Greetings,

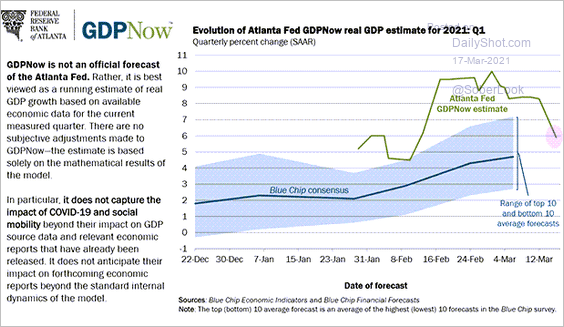

United States: After the economic releases, the Atlanta Fed’s GDPNow model sharply downgraded the Q1 growth projections.

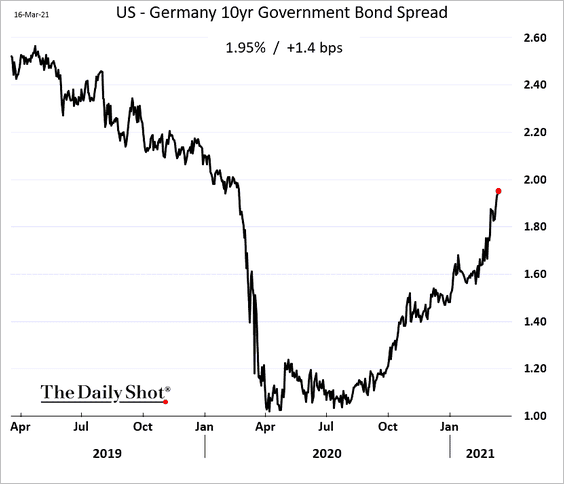

Europe: Here is the US-Germany 10yr bond spread.

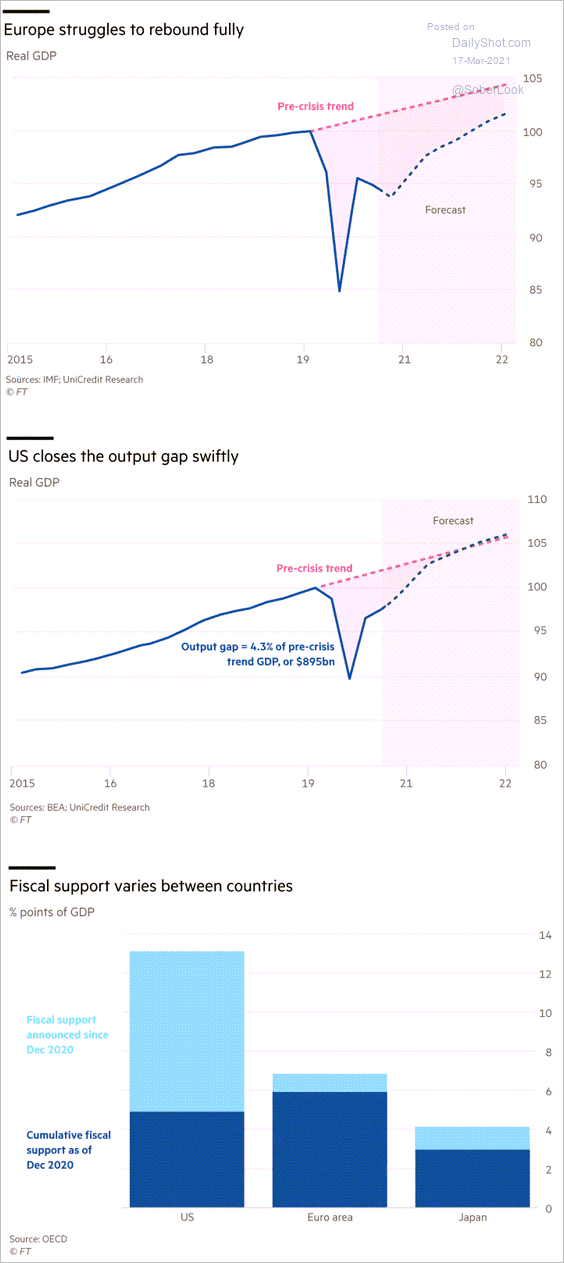

The widening spread is driven in part by the divergence in economic growth expectations – primarily due to the gap in fiscal stimulus between the US and Europe. A potential oversupply of Treasuries also contributes to wider spreads.

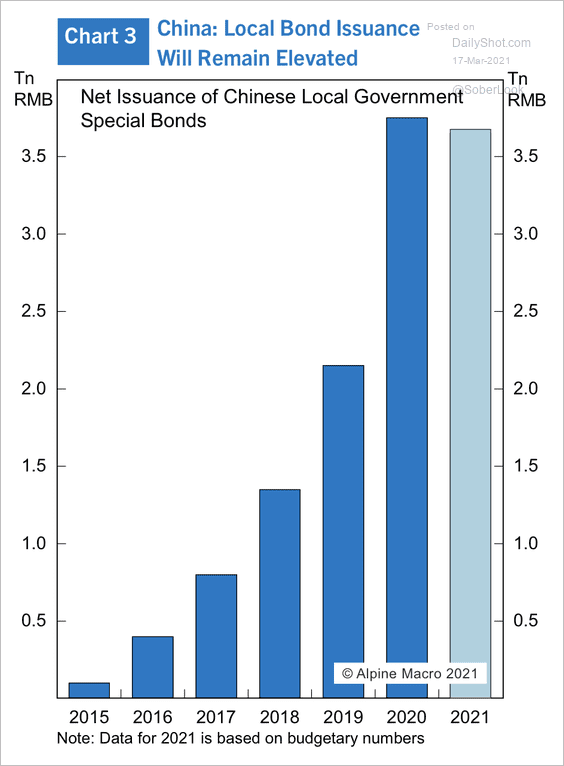

China: he quota for local government special bond issuance earmarked for infrastructure has barely changed from last year’s high, according to Alpine Macro.

