Greetings,

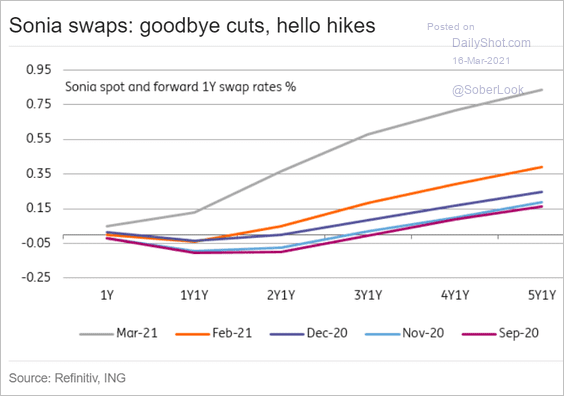

United Kingdom: The market is now pricing in a rate hike within a couple of years.

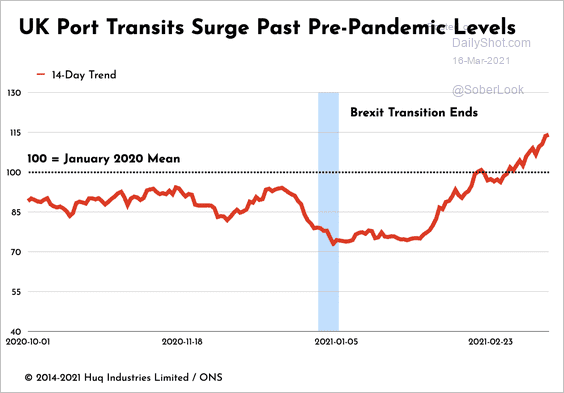

Port activity has rebounded.

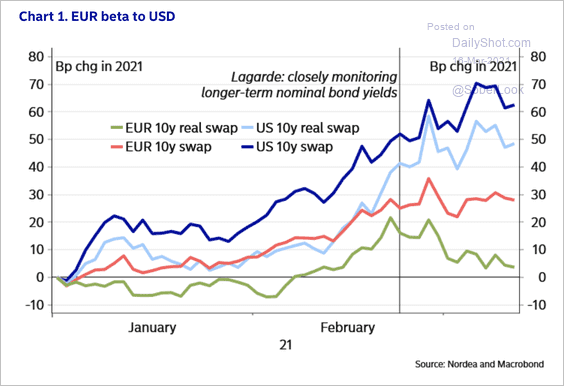

Eurozone: EUR 10-year rates have followed the initial USD move until the ECB kicked off verbal “intervention” last month. Since then, the 10-year real rates have declined.

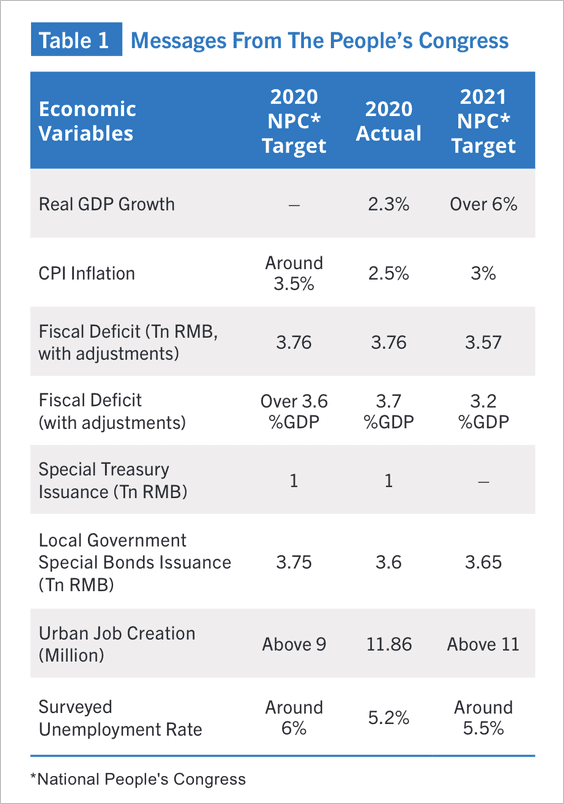

China: Here is a summary of economic targets from the People’s Congress.

