Greetings,

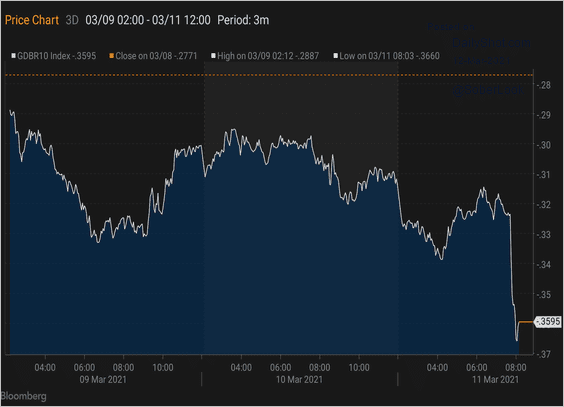

Rates: The ECB has had enough of rising bond yields as it announced a faster pace of QE.

The Governing Council: – First, the Governing Council will continue to conduct net asset purchases under the pandemic emergency purchase programme (PEPP) with a total envelope of €1,850 billion until at least the end of March 2022 and, in any case, until it judges that the coronavirus crisis phase is over. Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council expects purchases under the PEPP over the next quarter to be conducted at a significantly higher pace than during the first months of this year.

The announcement sent Bund yields lower.

Equities: Where’s my check, bro?

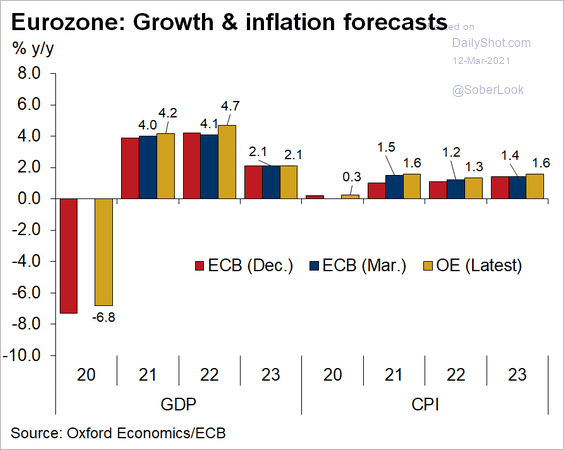

Eurozone: Growth and inflation forecasts were little changed in the latest ECB release. Here is a comparison with the projections from Oxford Economics.

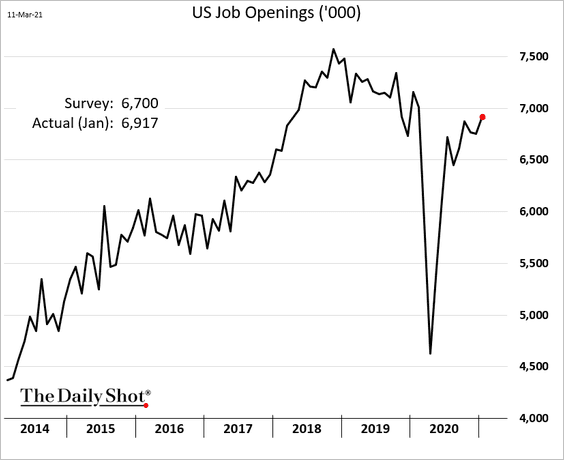

United States: January job openings were stronger than expected.

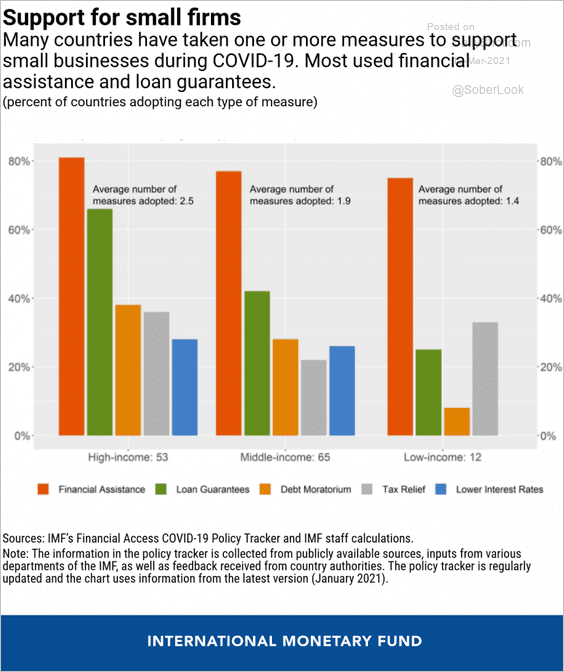

Global Developments: What kind of assistance did governments provide for small firms during the pandemic?

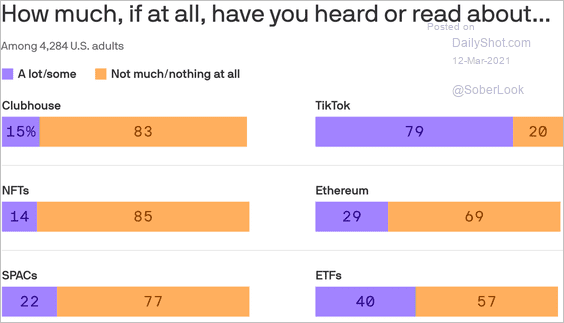

Food For Thought: How much have you heard about the following?

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com