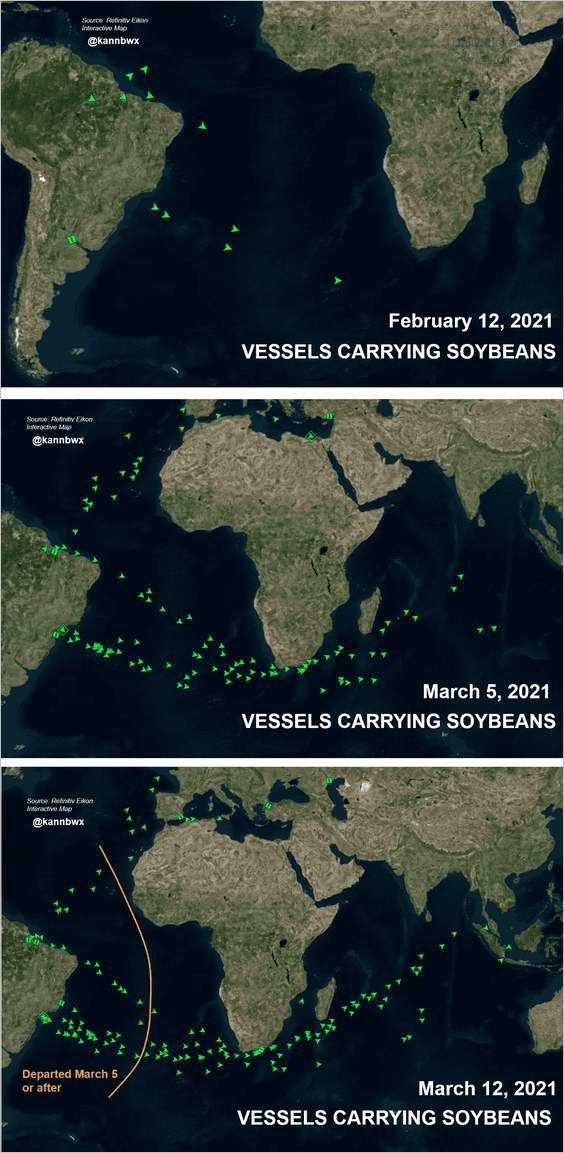

Commodities: Soybean shipments are flooding out of Brazil.

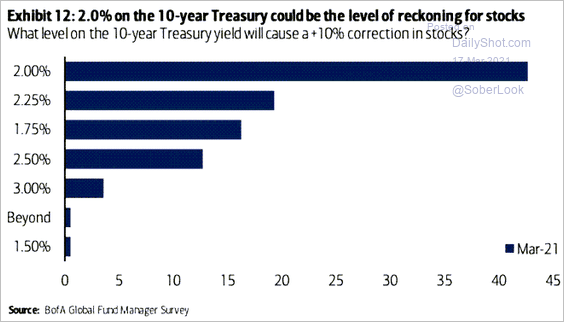

Equities: What level of Treasury yields will trigger a significant selloff in stocks? Fund managers have zeroed in on 2%.

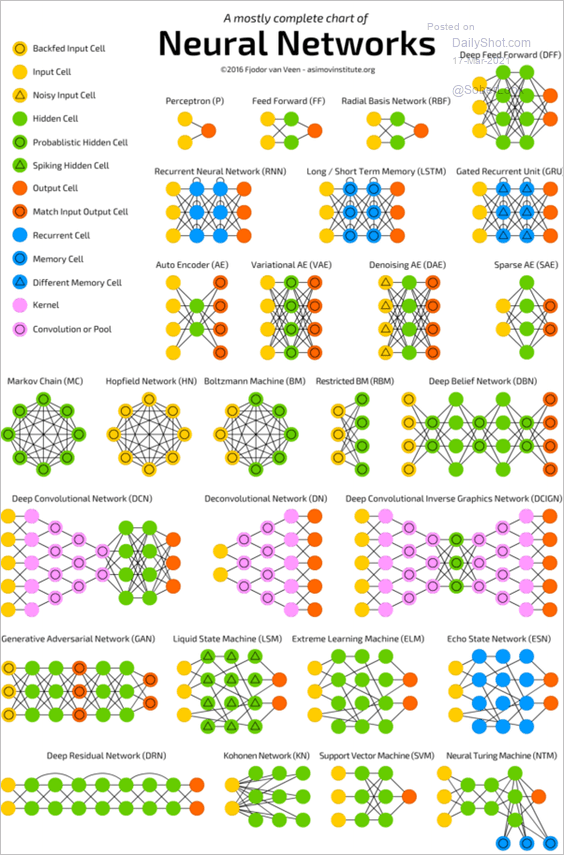

Food For Thought: Types of neural networks:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com