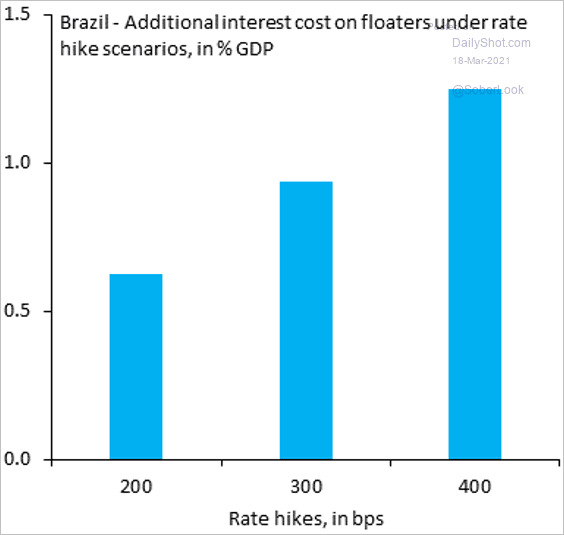

Emerging Markets: Brazil’s central bank hiked rates by 75 bps (the market expected 50 bps). More hikes are on the way.

Due to reliance on floating-rate bonds, the government’s debt costs will rise rapidly as the central bank hikes.

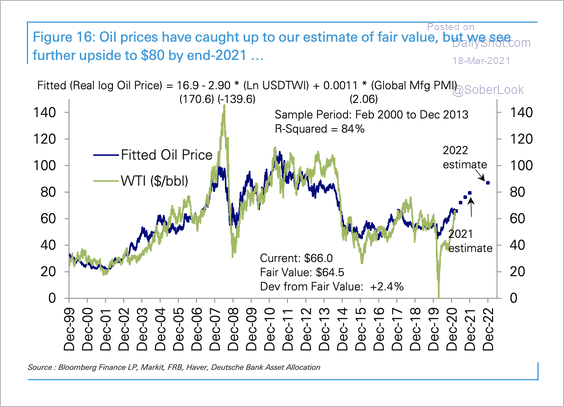

Energy: Deutsche Bank estimates an $80 WTI oil price by the end of the year.

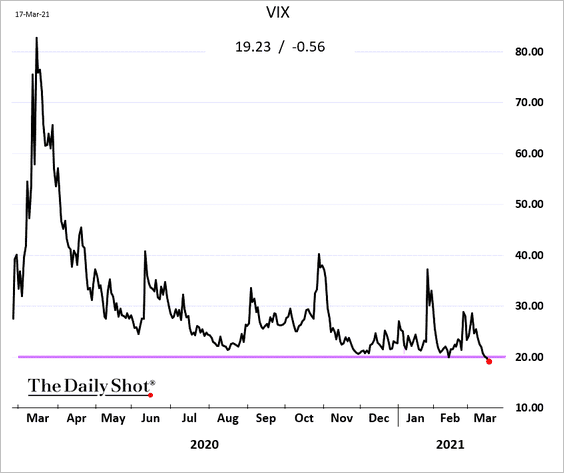

Equities: VIX is now firmly below 20 in response to the Fed’s dovish stance.

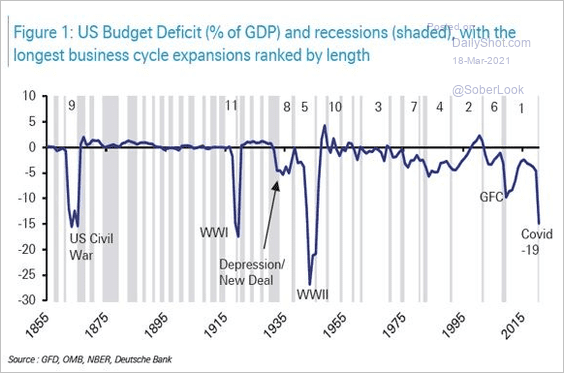

Food For Thought: The US budget surplus/deficit since 1855:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com