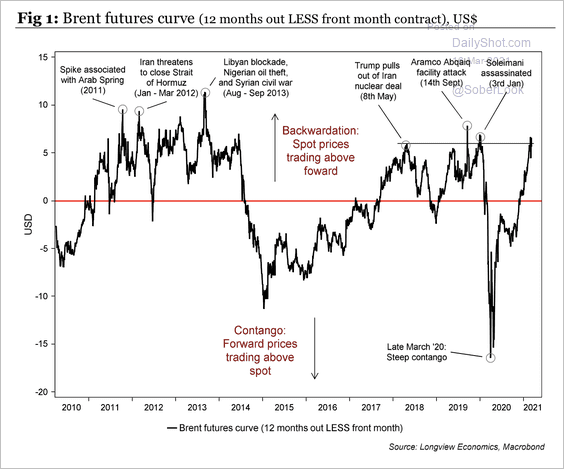

Energy: The Brent curve has moved into deep backwardation, back to January 2020 levels.

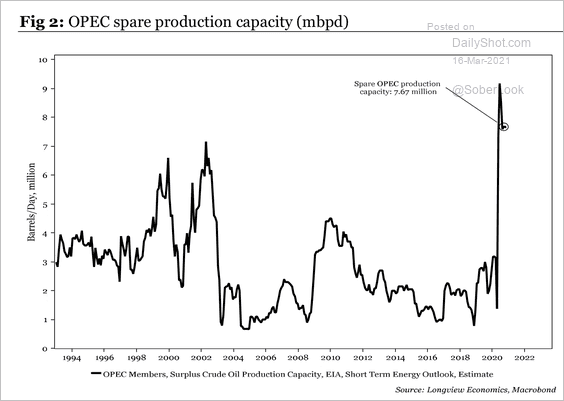

There is no shortage of oil. Spare production capacity within OPEC is close to record levels.

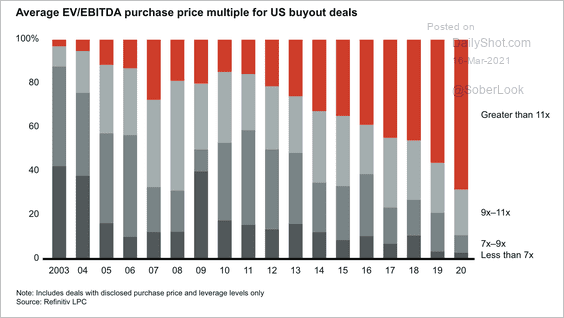

Alternatives: More than two-thirds of all US buyout deals were priced above 11x EBITDA (reflecting rich public valuations). High deal multiples are putting added pressure on general partners to produce growth, according to Bain.

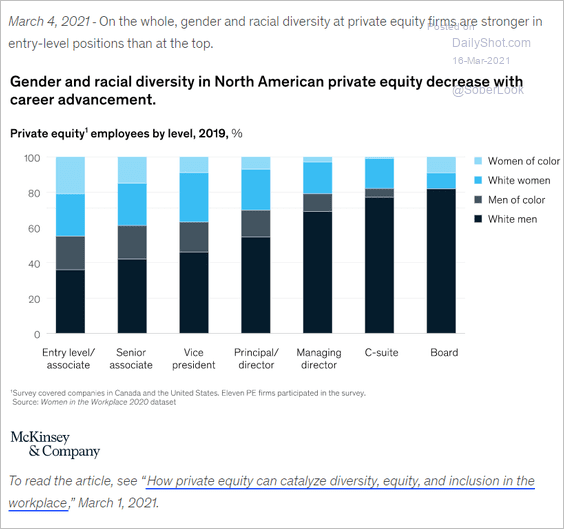

Next, we have gender and racial diversity data for private equity.

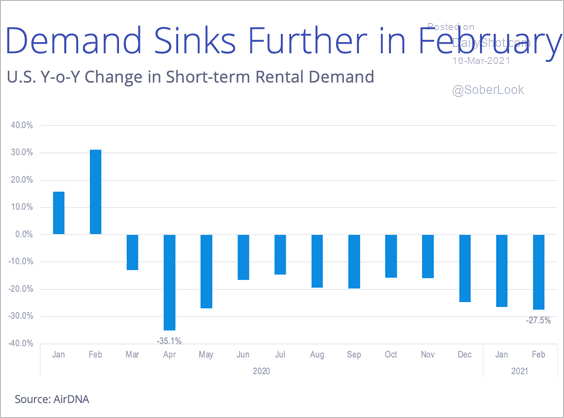

Food For Thought: Short-term rental demand (e.g., Airbnb):

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com